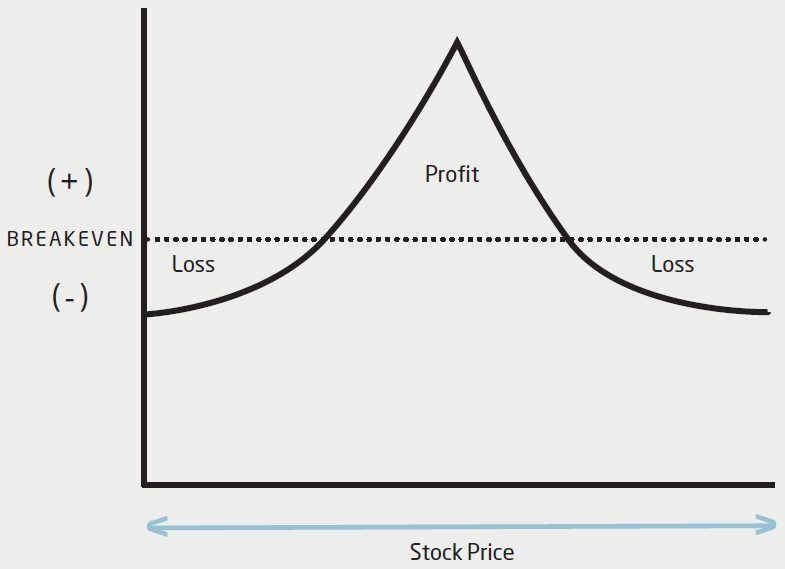

Calendar Options Spread - The only difference is the expiration dates. There are always exceptions to this. When running a calendar spread with calls, you’re selling and buying a call with the same strike price, but the call you buy will have a later expiration date than the call you sell. Web in finance, a calendar spread (also called a time spread or horizontal spread) is a spread trade involving the simultaneous purchase of futures or options expiring on a particular date and the sale of the same instrument expiring on another date. Web a calendar spread is an options strategy that is constructed by simultaneously buying and selling an option of the same type ( calls or puts) and strike price, but different expirations. The goal is to profit from the difference in time decay between the two options. This spread is considered an advanced options strategy. Web to really take control over what you can see, you can create a custom view. 7.8k views 2 years ago how to trade options. Traders use this strategy to capitalise on time decay and changes in implied volatility.

Calendar Spread Options Strategy VantagePoint

How does a calendar spread work? If we use 1.52 as our historical fair value benchmark, the current. Additionally, you use the same strike price.

The Long Calendar Spread Explained 1 Options Trading Software

Web what is a calendar spread? Web in finance, a calendar spread (also called a time spread or horizontal spread) is a spread trade involving.

Using Calendar Trading and Spread Option Strategies

If we use 1.52 as our historical fair value benchmark, the current. Web a calendar spread is a sophisticated options or futures strategy that combines.

Calendar Spreads Option Trading Strategies Beginner's Guide to the

It involves buying and selling contracts at the same strike price but expiring on different dates. This spread is considered an advanced options strategy. Web.

Pin on CALENDAR SPREADS OPTIONS

Calendar spreads are also known as ‘time spreads’, ‘counter spreads’ and. When running a calendar spread with calls, you’re selling and buying a call with.

Calendar Option Spread Trading Options Video 27 part 1 YouTube

Calendar spreads are also known as ‘time spreads’, ‘counter spreads’ and ‘horizontal spreads’. A diagonal spread allows option traders to collect premium and time decay.

How Long Calendar Spreads Work (w/ Examples) Options Trading

This spread is considered an advanced options strategy. Web what is a calendar spread? Web to utilize a calendar spread strategy, you buy and sell.

Trading Guide on Calendar Call Spread AALAP

Web a calendar spread is an options strategy that is constructed by simultaneously buying and selling an option of the same type ( calls or.

Calendar Spread, stratégie d'options sur deux échéances différentes.

This type of strategy is also known as a time or horizontal spread due to the differing maturity dates. Web a calendar spread is a.

It Is A Strategy Used By Investors Who Think The Security Price Will Be Close To The Strike Price At Expiration.

Calendar spreads are also known as ‘time spreads’, ‘counter spreads’ and. For example, you may create one option that expires in a month, then set the second one to expire in two months. Web meanwhile, a horizontal spread, also known as a calendar spread, involves buying options in one expiration and selling options (of the same type, all calls or all puts) in a different expiration but with the same strikes. Web the american lawyer reported earlier this year that one top firm that’s grown the portion of profits reserved for bonuses is latham & watkins, up to 15%.

How Does A Calendar Spread Work?

Traders use this strategy to capitalise on time decay and changes in implied volatility. Web the options are both calls or puts, have the same strike price and the same contract. In that case, you keep the money you earned from selling the option. It involves buying and selling contracts at the same strike price but expiring on different dates.

Web The S&P 500 Index Has Gained Almost 11% To Start The Year, Posting A String Of Record Highs On The Back Of A Resilient Economy, Improving Corporate Earnings And Generally Cooling Inflation, Not To.

Web what is a calendar spread? You may trade two calls or two puts, but each is the same type. Additionally, you use the same strike price for both. Web a calendar spread is an options strategy that involves multiple legs.

A Calendar Spread Profits From The Time Decay Of.

This type of strategy is also known as a time or horizontal spread due to the differing maturity dates. Web to utilize a calendar spread strategy, you buy and sell two options. Click the gear button (top right), then settings and view options. This spread is considered an advanced options strategy.

:max_bytes(150000):strip_icc()/dotdash_Final_Using_Calendar_Trading_and_Spread_Option_Strategies_Nov_2020-01-b1d47a55f4684e1b9d37580d219dc778.jpg)