Diagonal Calendar Spread - Web using two expiration cycles, the diagonal spread combines the characteristics of a vertical spread with the characteristics of a calendar spread. Web what is a diagonal spread and how does it work. Web the diagonal spread has just two legs, similar to the calendar spread, but it provides a more directional lean somewhat mirroring a long vertical debit spread, but also. A diagonal spread refers to an adjusted version of a calendar spread with different strike prices. However, they differ in terms of. Web the diagonal spread is a popular options trading strategy that involves the simultaneous purchase and sale of options of the same type but with different strike prices and. It all depends on how you build the spread. It involves buying and selling options with different strike prices and expiration dates, and can be bullish or bearish depending on the structure. The setup includes the entry of a long. Web any value of the spread outside this range gives us an opportunity to set up a calendar spread.

Calendar Spread & Diagonal Spread Strategy, Pros & Cons, Real Examples

Web a calendar spread allows option traders to take advantage of elevated premium in near term options with a neutral market bias. It involves two.

DIAGONAL WEEKLY CALENDAR WITH ADJUSTMENTS WEEKLY CALENDAR SPREAD

It is a fairly advanced option strategy and should only be. Web a put diagonal spread is a combination of a bull put credit spread.

Diagonal Calendar Spread What It Is & How To Use It YouTube

Web a diagonal spread is an options strategy that combines a horizontal spread and a vertical spread. A diagonal spread allows option traders to. Web.

Diagonal Calendar Spread

Web the diagonal spread is a popular options trading strategy that involves the simultaneous purchase and sale of options of the same type but with.

Diagonal Calendar Spread low vix strategy YouTube

A diagonal spread is a hybrid of a bull call spread or a bear put spread, combined with a calendar spread. Web using two expiration.

DOUBLE DIAGONAL CALENDAR SPREAD STRATEGY TRADING PLUS YouTube

Web a put diagonal spread is a combination of a bull put credit spread and a put calendar spread. A double diagonal spread is made.

Trading Calendar and Diagonal Spreads l Options Trading YouTube

Web the diagonal spread has just two legs, similar to the calendar spread, but it provides a more directional lean somewhat mirroring a long vertical.

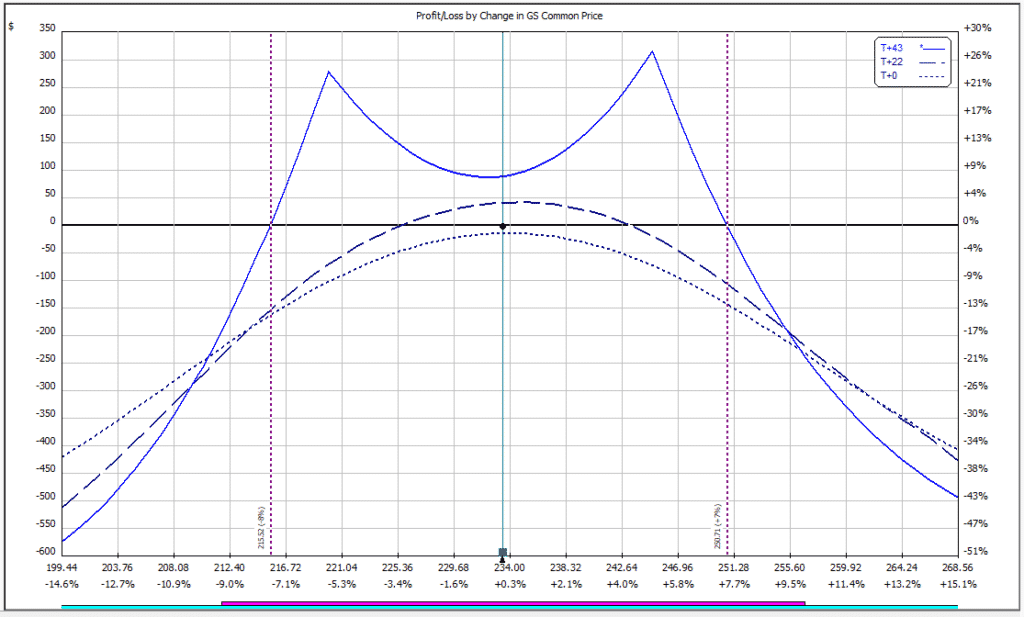

Case Study Goldman Sachs Double Calendar and Double Diagonal

If the spread has increased beyond the upper range of 1.7205, it means either. Web the diagonal spread has just two legs, similar to the.

When Calendar Met Vertical A Diagonal Spread Tale Ticker Tape

It involves two calls or puts with. Web using two expiration cycles, the diagonal spread combines the characteristics of a vertical spread with the characteristics.

Web Diagonal Spreads Are An Advanced Options Strategy.

Call diagonal spreads are bearish and capitalize on time. It all depends on how you build the spread. A diagonal spread is an options trading strategy that combines elements of both vertical and calendar spreads. Web calendar spread vs diagonal spread.

Web What Is A Diagonal Spread And How Does It Work.

A diagonal spread refers to an adjusted version of a calendar spread with different strike prices. The setup includes the entry of a long. Web a diagonal spread is similar to a calendar spread with the only difference being that the strikes are different. The main difference in a calendar vs a diagonal spread is that you are not trading the same strike price although you are still trading.

Here's A Screenshot Of What Would Officially Be Called A Calendar.

Web a calendar spread allows option traders to take advantage of elevated premium in near term options with a neutral market bias. However, they differ in terms of. Web what is a call diagonal spread? It is a fairly advanced option strategy and should only be.

A Double Diagonal Spread Is Made Up Of A Diagonal Call Spread And A Diagonal Put Spread.

A diagonal spread allows option traders to. Web using two expiration cycles, the diagonal spread combines the characteristics of a vertical spread with the characteristics of a calendar spread. Web calendar spreads and diagonal spreads are both types of spread trades that involve buying and selling options with different expiration dates. It starts out as a time decay play.