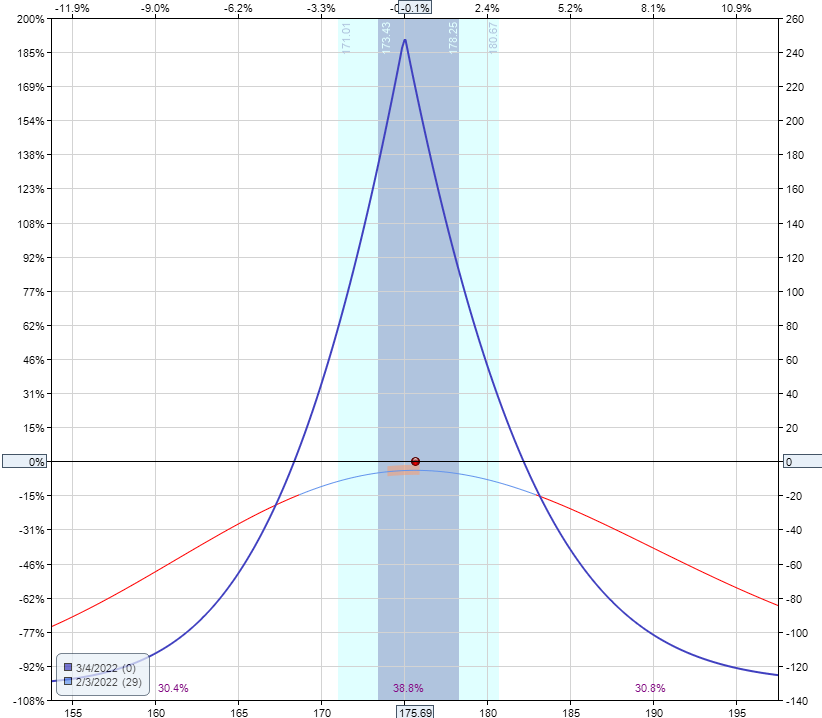

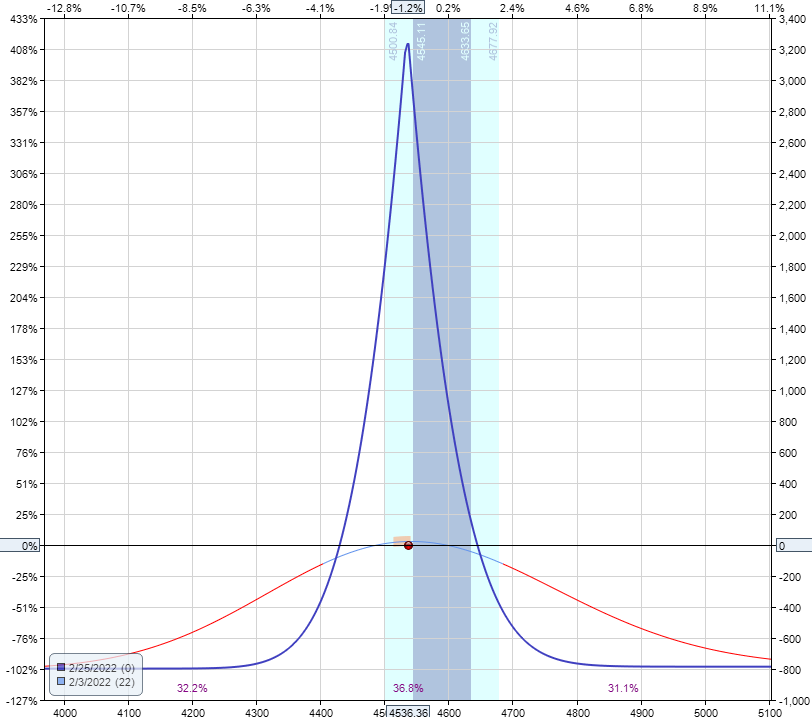

Calendar Spreads With Weekly Options - Strategic trading with weekly options. Web what is a double calendar spread? Web learn how to trade calendar spreads and other weekly option strategies with high gamma and theta. So for example with delta 20 shorts, the sag is bigger,. Web the calendar spread options strategy is a market neutral strategy for seasoned options traders that expect different levels of volatility in the underlying stock at varying points in. Web learn how to collect weekly income with options calendar spreads, which are similar to long call diagonal debit spreads but use the same strike prices. Web a calendar spread is a risk averse strategy that benefits from time passing. If you are looking for a higher return on investment. Web double calendars are tricky in the sense that the sag in the middle (between your two shorts) is dependent on vega. You use the same strike price for the long and short options, but in different expiration.

Calendar Spreads Weekly Option Selling Strategy Trading Options

Web learn how to use calendar spreads to profit from low volatility in spy on fridays. So for example with delta 20 shorts, the sag.

Calendar Spreads Weekly Option Selling Strategy YouTube

Find out the maximum loss, gain, breakeven price,. A double calendar spread is an option trading strategy that involves selling near month calls and puts.

Free Printable Bullet Journal Weekly Spread Customize then Print

In this article, we’ll delve into the art of optimizing earnings announcements using this powerful technique to help you master the world of. A double.

Calendar Spread Options Strategy How to Trade Weekly Options? YouTube

If you are looking for a higher return on investment. Web the neutral calendar spread is a strategy that should immediately peak your interest using.

Calendar Spreads With Weekly Options

Find out the maximum loss, gain, breakeven price,. Web learn how to trade calendar spreads and other weekly option strategies with high gamma and theta..

What are Calendar Spread and Double Calendar Spread Strategies

Calendar spreads are positive vega strategies that benefit from. Web what are calendar spreads? Web learn how to trade calendar spreads with options on the.

What is option trading beginner tutorial for dummies ep 248 Artofit

Strategic trading with weekly options. Web learn how to trade calendar spreads with options on the same instrument with different expiration periods. So for example.

Calendar Spreads With Weekly Options

Calendar spreads are positive vega strategies that benefit from. Web learn how to use calendar spreads, a strategy that involves buying and selling options or.

Calendar Spreads Weekly Option Selling Strategy Theta Gainers YouTube

Web the neutral calendar spread is a strategy that should immediately peak your interest using weekly options. 12k views 1 year ago. Web a calendar.

Web Double Calendars Are Tricky In The Sense That The Sag In The Middle (Between Your Two Shorts) Is Dependent On Vega.

Web learn how to trade calendar spreads with options on the same instrument with different expiration periods. Web learn how to use calendar spreads, a strategy that involves buying and selling options or futures contracts with different expiration dates on the same. Web the neutral calendar spread is a strategy that should immediately peak your interest using weekly options. See an example of a successful trade and the rationale behind it.

Web Learn How To Trade Calendar Spreads And Other Weekly Option Strategies With High Gamma And Theta.

You use the same strike price for the long and short options, but in different expiration. 12k views 1 year ago. So for example with delta 20 shorts, the sag is bigger,. In this video i will share one of the best trading strategy for weekly options in nifty & bank nifty.

In This Article, We’ll Delve Into The Art Of Optimizing Earnings Announcements Using This Powerful Technique To Help You Master The World Of.

Learn how to use calendar spreads, a combination of spreads and directional options trades, to reduce risk and take advantage of time decay. Web learn how to use calendar spreads to profit from low volatility in spy on fridays. A double calendar spread is an option trading strategy that involves selling near month calls and puts and buying future. Calendar spreads are positive vega strategies that benefit from.

Web What Are Calendar Spreads?

If you are looking for a higher return on investment. Web a calendar spread is a risk averse strategy that benefits from time passing. Find out the maximum loss, gain, breakeven price,. What are weekly options and how do they work?