Calendar Option Spread - A calendar spread is a strategy used in options and futures trading: Web what is a calendar spread? Before getting underway, let's give you a cheat sheet for some key terms. It is a strategy used by investors who think the security price will be close to the strike price at expiration. Web a calendar spread is a sophisticated options or futures strategy that combines both long and short positions on the same underlying asset, but with distinct delivery dates. It involves buying and selling contracts at the same strike price but expiring on different dates. This spread is considered an advanced options strategy. In this article, we will learn how to adjust and manage calendar spreads so that we can stay in the trade long enough to get some profits. From your calendar list, select the other calendar (s) you want to view in addition to the default calendar. How does a calendar spread work?

Trading Guide on Calendar Call Spread AALAP

A calendar spread profits from the time. Web what is a calendar spread? Web a calendar spread is a sophisticated options or futures strategy that.

Calendar Option Spread Trading Options Video 27 part 1 YouTube

In that case, you keep the money you earned from selling the option. Web a calendar spread is an options strategy that involves multiple legs..

Pin on CALENDAR SPREADS OPTIONS

A calendar spread profits from the time. Web in finance, a calendar spread (also called a time spread or horizontal spread) is a spread trade.

How Long Calendar Spreads Work (w/ Examples) Options Trading

Web a calendar spread is a strategy used in options and futures trading: Web any value of the spread outside this range gives us an.

Calendar Spread, stratégie d'options sur deux échéances différentes.

Both put options will have the same strike price. It is a strategy used by investors who think the security price will be close to.

Calendar Spread Options Strategy VantagePoint

Web a long calendar spread—often referred to as a time spread—is the buying and selling of a call option or the buying and selling of.

Put Calendar Spread Guide [Setup, Entry, Adjustments, Exit]

Web a long calendar spread—often referred to as a time spread—is the buying and selling of a call option or the buying and selling of.

How Calendar Spreads Work (Best Explanation) projectoption

This spread is considered an advanced options strategy. Both put options will have the same strike price. Web meanwhile, a horizontal spread, also known as.

Killing Time A Calendar Spread Trading Primer Ticker Tape

Web a calendar spread is an options strategy that involves multiple legs. It involves buying and selling contracts at the same strike price but expiring.

The Goal Is To Profit From The Difference In Time Decay Between The Two Options.

Both put options will have the same strike price. On the navigation bar, select calendar. Search a symbol to visualize the potential profit and loss for a calendar call spread option strategy. You make money when the stock price is at or just below the strike price when the contract expires.

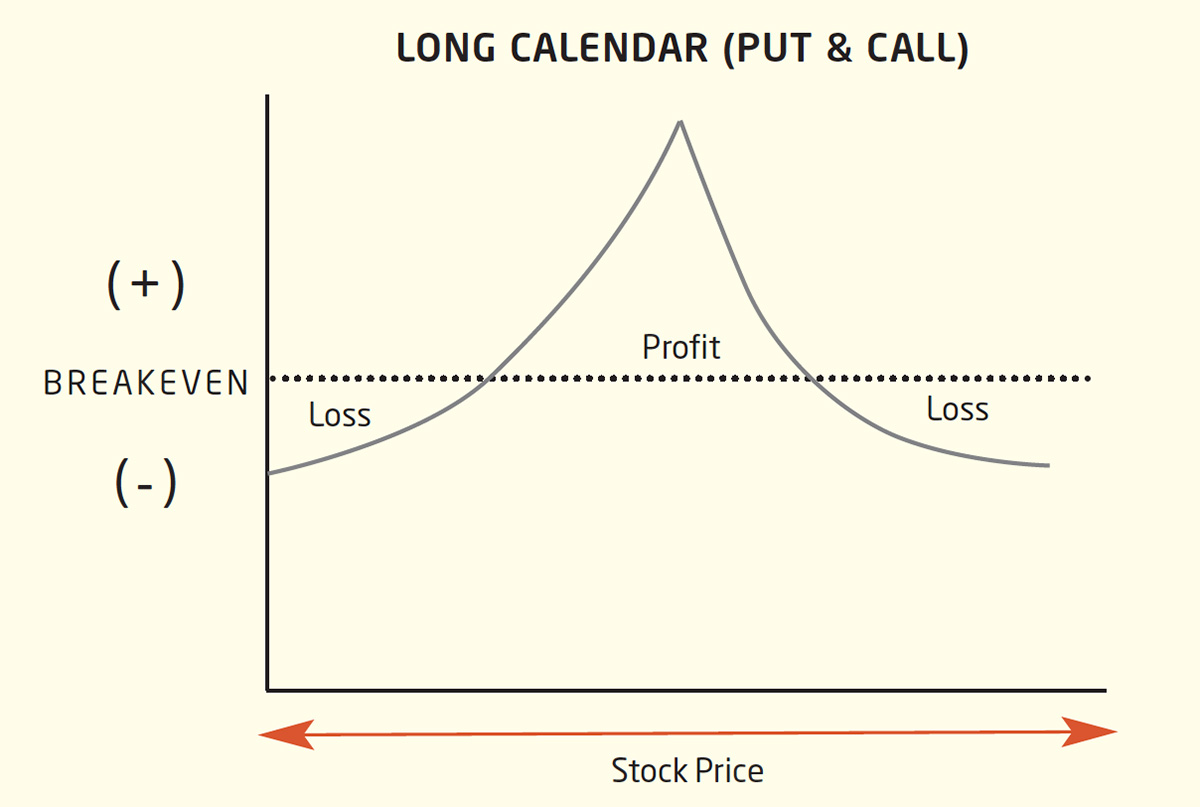

Neutral Limited Profit Limited Loss.

Call option: a contract giving the buyer the right, but not the obligation, to purchase an underlying asset at a set price, called the strike price, by a specific date, called the expiration. Web meanwhile, a horizontal spread, also known as a calendar spread, involves buying options in one expiration and selling options (of the same type, all calls or all puts) in a different expiration but with the same strikes. Traders use this strategy to capitalise on time decay and changes in implied volatility. Web a calendar spread is a strategy used in options and futures trading:

Long Put Calendar Spreads Will.

This spread is considered an advanced options strategy. From your calendar list, select the other calendar (s) you want to view in addition to the default calendar. Put option: a contract allowing the buyer the. Calendar spreads are also known as ‘time spreads’, ‘counter spreads’ and ‘horizontal spreads’.

A Calendar Spread Profits From The Time.

A calendar spread is an options trading strategy that involves buying and selling two options with the same strike price but different expiration dates. A calendar spread is a strategy used in options and futures trading: Web calendar spread options strategy. Before getting underway, let's give you a cheat sheet for some key terms.

![Put Calendar Spread Guide [Setup, Entry, Adjustments, Exit]](https://assets-global.website-files.com/5fba23eb8789c3c7fcfb5f31/6019b83133ac2d32ef084fa5_TsbQgZxQ0e-zKJ9h6Fa7azNlnvn0zH-UBlX3l7hriHll2es1fvyFY5N-nOyM1153MJ4wXLNIhH4zanFkJQB0mpqs81lwEBIvqa7IZQRPWXZY1i3J7vV3BpTIL3v5nCyqn-CEbq2U.png)