Calendar Spread Option - When running a calendar spread with puts, you’re selling and buying a put with the same strike price, but the put you buy will have a later expiration date than the. Web a calendar spread is an options strategy that involves multiple legs. Web a calendar spread is a sophisticated options or futures strategy that combines both long and short positions on the same underlying asset, but with distinct. Learn how to use calendar spreads, a derivatives strategy that involves buying and selling options on the same underlying asset but with different expiration dates. Web a calendar spread takes advantage of the pricing differential that may start to develop between a front month option and a back month option. Web in finance, a calendar spread (also called a time spread or horizontal spread) is a spread trade involving the simultaneous purchase of futures or options expiring on a particular. Today we will focus our attention on adjusting calendar spreads and how to manage them. Web a long calendar spread—often referred to as a time spread—is the buying and selling of a call option or the buying and selling of a put option with the same strike. Web the simple definition of a calendar spread is that it is basically an options spread that involves options contracts with different expiration dates. Web a calendar spread is a strategy involving buying longer term options and selling equal number of shorter term options of the same underlying stock or index with.

Put Calendar Spread Guide [Setup, Entry, Adjustments, Exit]

It involves buying and selling contracts at the same strike price but expiring on different dates. Web the calendar spread options strategy is a market.

What are Calendar Spread and Double Calendar Spread Strategies

Today we will focus our attention on adjusting calendar spreads and how to manage them. Web a calendar spread takes advantage of the pricing differential.

Trading Guide on Calendar Call Spread AALAP

Web a calendar spread is an options strategy that involves multiple legs. Web the simple definition of a calendar spread is that it is basically.

Calendar Spread Options Strategy VantagePoint

Web the simple definition of a calendar spread is that it is basically an options spread that involves options contracts with different expiration dates. Most.

How Long Calendar Spreads Work (w/ Examples) Options Trading

This strategy can be done with either calls. Web in finance, a calendar spread (also called a time spread or horizontal spread) is a spread.

Calendar Spreads Option Trading Strategies Beginner's Guide to the

It involves buying and selling contracts at the same strike price but expiring on different dates. Web a calendar spread is a strategy used in.

Pin on CALENDAR SPREADS OPTIONS

Web a long calendar spread—often referred to as a time spread—is the buying and selling of a call option or the buying and selling of.

The Long Calendar Spread Explained 1 Options Trading Software

Web a calendar spread (time spread) refers to selling a near term expiry option and buying a longer term expiry option, at the same strike..

Calendar Spread, stratégie d'options sur deux échéances différentes.

Most calendar spreads are set. Web a calendar spread is a strategy involving buying longer term options and selling equal number of shorter term options.

Web The Simple Definition Of A Calendar Spread Is That It Is Basically An Options Spread That Involves Options Contracts With Different Expiration Dates.

Web in finance, a calendar spread (also called a time spread or horizontal spread) is a spread trade involving the simultaneous purchase of futures or options expiring on a particular. Web a calendar spread is a sophisticated options or futures strategy that combines both long and short positions on the same underlying asset, but with distinct. Learn how to use calendar spreads, a derivatives strategy that involves buying and selling options on the same underlying asset but with different expiration dates. Find out the pros, cons, and examples of regular and reverse calendar spreads.

Web A Calendar Spread (Time Spread) Refers To Selling A Near Term Expiry Option And Buying A Longer Term Expiry Option, At The Same Strike.

This strategy can be done with either calls. Web a long calendar spread—often referred to as a time spread—is the buying and selling of a call option or the buying and selling of a put option with the same strike. Web a calendar spread is an options strategy that involves multiple legs. Web a calendar spread is a strategy involving buying longer term options and selling equal number of shorter term options of the same underlying stock or index with.

Web A Calendar Spread Is An Options Strategy That Is Constructed By Simultaneously Buying And Selling An Option Of The Same Type ( Calls Or Puts) And Strike.

Horizontal call spread) calculate potential profit, max loss, chance of profit, and more for calendar call spread options and over 50 more strategies. It involves buying and selling contracts at the same strike price but expiring on different dates. A calendar spread is an options trading strategy that involves buying and selling two options with the same strike price but. Web a calendar spread is a strategy used in options and futures trading:

Web What Is A Calendar Spread?

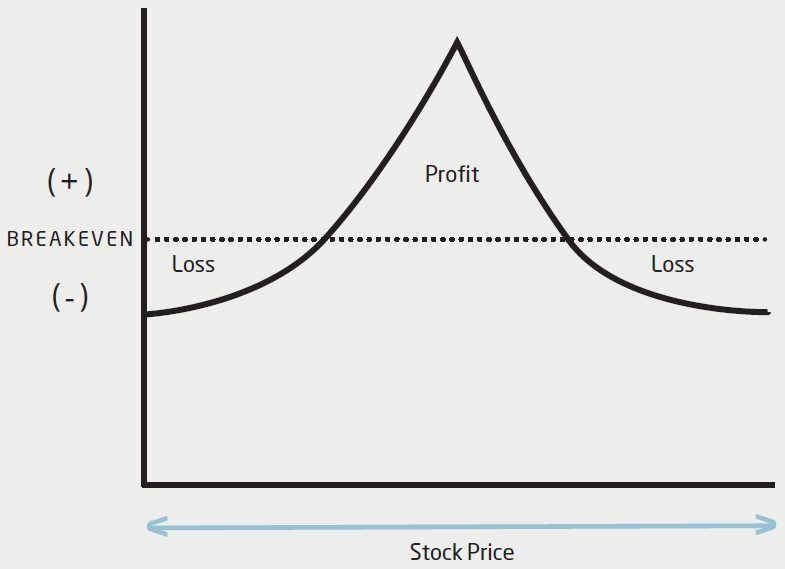

Web a calendar spread takes advantage of the pricing differential that may start to develop between a front month option and a back month option. Most calendar spreads are set. Today we will focus our attention on adjusting calendar spreads and how to manage them. Web the calendar spread options strategy is a market neutral strategy for seasoned options traders that expect different levels of volatility in the underlying stock at varying points in.

![Put Calendar Spread Guide [Setup, Entry, Adjustments, Exit]](https://assets-global.website-files.com/5fba23eb8789c3c7fcfb5f31/6019b83133ac2d32ef084fa5_TsbQgZxQ0e-zKJ9h6Fa7azNlnvn0zH-UBlX3l7hriHll2es1fvyFY5N-nOyM1153MJ4wXLNIhH4zanFkJQB0mpqs81lwEBIvqa7IZQRPWXZY1i3J7vV3BpTIL3v5nCyqn-CEbq2U.png)