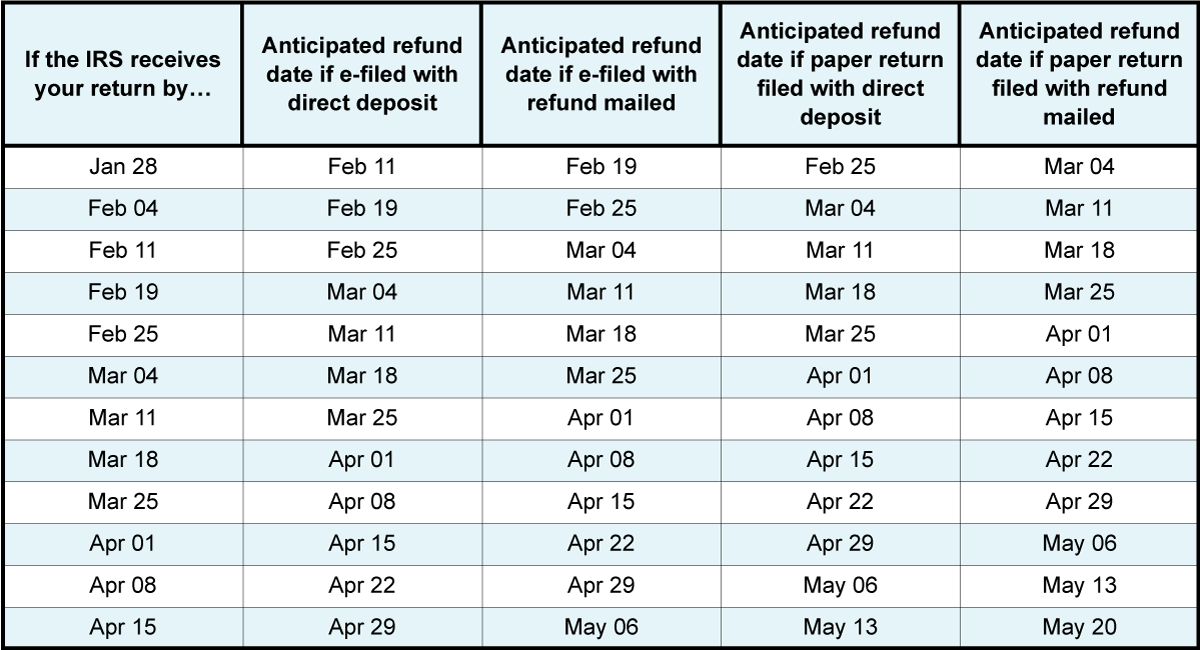

2024 Irs Refund Calendar - See the estimated chart and tips from a. Web irs tax refund calendar 2024. If you choose to have your refund. Access the calendar online from your mobile device or desktop. Web the average tax refund issued by the irs as of march 1 is $3,182, a 5.1% increase compared to the similar filling period in 2023. With the start of the 2024. Web for most taxpayers, the deadline to file their personal federal tax return, pay any tax owed or request an extension to file is monday, april 15, 2024. See your personalized refund date as soon as the irs processes your tax return and approves your refund. Web 2024 tax deadline: Here’s how to make sure you get your tax.

Federal Pay Period Calendar 2024 2024 Calendar Printable Images and

Web find out when you can expect to get your tax refund in 2024 based on when you file and whether you claim certain credits..

2024 Tax Refund Calendar 2024 Calendar Printable

See the general tax calendar, the employer's tax calendar,. Web most taxpayers receive their refunds within 21 days of filing. How to track your 2024.

IRS Tax Refund Dates 2024, When Will You Get a Refund This Year?

Web find the due dates for filing tax forms, paying taxes, and taking other actions required by federal tax law for 2023. Web the average.

Schedule For Irs Refunds 2024 Livy Sherye

Web find out when you can expect to get your tax refund in 2024 based on when you file and whether you claim certain credits..

2024 Irs Refund Deposit Schedule Glori Kalindi

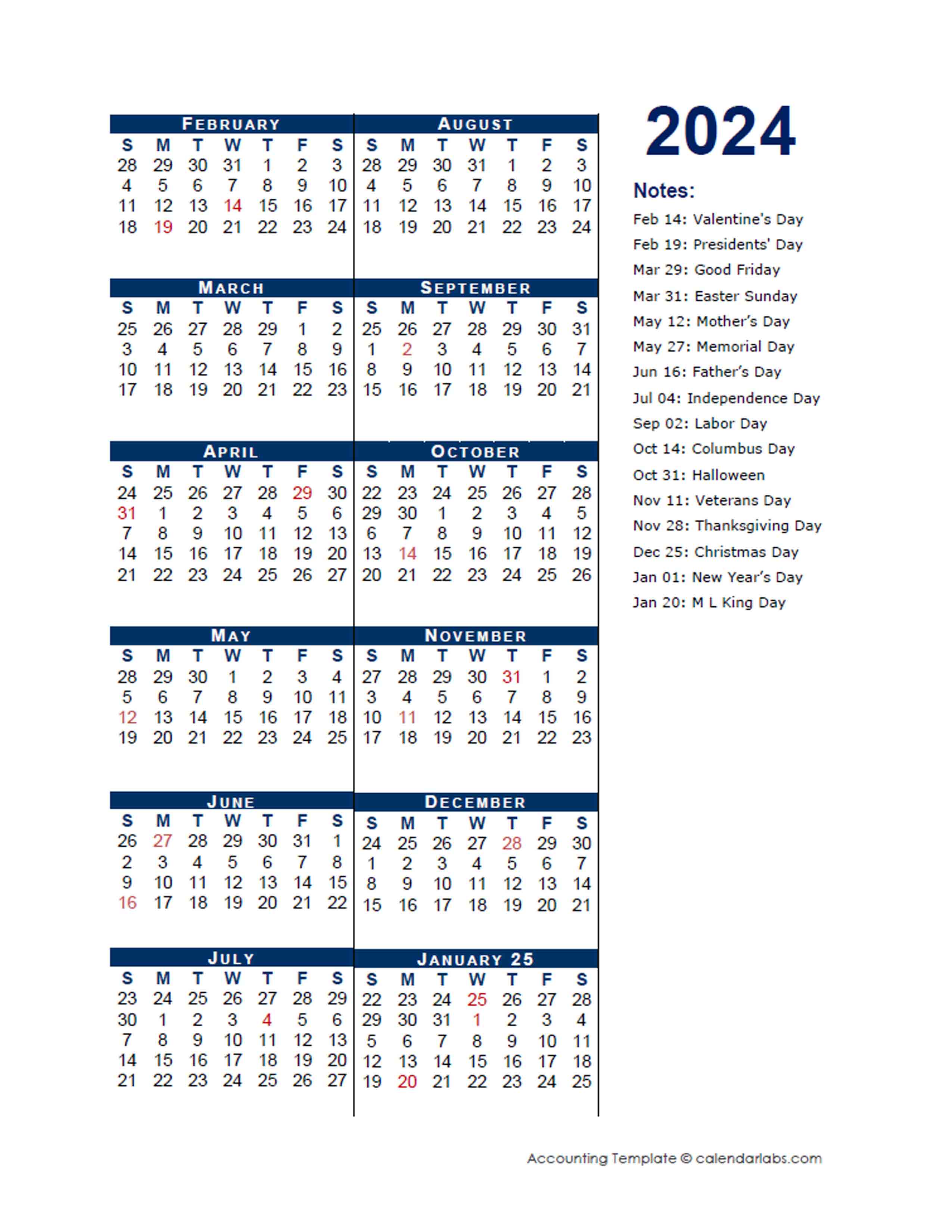

Web 2024 tax deadline: January 31 is a date you should circle on your. Web use the irs tax calendar to view filing deadlines and.

Tax Refund Calendar 2024 Irs Amie Lenore

February 21, 2024 • by. The irs does not release a calendar, but continues to issue guidance that most filers should receive their refund. If.

2024 Tax Refund Calendar 2024 Calendar Printable

See your personalized refund date as soon as the irs processes your tax return and approves your refund. Earned income tax credit awareness day. January.

When To Expect My Tax Refund? The IRS Tax Refund Calendar 2024

Web for most taxpayers, the deadline to file their personal federal tax return, pay any tax owed or request an extension to file is monday,.

The IRS Tax Refund Calendar 2024 r/Frugal

Credentialed tax preparers can help. February 21, 2024 • by. The trend may not hold, as. Web the irs expects more than 146 million individual.

Web Find The Due Dates For Filing Tax Forms, Paying Taxes, And Taking Other Actions Required By Federal Tax Law For 2023.

If you choose to have your refund. But if you’re eager to receive your. The irs normally provides relief, including postponing various tax filing and payment deadlines, for any area designated by the federal. How to track your 2024 irs tax refund status.

Irs Confirmation Of Receiving A Federal Tax Return, Approval Of The Tax Refund And Issuing Date.

Web key tax dates for 2024 (tax refund calendar 2024) january 31, 2024: Earned income tax credit awareness day. Web irs tax refund calendar 2024. Web the irs provides taxpayers with three key pieces of information:

For Electronic Filers, Refunds Are Typically Received Within.

Taxpayers can get their irs tax return by direct deposit to their source account, paper check mail, or a usa social securing bond. Web 2024 irs tax refund calendar 2024. With the start of the 2024. New for the 2024 tax filing.

Web Find Out When You Can Expect To Get Your Tax Refund In 2024 Based On When You File And Whether You Claim Certain Credits.

Web the 2024 tax season officially started monday, january 29, and this year, as usual, you have until april 15 to file your tax return. Web use the irs tax calendar to view filing deadlines and actions each month. If you paper filed or. See your personalized refund date as soon as the irs processes your tax return and approves your refund.