Calendar Year Vs Tax Year - A fiscal year is the 12 months that a company designates as a year for financial and tax reporting purposes. The choice is made easy but its. Some businesses file taxes based on the. Which one is better for my business? Web the internal revenue service (irs) defines a fiscal year as 12 consecutive months ending on the last day of any month except december. In most cases, this means a period of 12 months—beginning, for. Web while a calendar year splits income and expenses into two tax returns, a fiscal year keeps them together. Web since unincorporated small businesses run on a tax year based on the calendar year, the tax filing deadline is a set date. What is the assessment year? Web calendar year is the period from january 1st to december 31st.

Calendar For Taxes 2024 Adel Loella

31, or a fiscal year, which is either a period of 12 consecutive months. What is a fiscal year? Web the internal revenue service (irs).

Fillable Online Fiscal Year vs. Tax Year vs. Calendar Year Stash

What is a fiscal year? Web while a calendar year splits income and expenses into two tax returns, a fiscal year keeps them together. Web.

Calendar Year Vs Tax Year 2024 Calendar 2024 Ireland Printable

Web fiscal year vs calendar year: Common uses while normal life activities or occurrences abide by the. Web while a calendar year splits income and.

Calendar Year Vs Tax Year 2024 New Perfect Awesome Incredible Lunar

It is common for organizations to use a calendar year, as opposed to a fiscal year, as the tax year calendar for their company. Web.

Higher Federal Withholding Table Vs Standard 2021 Federal Withholding

The tax year can end at different times depending on how a business files taxes. Web fiscal year vs calendar year: The calendar year commonly.

What Is a Fiscal Year & How Is it Different From a Tax Year?

Web the key difference is their alignment with the calendar: A fiscal year can start and end in any month while a calendar year aligns.

Tax Year Calendar 2019 2020

An individual can adopt a fiscal year. Web a fiscal and a calendar year are two different things. The choice is made easy but its..

Stay organized with your 2018 tax calendar

Web the internal revenue service (irs) defines a fiscal year as 12 consecutive months ending on the last day of any month except december. A.

25+ Calendar Templates in Excel

Web the key difference is their alignment with the calendar: Which one is better for my business? A tax year can be a calendar tax.

What Is The Assessment Year?

A fiscal year can start and end in any month while a calendar year aligns with the gregorian calendar. Web while a calendar year splits income and expenses into two tax returns, a fiscal year keeps them together. The tax year can end at different times depending on how a business files taxes. Web since unincorporated small businesses run on a tax year based on the calendar year, the tax filing deadline is a set date.

May 29, 2024 11:53 Am.

Israel’s war against hamas in gaza will likely extend past the end of the calendar year, israeli national security adviser tzachi. Web although a fiscal year need not start at the beginning of the calendar year, it must be a yearlong period. What is a fiscal year? In most cases, this means a period of 12 months—beginning, for.

When Does The Tax Year End?

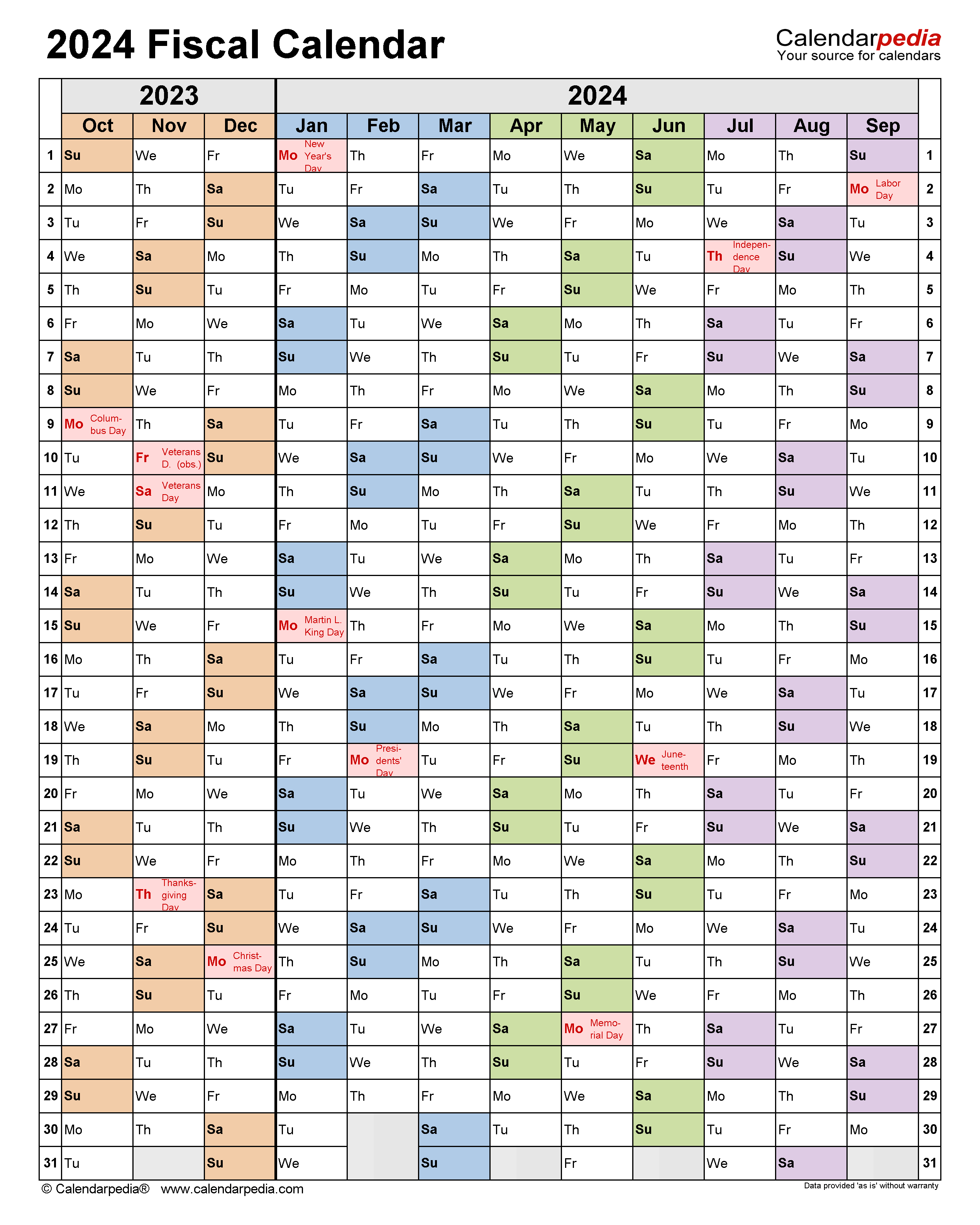

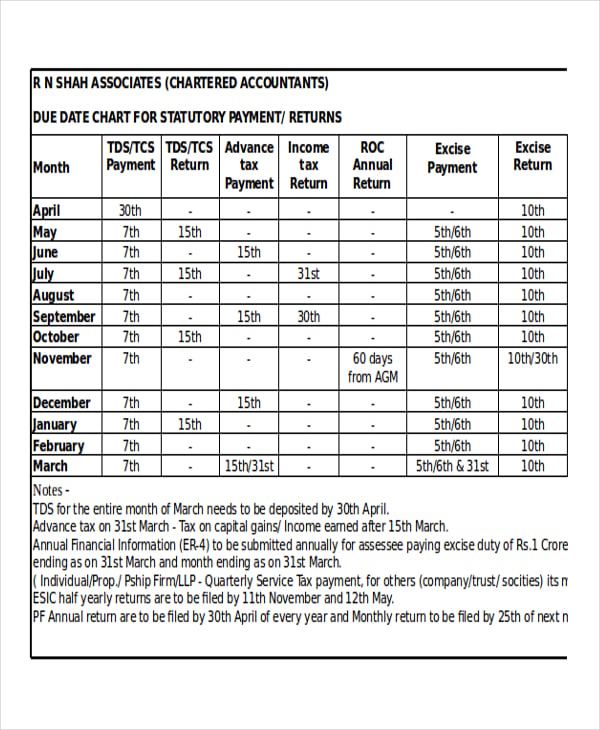

Web chart of various fiscal years. Some businesses file taxes based on the. The year on a physical calendar is a calendar year. Web the calendar year begins on the first of january and ends on 31st december every year, while the fiscal year can begin on any day of the year but will end on exactly the 365th.

It Is Common For Organizations To Use A Calendar Year, As Opposed To A Fiscal Year, As The Tax Year Calendar For Their Company.

Web fiscal year vs calendar year: Web the internal revenue service (irs) defines a fiscal year as 12 consecutive months ending on the last day of any month except december. Web fiscal years can differ from a calendar year and are an important concern for accounting purposes because they are involved in federal tax filings, budgeting, and financial. Which one is better for my business?