Calendar Option - Web the simple definition of a calendar spread is that it is basically an options spread that involves options contracts with different expiration dates. The calendars listed under icloud should have the option to add person when you tap the i to the far right of the calendar. Web a long calendar spread—often referred to as a time spread—is the buying and selling of a call option or the buying and selling of a put option with the same strike. Today we will focus our attention on adjusting calendar spreads and how to manage them. Web click the gear icon (top right), choose settings and view options, and you'll see there are several other ways to configure the look of google calendar, besides. Lay out your calendar grid. Web a calendar spread is a strategy used in options and futures trading: Web the calendar call spread is a neutral options trading strategy, which means you can use it to generate a profit when the price of a security doesn't move, or only moves a little. When running a calendar spread with calls, you’re selling and buying a call with the same strike price, but the call you buy will have a later expiration date than the. Web 2023 | 2024 | 2025.

Calendar Option Spread Option Trading Strategies Video 31 part 5

Web a calendar spread is a strategy involving buying longer term options and selling equal number of shorter term options of the same underlying stock.

Trading Guide on Calendar Call Spread AALAP

Web in finance, a calendar spread (also called a time spread or horizontal spread) is a spread trade involving the simultaneous purchase of futures or.

Calendar Options Spreads A Strategy for Low Volatility Ticker Tape

As i am creating new months for the calendar it stops in october 2024 from the. Web a calendar spread is a strategy used in.

Calendar Spread Options Strategy VantagePoint

Web the simple definition of a calendar spread is that it is basically an options spread that involves options contracts with different expiration dates. As.

Calendar Spread, stratégie d'options sur deux échéances différentes.

Web the calendar spread options strategy is a market neutral strategy for seasoned options traders that expect different levels of volatility in the underlying stock.

Calendar Spread Option Strategy 2024 Easy to Use Calendar App 2024

Web meanwhile, trader b initiates a synthetic long with options expiring in about a six weeks. Today we will focus our attention on adjusting calendar.

How to Share a Calendar Between Schedules in Microsoft Project

Web a long calendar spread—often referred to as a time spread—is the buying and selling of a call option or the buying and selling of.

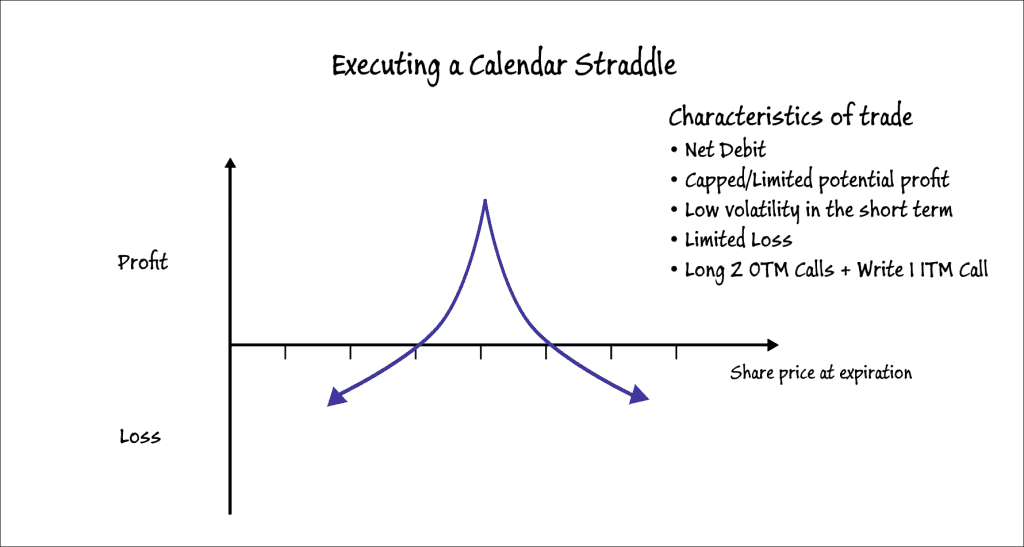

Calendar Straddle An advanced Neutral Options Trading Strategy

A calendar spread can be constructed with either calls or puts by. Web 2024 has 366 days which means it's categorized as a leap year..

Using Calendar Trading and Spread Option Strategies

View or download over a year’s worth of listing and expiration dates across cme group’s benchmark options, including yet to be. Web the simple definition.

On The Navigation Bar, Select Calendar.

Web the calendar call spread is a neutral options trading strategy, which means you can use it to generate a profit when the price of a security doesn't move, or only moves a little. Browse our collection of 12 month calendar templates below, featuring multiple designs that can be downloaded. When running a calendar spread with calls, you’re selling and buying a call with the same strike price, but the call you buy will have a later expiration date than the. From your calendar list, select the other calendar (s) you want to view in addition to the default.

Web The Calendar Spread Options Strategy Is A Market Neutral Strategy For Seasoned Options Traders That Expect Different Levels Of Volatility In The Underlying Stock At Varying Points In.

A calendar spread can be constructed with either calls or puts by. I had briefly introduced the concept of calendar spreads in chapter 10 of the. Web a calendar spread is an options strategy that involves multiple legs. Web a calendar spread is an options trading strategy that involves buying and selling two options with the same strike price but different expiration dates.

Lay Out Your Calendar Grid.

I have downloaded a calendar template for excel that i like. Web click the gear icon (top right), choose settings and view options, and you'll see there are several other ways to configure the look of google calendar, besides. The calendars listed under icloud should have the option to add person when you tap the i to the far right of the calendar. Web 2024 has 366 days which means it's categorized as a leap year.

Web Tap Calendars At The Bottom.

Today we will focus our attention on adjusting calendar spreads and how to manage them. Web a calendar spread is a neutral strategy that profits from time decay and an increase in implied volatility. Web the simple definition of a calendar spread is that it is basically an options spread that involves options contracts with different expiration dates. It involves buying and selling contracts at the same strike price but expiring on different.

:max_bytes(150000):strip_icc()/dotdash_Final_Using_Calendar_Trading_and_Spread_Option_Strategies_Nov_2020-01-b1d47a55f4684e1b9d37580d219dc778.jpg)