Calendar Put Spread - Sell one $610 tsla jul. Web a short calendar spread with puts is a possible strategy choice when the forecast is for a big stock price change but the direction of the change is uncertain. Web demystifying the put calendar spread: A calendar spread allows option traders to take advantage of elevated premium in near term options with a neutral market bias. Web a long calendar spread—often referred to as a time spread—is the buying and selling of a call option or the buying and selling of a put option with the same strike. Ultimately, utilizing this strategy is an effective way to minimize risk. Web a calendar spread is a neutral strategy that profits from time decay and an increase in implied volatility. Web put calendar example. Try an example ($spy) what is a. Web two put positions (short and long), with the same strike price and different expiration dates, are required to form a put calendar spread.

Trading on Time Decay How to Approach Calendar Spreads Ticker Tape

Search a symbol to visualize the potential profit and loss for a calendar put spread option strategy. This strategy is one that you can use.

Killing Time A Calendar Spread Trading Primer Ticker Tape

Option trading strategies offer traders and investors the opportunity to profit in ways not. Today, we are going to look at a bearish put calendar.

Long Calendar Spread with Puts Strategy With Example

Search a symbol to visualize the potential profit and loss for a calendar put spread option strategy. Web what are calendar spreads? Web two put.

The Dual Calendar Spread (A Strategy for a Trading Range Market) (1106

Web demystifying the put calendar spread: Web what are calendar spreads? It involves buying and selling contracts at the same strike price but. A calendar.

Ameritrade Minimum Balance To Trade Options Calendar Put Spread Option

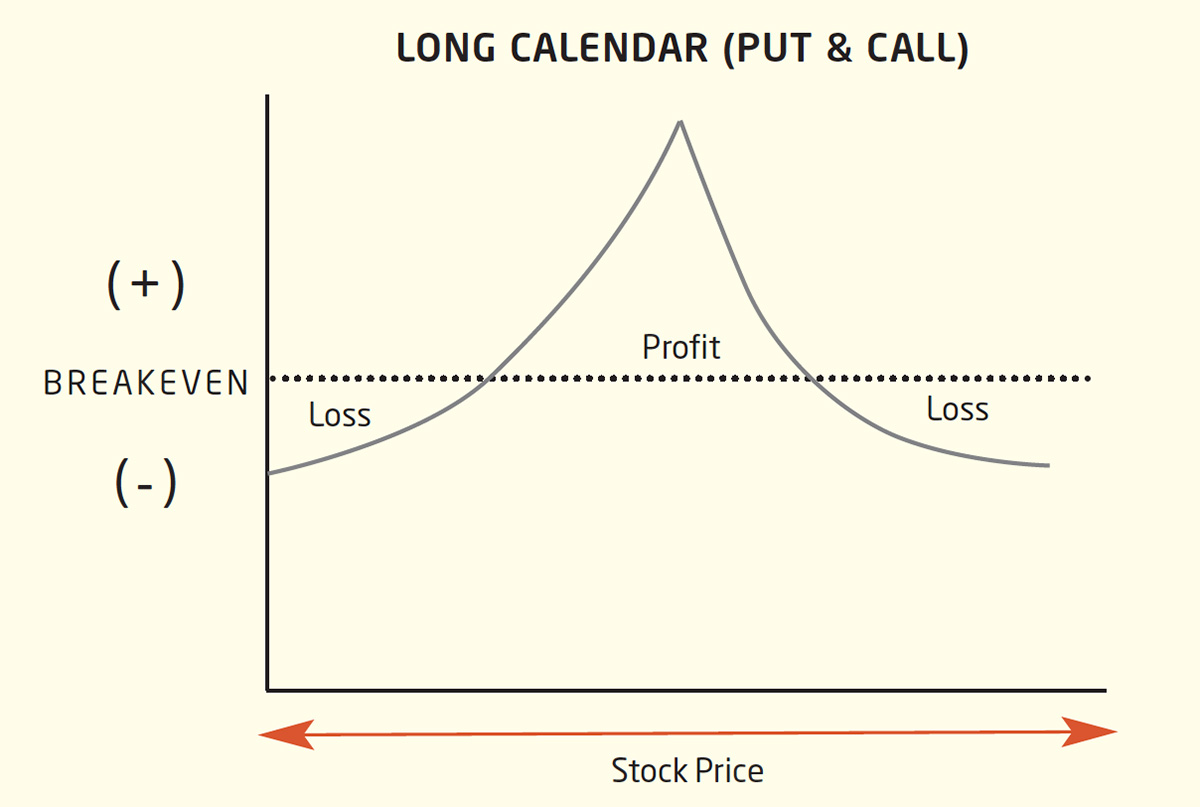

Web a calendar spread is an options or futures strategy where an investor simultaneously enters long and short positions on the same underlying asset but.

Calendar Put Spread Options Edge

Includes box scores, video highlights, play breakdowns and updated odds. Sell one $610 tsla jul. Web a calendar spread is an options or futures strategy.

Bearish Put Calendar Spread Option Strategy Guide

Web what is a calendar spread? The midpoint of the spread is 1.50. Web a calendar spread is a strategy involving buying longer term options.

How Calendar Spreads Work (Best Explanation) projectoption

This strategy is one that you can use when you think a stock price is going to go. It involves buying and selling contracts at.

Options Trading Made Easy Ratio Put Calendar Spread

A calendar spread typically involves buying and selling the same type of option (calls or puts) for the same underlying security at the same. Try.

Web Updated October 31, 2021.

This strategy is one that you can use when you think a stock price is going to go. Calendar spreads are useful in any market climate. When running a calendar spread with puts, you’re selling and buying a put with the same strike price, but the put you buy will have a later expiration date than the. Web a short calendar spread with puts is a possible strategy choice when the forecast is for a big stock price change but the direction of the change is uncertain.

Web Put Calendar Example.

A calendar spread can be constructed with either calls or puts by. Web currently, the calendar put spread is bid at 1.48 and offered at 1.52. Web live scores for every 2024 ncaaf season game on espn. Web demystifying the put calendar spread:

Web What Is A Calendar Spread?

Search a symbol to visualize the potential profit and loss for a calendar put spread option strategy. If we use 1.80 as our historical fair value benchmark, the. It involves buying and selling contracts at the same strike price but. Web two put positions (short and long), with the same strike price and different expiration dates, are required to form a put calendar spread.

Since The Options Are On The Same Strike,.

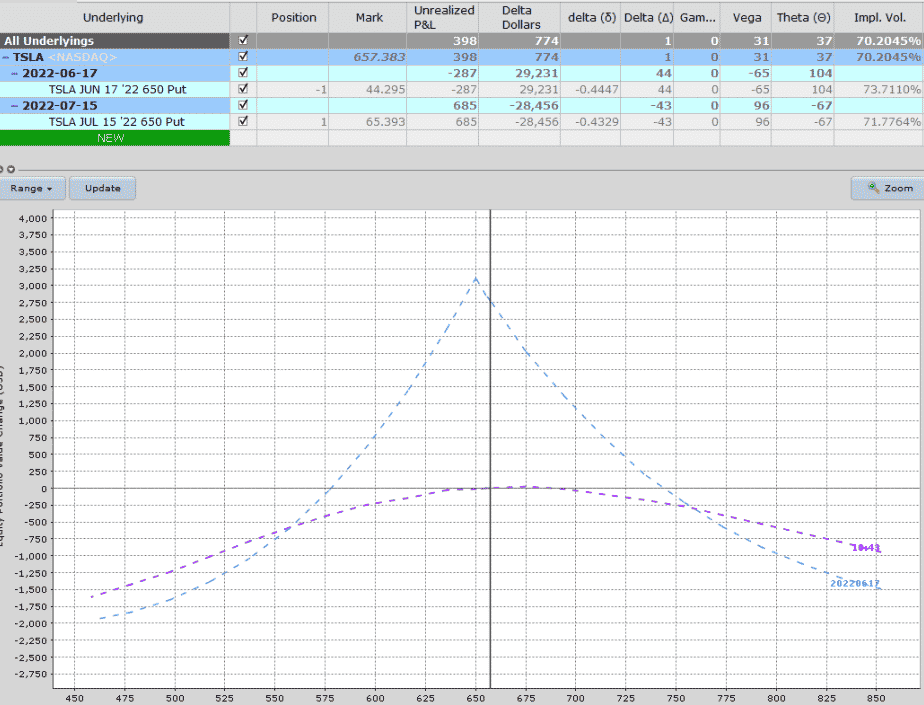

Suppose an investor initiates a put calendar spread on tesla (tsla): Sell one $610 tsla jul. A calendar spread allows option traders to take advantage of elevated premium in near term options with a neutral market bias. The calendar spread, which uses two put options or two call options, enables a trader to express a view on volatility in the short.

![Put Calendar Spread Guide [Setup, Entry, Adjustments, Exit]](https://assets-global.website-files.com/5fba23eb8789c3c7fcfb5f31/6019b83133ac2d32ef084fa5_TsbQgZxQ0e-zKJ9h6Fa7azNlnvn0zH-UBlX3l7hriHll2es1fvyFY5N-nOyM1153MJ4wXLNIhH4zanFkJQB0mpqs81lwEBIvqa7IZQRPWXZY1i3J7vV3BpTIL3v5nCyqn-CEbq2U.png)