Call Calendar - Web there are two types of long calendar spreads: Web entering into a calendar spread simply involves buying a call or put option for an expiration month that's further out while simultaneously selling a call or put option for a closer. Web thanks to the moon’s orbit around earth, the angle of sunlight hitting the lunar surface and being reflected back tocontinue reading 2024 full moon calendar: Operating room call scheduling software for nurses and surgical techs in the operating room to sign up for call and to manage a call schedule from any mobile device, tablet or computer. There are inherent advantages to trading a put calendar over a call calendar, but both are readily acceptable trades. When running a calendar spread with calls, you’re selling and buying a call with the same strike price, but the call you buy will have a later expiration date than the call you sell. Dates, times, types, and names the. About long call calendar spreads. Web a calendar spread is a strategy involving buying longer term options and selling equal number of shorter term options of the same underlying stock or index with the same strike price. Alan jackson is taking his final ride with the announcement of tour dates in 2024 and 2025.

On Call Schedule Template Lovely 9 Call Schedule Template Excel

Learn more with option alpha. Alternatively, bookmark our euro 2024. Web updated march 04, 2024. In this article, we will learn how to adjust and.

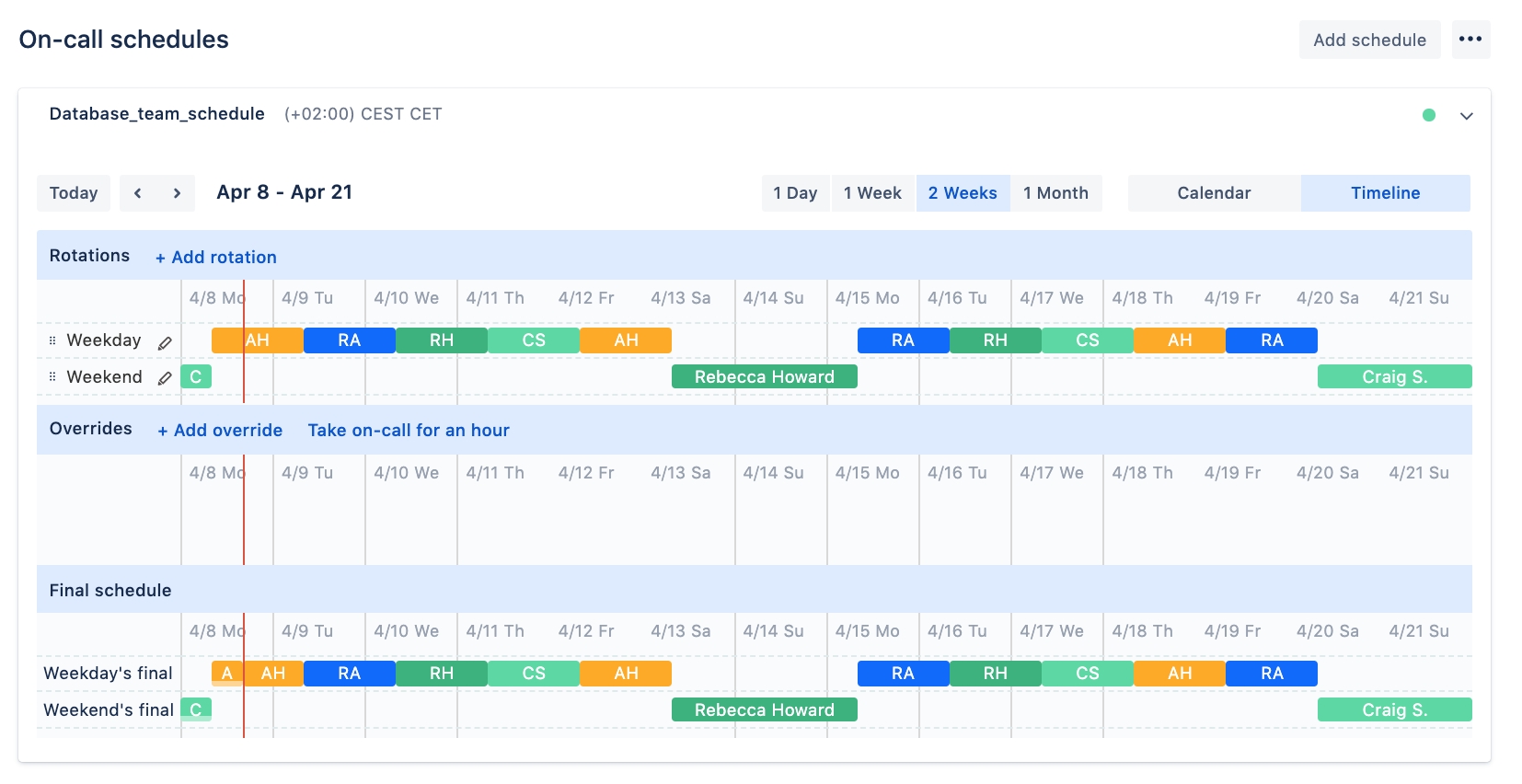

Pin on Letter Sample

Web entering into a calendar spread simply involves buying a call or put option for an expiration month that's further out while simultaneously selling a.

On Call Rotation Schedule Template Best Of Call Rotation Schedule

There are inherent advantages to trading a put calendar over a call calendar, but both are readily acceptable trades. When running a calendar spread with.

On Call Calendar Template

Save time and stay focused with zoom mail & calendar client, which are included for all zoom users. Web a calendar spread is an option.

How to add oncall to your schedule in Excel YouTube

Web thanks to the moon’s orbit around earth, the angle of sunlight hitting the lunar surface and being reflected back tocontinue reading 2024 full moon.

On Call Schedule Template Excel Inspirational Call Calendar Template

Simply click on the links below to print off our calendar and wall chart: About long call calendar spreads. Horizontal call spread) calculate potential profit,.

Best On Call Calendar Template Get Your Calendar Printable

Web a calendar call spread is an options strategy where two calls are traded on the same underlying and the same strike, one long and.

On Call Schedule Template Venngage

A calendar spread is an options or futures strategy where an investor simultaneously enters long and short. Selling a call calendar spread consists of buying.

Rotating OnCall Schedule Template

A calendar spread is an options or futures strategy where an investor simultaneously enters long and short. All trials will proceed as scheduled. The day.

It Is Sometimes Referred To As A Horiztonal Spread, Whereas A Bull Put Spread Or Bear Call Spread Would Be Referred To As A Vertical Spread.

When running a calendar spread with calls, you’re selling and buying a call with the same strike price, but the call you buy will have a later expiration date than the call you sell. A long call calendar spread involves buying and selling call options for the same underlying security at the same strike price, but at different expiration dates. There are inherent advantages to trading a put calendar over a call calendar, but both are readily acceptable trades. Web a calendar spread is a strategy used in options and futures trading:

Alternatively, Bookmark Our Euro 2024.

Web to capture the profit potential created by wild market reversals to the upside and the accompanying collapse in implied volatility from extreme highs, the one strategy that works the best is called. Web sun, may 26th, 2024. Web entering into a calendar spread simply involves buying a call or put option for an expiration month that's further out while simultaneously selling a call or put option for a closer. Learn more with option alpha.

Simply Click On The Links Below To Print Off Our Calendar And Wall Chart:

Web zoom mail and calendar client. The only thing that separates them is their expiry date. The aim of the strategy is to profit from the difference in time decay between the two options. Web thanks to the moon’s orbit around earth, the angle of sunlight hitting the lunar surface and being reflected back tocontinue reading 2024 full moon calendar:

Web A Calendar Call Spread Is An Options Strategy Where Two Calls Are Traded On The Same Underlying And The Same Strike, One Long And One Short.

The strategy most commonly involves calls with the same strike (horizontal spread), but can also be done with different strikes (diagonal spread). Web there are two types of long calendar spreads: Web the calendar call spread is a neutral options trading strategy, which means you can use it to generate a profit when the price of a security doesn't move, or only moves a little. Calendar spreads are also known as ‘time spreads’, ‘counter spreads’ and ‘horizontal spreads’.