Call Calendar Spread - A calendar spread typically involves buying and selling the same type of option (calls or puts) for the same underlying security at the same. Web the calendar call spread is a neutral options trading strategy, which means you can use it to generate a profit when the price of a security doesn't move, or only moves a little. Search a symbol to visualize the potential profit and loss for a calendar call spread option strategy. Web a long call calendar spread involves buying and selling call options for the same underlying security at the same strike price, but at different expiration dates. In this article, we will learn how to adjust and. Web calendar call spread calculator. Web this article provides a comprehensive understanding of calendar spreads, including their purpose, execution, potential profits, and key considerations. Web a calendar spread, also known as a horizontal spread, is created with a simultaneous long and short position in options on the same underlying asset and strike. Web what is a call calendar spread. Try an example ($spy) what is a calendar.

How to Trade Options Calendar Spreads (Visuals and Examples)

Web live scores for every 2024 ncaaf season game on espn. Web a long calendar spread—often referred to as a time spread—is the buying and.

Diagonal Call Calendar Spread Smart Trading

In this article, we will learn how to adjust and. Web this article provides a comprehensive understanding of calendar spreads, including their purpose, execution, potential.

What Is a Call Calendar Spread YouTube

Web any value of the spread outside this range gives us an opportunity to set up a calendar spread. It involves buying and selling contracts.

Calendar Call Option Spread [SPX] YouTube

Web calendar call spread calculator. Search a symbol to visualize the potential profit and loss for a calendar call spread option strategy. Web what is.

Trading Guide on Calendar Call Spread AALAP

A calendar spread involves buying and selling options with different. Web a long call calendar spread involves buying and selling call options for the same.

Long Call Calendar Spread Options Strategy

Web learn how to use calendar spreads, a derivatives strategy that involves buying and selling options or futures contracts with different expiration dates. Web what.

Call Calendar Spread Guide [Setup, Entry, Adjustments, Exit]

Web a long calendar spread—often referred to as a time spread—is the buying and selling of a call option or the buying and selling of.

The Dual Calendar Spread (A Strategy for a Trading Range Market) (1106

Web a calendar spread, also known as a horizontal spread, is created with a simultaneous long and short position in options on the same underlying.

Calendar Call Spread Calculator

Web what is a calendar spread? Try an example ($spy) what is a calendar. Web learn how to use calendar spreads, a derivatives strategy that.

A Calendar Spread Involves Buying And Selling Options With Different.

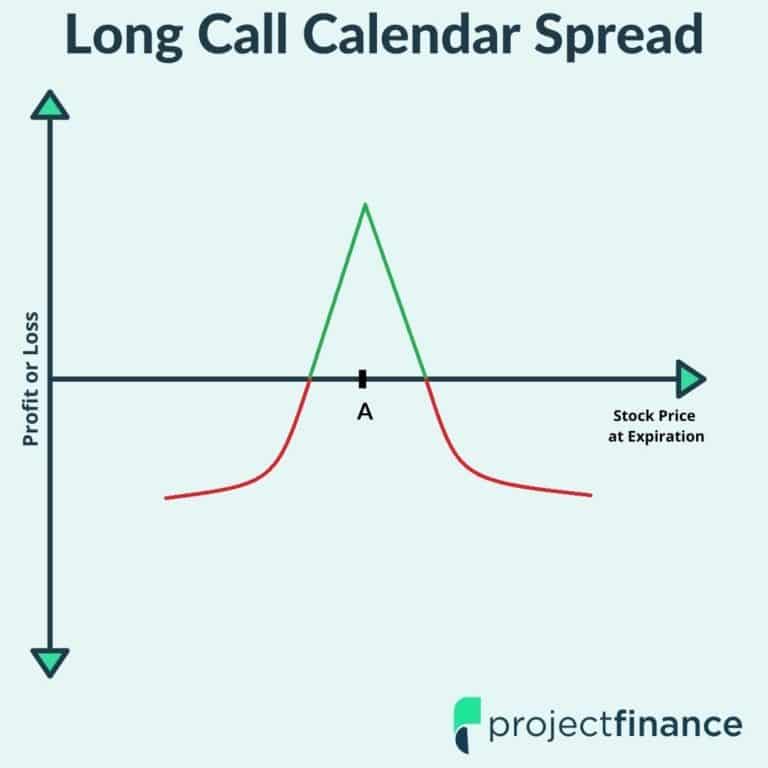

Web a long calendar spread—often referred to as a time spread—is the buying and selling of a call option or the buying and selling of a put option with the same strike. Web the calendar call spread is a neutral options trading strategy, which means you can use it to generate a profit when the price of a security doesn't move, or only moves a little. Web a calendar spread, also known as a horizontal spread, is created with a simultaneous long and short position in options on the same underlying asset and strike. Try an example ($spy) what is a calendar.

Includes Box Scores, Video Highlights, Play Breakdowns And Updated Odds.

Web live scores for every 2024 ncaaf season game on espn. If the spread has increased beyond the upper range of 1.7205, it. Web learn how a calendar spread works and how implied volatility affects its profit potential. A calendar spread typically involves buying and selling the same type of option (calls or puts) for the same underlying security at the same.

Search A Symbol To Visualize The Potential Profit And Loss For A Calendar Call Spread Option Strategy.

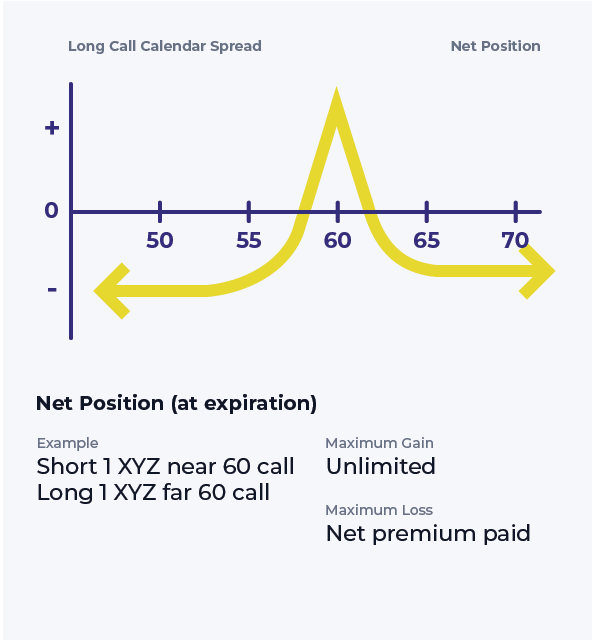

Web a long call calendar spread involves buying and selling call options for the same underlying security at the same strike price, but at different expiration dates. Web any value of the spread outside this range gives us an opportunity to set up a calendar spread. In this article, we will learn how to adjust and. Short one call option and long a second call option with a more distant expiration is an example of a long call calendar spread.

Web Calendar Call Spread Calculator.

Web what is a call calendar spread. It involves buying and selling contracts at the same strike price but expiring on different. Web this article provides a comprehensive understanding of calendar spreads, including their purpose, execution, potential profits, and key considerations. Web a calendar spread is an options strategy that involves multiple legs.

![Calendar Call Option Spread [SPX] YouTube](https://i.ytimg.com/vi/em03gM2jnxs/maxresdefault.jpg)

![Call Calendar Spread Guide [Setup, Entry, Adjustments, Exit]](https://assets-global.website-files.com/5fba23eb8789c3c7fcfb5f31/6019ad90afc0a18011924af0_3Ui8KuFuRxcjUyFQ2mvscNmGIXALxE0ESnrXkoAAqNejP5Ygrj-dyv3Kfo-1jmOjFg2axgrXs-MriQsNl-6is4rU-lDczPVaDzlttqUjTEJIvT6pRF0GK8qSlYVoNo6r5r07P-gi.png)