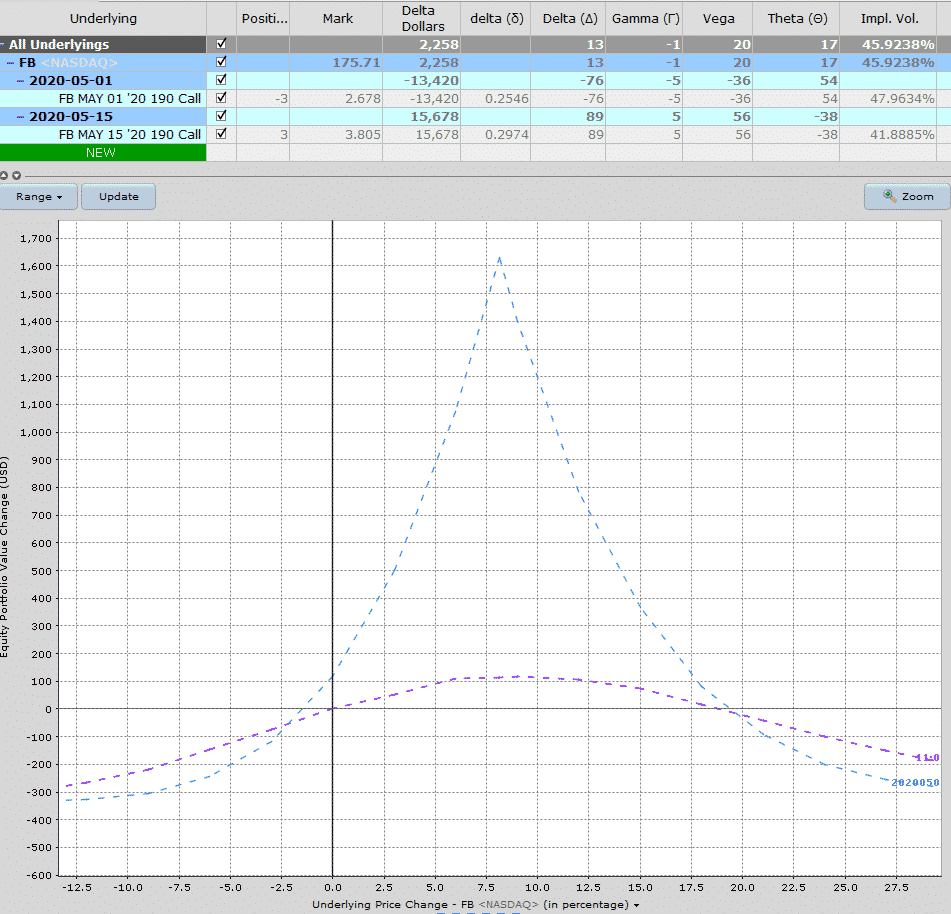

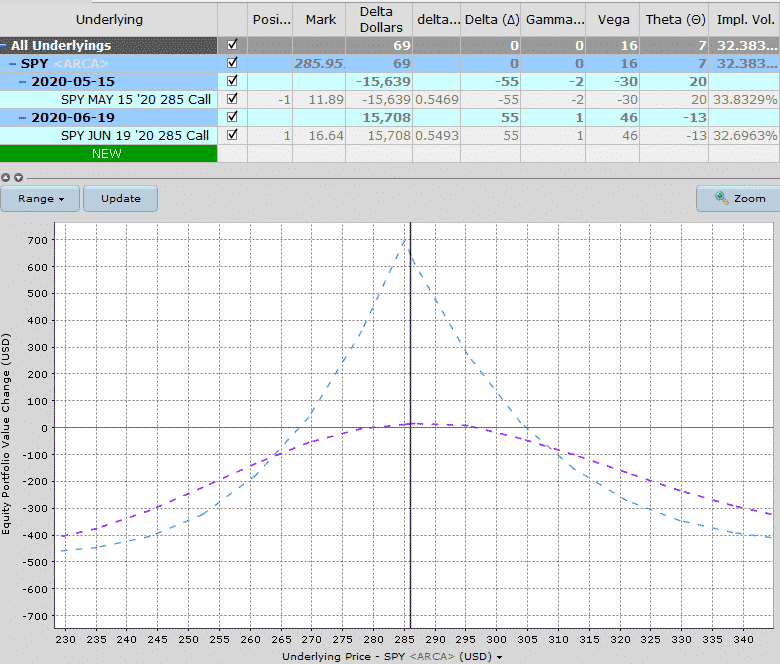

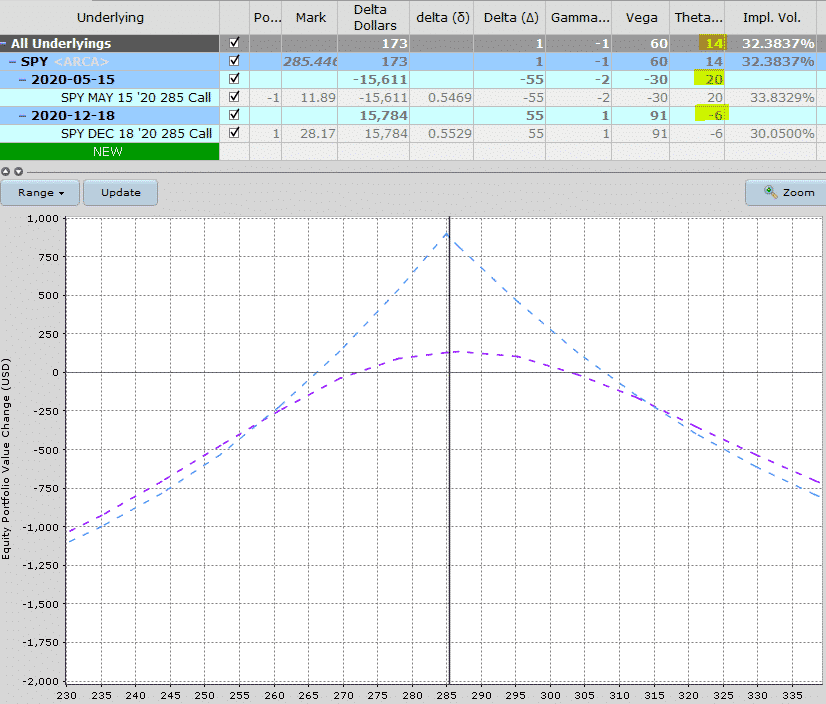

Calendar Spreads - These individual purchases, known as the legs of the spread, vary only in expiration. Web learn how to use calendar spreads, a derivatives strategy that involves buying and selling options or futures contracts with different expiration dates. Web this article provides a comprehensive understanding of calendar spreads, including their purpose, execution, potential profits, and key considerations. Web a calendar spread is a neutral strategy that profits from time decay and an increase in implied volatility. Time decay of the near month option's premium will be faster than that of the far month option. Traditionally calendar spreads are dealt with a price based approach. This spread is considered an advanced options strategy. Web a calendar spread is a strategy involving buying longer term options and selling equal number of shorter term options of the same underlying stock or index with the same strike price. How to profit from a neutral stock price. The maximum loss possible is the cost of the spread.

Calendar Spreads 101 Everything You Need To Know

Long call calendar spreads will require paying a debit at entry. Web learn what a calendar spread is, how it works, and how to trade.

Calendar Spreads Option Trading Strategies Beginner's Guide to the

Web the calendar spread benefits from the different rate of time decay of the two options involved. They can provide downside protection while having unlimited.

Calendar Spreads 101 Everything You Need To Know

Both call options will have the same strike price. For example, you might sell the 50 strike puts in january, and then buy the 50.

Calendar Spreads 101 Everything You Need To Know

Web in finance, a calendar spread (also called a time spread or horizontal spread) is a spread trade involving the simultaneous purchase of futures or.

Calendar Spreads 101 Everything You Need To Know

Web learn how to use calendar spreads, a derivatives strategy that involves buying and selling options or futures contracts with different expiration dates. Time decay.

How Calendar Spreads Work (Best Explanation) projectoption

There are several types, including horizontal spreads and diagonal spreads. The maximum loss possible is the cost of the spread. This has the effect of.

What are Calendar Spread and Double Calendar Spread Strategies

Web learn how to options on futures calendar spreads to design a position that minimizes loss potential while offering possibility of tremendous profit. These individual.

How Long Calendar Spreads Work (w/ Examples) Options Trading

Calendar spreads are useful in any market climate. Web what is a calendar spread? Traditionally calendar spreads are dealt with a price based approach. Web.

Calendar Spreads 101 Everything You Need To Know

This spread is considered an advanced options strategy. There are several types, including horizontal spreads and diagonal spreads. They allow you to take advantage of.

Web I Had Briefly Introduced The Concept Of Calendar Spreads In Chapter 10 Of The Futures Trading Module.

Long call calendar spreads will require paying a debit at entry. Web what is a calendar spread? If you want to use calendar spreads for income, the good news is that calendar spread earnings tend to be higher than other debit or credit spreads. Web what are calendar spreads?

Learn How To Optimize This Strategy To Capitalize On Time Decay And Implied Volatility Changes, While Minimizing Risks And Maximizing Gains.

Web a calendar spread is a long or short position in the stock with the same strike price and different expiration dates. A calendar spread is an option trade that involves buying and selling an option on the same instrument with the same strikes price, but different expiration periods. A calendar spread is an options strategy that involves multiple legs. Find out the pros, cons, and examples of regular and reverse calendar spreads.

Web Learn How To Options On Futures Calendar Spreads To Design A Position That Minimizes Loss Potential While Offering Possibility Of Tremendous Profit.

Find out the benefits, risks, and tools for this strategy on fidelity.com. When running a calendar spread with calls, you’re selling and buying a call with the same strike price, but the call you buy will have a later expiration date than the call you sell. A calendar spread can be constructed with either calls or puts by simultaneously entering a long and short position on the same underlying asset but with different expiry dates. There are several types, including horizontal spreads and diagonal spreads.

A Calendar Spread Allows Option Traders To Take Advantage Of Elevated Premium In Near Term Options With A Neutral Market Bias.

They can provide downside protection while having unlimited profit potential to the upside. Web this article provides a comprehensive understanding of calendar spreads, including their purpose, execution, potential profits, and key considerations. Updated on december 29, 2021. For example, you might sell the 50 strike puts in january, and then buy the 50 strike puts in february or march.