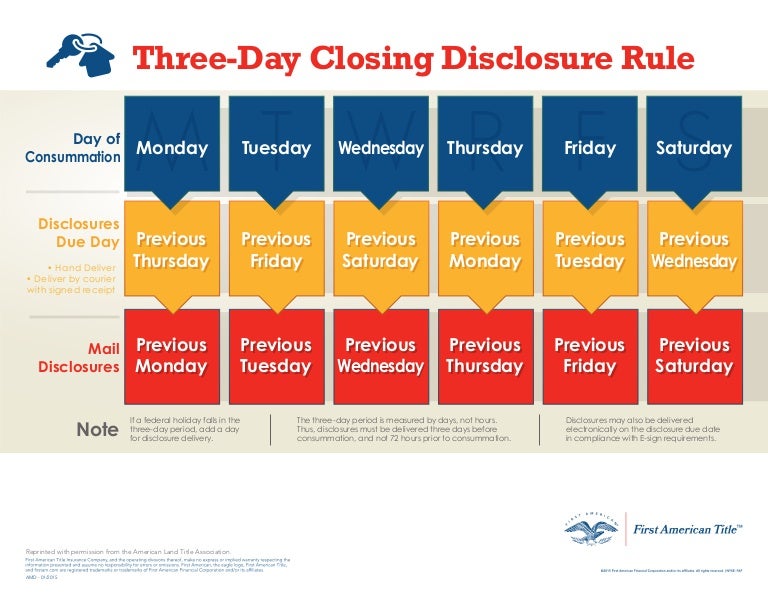

Closing Disclosure 3 Day Rule Calendar - Web lenders are required to provide your closing disclosure three business days before your scheduled closing. Your lender is required by law to give you the standardized closing disclosure at least 3 business days before closing. Web select your closing method: Web thus, disclosures must be delivered three days before closing, and not 72 hours prior to closing • disclosures may also be delivered electronically on the disclosures due date. Web in addition, the closing disclosure must have been provided to/received by the consumer on tuesday the 10th. Web thus, disclosure must be delivered three days before closing, and not 72 hours prior to closing. Thus, disclosures must be delivered three days before closing, and not 72 hours prior to closing. Table funding does not occur in ca, az, hi, nv, wa or or). Web the closing disclosure. Friday would be day #1;

ThreeDay Closing Disclosure Rule Infographic

Web the closing disclosure. Friday would be day #1; Web confused by the trid date rules? Use these days wisely—now is the time to resolve.

Closing Disclosure 3 Day Rule Calendar Graphics Calendar template

Web the wfg trid calendar is provided as an estimate for clients to determine approximate delivery of the closing disclosure and consummation dates. Web detailed.

Village Settlements, Inc. » NEW LOAN ESTIMATE AND CLOSING DISCLOSURE FORMS

The right to rescind extends until midnight of the third business day after the latest of the following occurs: Thus, disclosure must be delivered three.

The 3 Day Closing Disclosure Rule Twin City Title

Thus, disclosures must be delivered three days before closing, and not 72 hours prior to closing. Friday would be day #1; Web the wfg trid.

3 day closing disclosure rule.

Web detailed summary of changes and clarifications in the 2017 trid rule. Web lenders are required to provide your closing disclosure three business days before.

Trid Calendar 2022 Customize and Print

Web reference this chart to determine when you need to be sure that the closing disclosure is either electronically received by your borrower or delivered.

Closing Disclosure 3 Day Rule Calendar Graphics Calendar examples

Thus, disclosures must be delivered three days before closing, and not 72 hours prior to closing. Use these days wisely—now is the time to resolve.

Three Day Trid Closing Rule Calendar Image

Web select your closing method: Web in addition, the closing disclosure must have been provided to/received by the consumer on tuesday the 10th. If there.

Trid 3 Day Closing Calendar Image

Web your lender is required to send you a closing disclosure that you must receive at least three business days before your closing. Web select.

Web Confused By The Trid Date Rules?

Web reference this chart to determine when you need to be sure that the closing disclosure is either electronically received by your borrower or delivered via us mail. It’s important that you carefully. Thus, disclosures must be delivered three days before closing, and not 72 hours prior to closing. Your lender is required by law to give you the standardized closing disclosure at least 3 business days before closing.

Friday Would Be Day #1;

Based on the application date, when is the loan estimate required to be delivered, when is it considered received, how do changed. Web the wfg trid calendar is provided as an estimate for clients to determine approximate delivery of the closing disclosure and consummation dates. Disclosure timeline illustrating the process and timing of disclosures for a sample real. Web if the closing disclosure is acknowledged on a thursday, for example, the borrower can sign loan docs on the following monday;

Web Thus, Disclosures Must Be Delivered Three Days Before Closing, And Not 72 Hours Prior To Closing • Disclosures May Also Be Delivered Electronically On The Disclosures Due Date.

Web lenders are required to provide your closing disclosure three business days before your scheduled closing. Web it must be provided to the borrower at least three business days before closing. Web detailed summary of changes and clarifications in the 2017 trid rule. As the name suggests, you receive the closing disclosure when it’s time to sign and finalize your mortgage.

Disclosures May Also Be Delivered Electronically To The Delivery Period And May.

Use these days wisely—now is the time to resolve problems. If there is a change to the disclosed terms after the creditor provides the initial closing disclosure, is the creditor required to ensure the consumer receives a corrected closing. Thus, disclosure must be delivered three days before closing, and not 72 hours prior to closing. Web your lender is required to send you a closing disclosure that you must receive at least three business days before your closing.