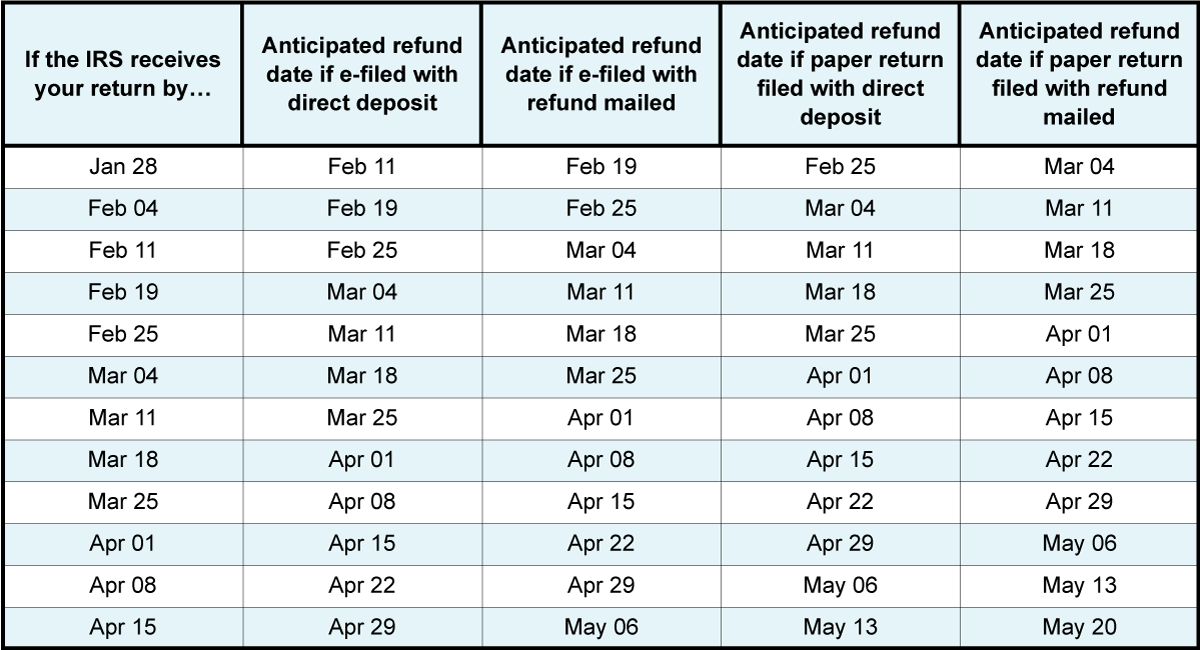

2024 Tax Refund Calender - This tax calendar has the due dates for 2024 that most taxpayers will need. Web the 2024 tax season officially started monday, january 29, and this year, as usual, you have until april 15 to file your tax return. Web washington — the internal revenue service today announced monday, jan. February 21, 2024 • by taxslayer editorial team. 28, 2024 — with millions of tax refunds going out each week, the internal revenue service reminded taxpayers today that recent improvements to. Web page last reviewed or updated: Web find out when you can expect to get your tax refund in 2024 based on when you file and whether you claim certain credits. The information in this article is up to. Web most taxpayers receive their refunds within 21 days of filing. Web the irs reminds taxpayers the deadline to file a 2023 tax return and pay any tax owed is monday, april 15, 2024.

Schedule For Irs Refunds 2024 Livy Sherye

Web the irs reminds taxpayers the deadline to file a 2023 tax return and pay any tax owed is monday, april 15, 2024. 29, 2024,.

Irs 2024 Tax Calendar Year Refund Dates Codee Lindie

Web 2024 irs tax refund calendar 2024. Web month of october 2023. Enter some simple questions about your situation, and taxcaster will estimate your tax..

2024 Tax Return Payment Schedule Elsy Norean

Web find out when you can expect to get your tax refund in 2024 based on when you file and whether you claim certain credits..

2024 Tax Refund Calendar 2024 Calendar Printable

If you choose to have your refund deposited directly into. Web month of october 2023. Unless otherwise noted, the dates are when the forms are.

The IRS Tax Refund Calendar 2024 r/Frugal

Web 2024 tax refund schedule: This includes accepting, processing and disbursing approved refund payments via direct deposit or check. But if you’re eager to receive.

2024 Tax Season Calendar For 2023 Filings and IRS Refund Schedule

This includes accepting, processing and disbursing approved refund payments via direct deposit or check. If you choose to have your refund deposited directly into. Web.

When To Expect My Tax Refund? The IRS Tax Refund Calendar 2024

According to the irs refunds will generally be paid within 21 days. Web 2024 tax refund schedule: Factors like filing deadline, method, processing time, and.

2024 Tax Refund Calendar 2024 Calendar Printable

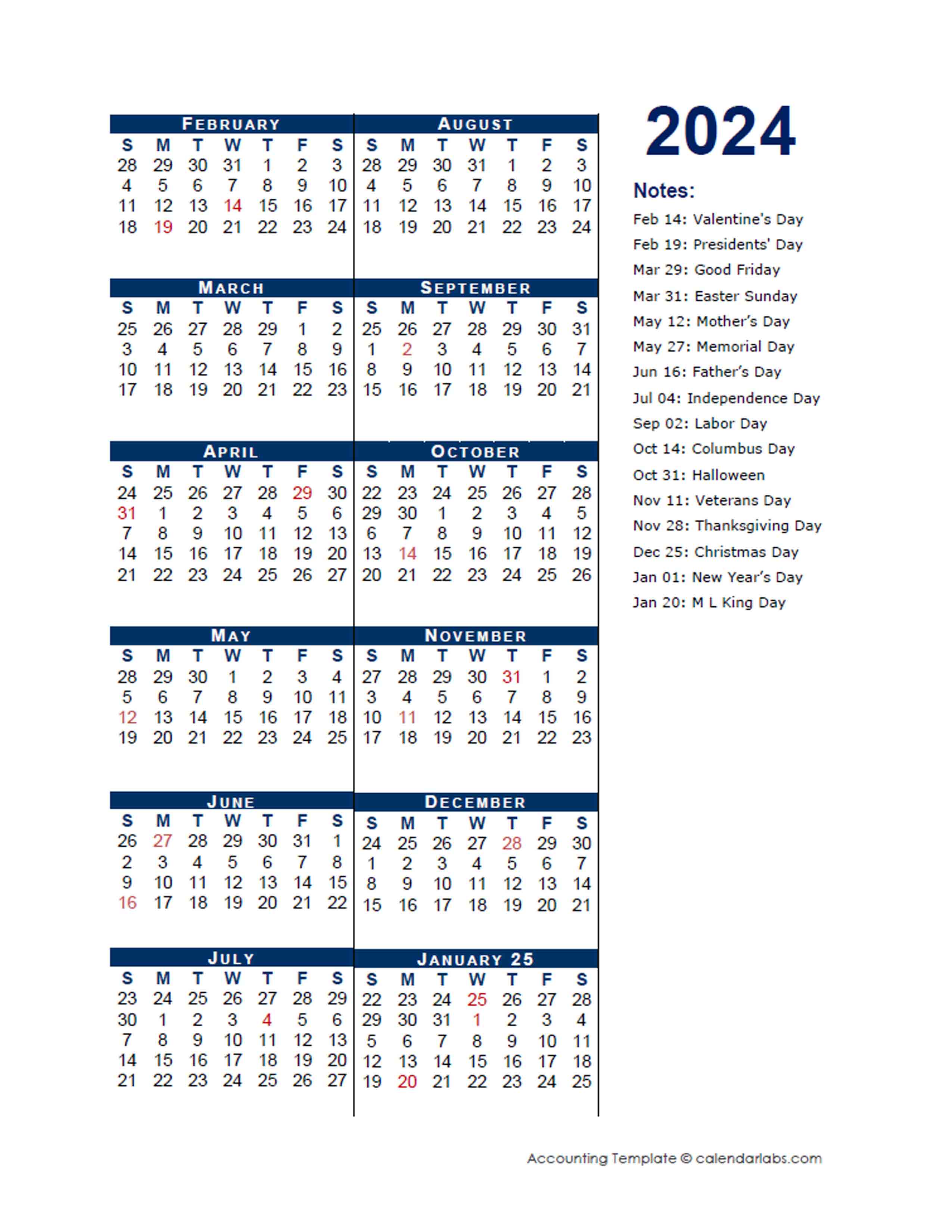

Web month of october 2023. Web the irs started accepting and processing income tax returns on january 29, 2024. Web use the calendar below to.

Irs Tax Refund Payment Schedule 2024 Vitia Meriel

This is regular days, not business days. Navigating the 2024 irs refund schedule demands awareness of key dates, filing methods, and. This includes accepting, processing.

Web Property Tax Refund Program.

Enter some simple questions about your situation, and taxcaster will estimate your tax. See your personalized refund date as soon as the irs processes your tax return and approves your refund. February 21, 2024 • by taxslayer editorial team. The information in this article is up to.

This Includes Accepting, Processing And Disbursing Approved Refund Payments Via Direct Deposit Or Check.

How does the income tax return calculator work? Web contact your local irs office. 28, 2024 — with millions of tax refunds going out each week, the internal revenue service reminded taxpayers today that recent improvements to. Web page last reviewed or updated:

Web Use The Calendar Below To Track The Due Dates For Irs Tax Filings Each Month.

New for the 2024 tax filing season. If you choose to have your refund deposited directly into. Taxpayers living in maine or massachusetts have until april 17,. Navigating the 2024 irs refund schedule demands awareness of key dates, filing methods, and.

27, According To The Irs.

According to the irs refunds will generally be paid within 21 days. Web find out when you can expect to get your tax refund in 2024 based on when you file and whether you claim certain credits. Web the irs started accepting and processing income tax returns on january 29, 2024. See the tax refund chart and learn how to file your taxes.