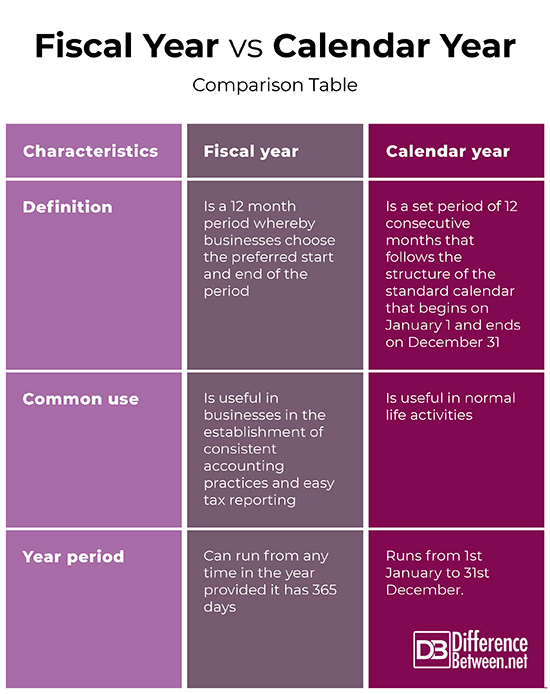

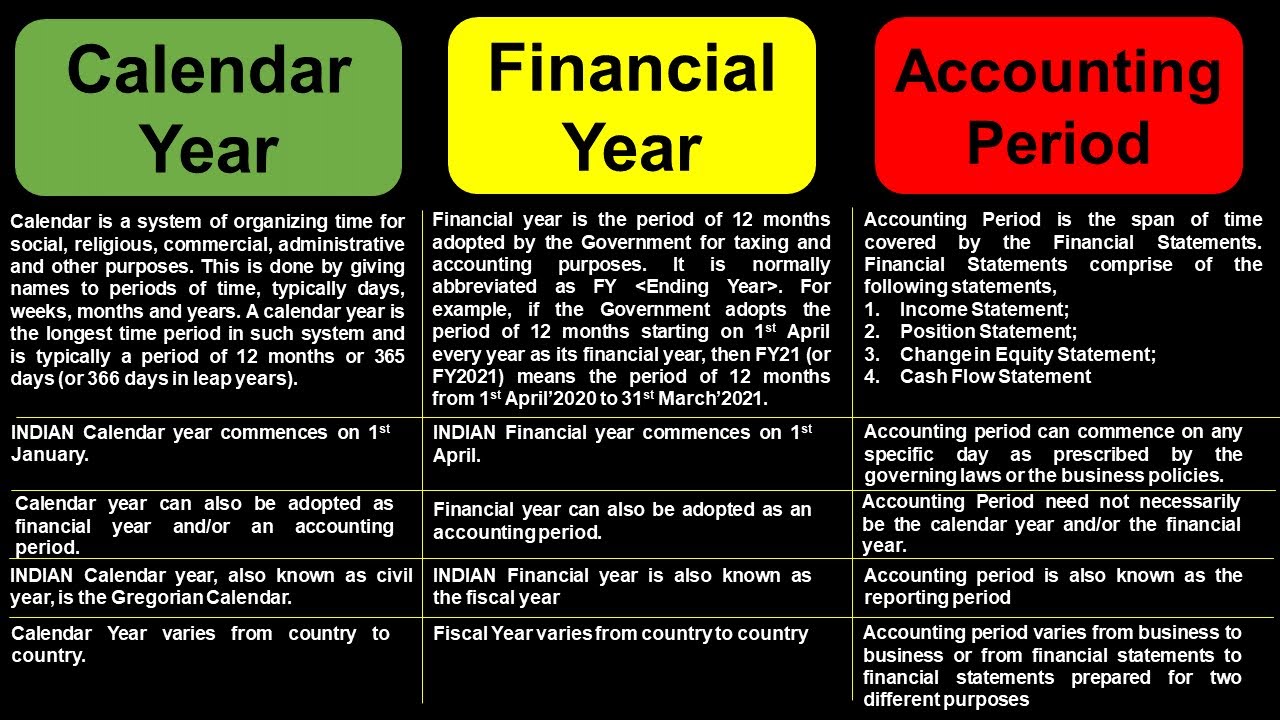

Difference Between Calendar Year And Fiscal Year - 31 for those using the gregorian calendar). Difference between the calendar year vs fiscal year. Web here’s a quick and easy breakdown of the core differences between fiscal and calendar years: Web while a fiscal year lasts one year, it doesn't always align with the calendar year. In contrast, the latter begins on the first of january and ends every year on the 31st of december. Web any individual or business can use a calendar year, but if your organization meets any of the following criteria, you must use a calendar year: Mostly the company’s financial statements are prepared for 1 year, although the dates might change according to the organization and also depend on country to country. Web the fiscal year, a period of 12 months ending on the last day of the month, does not line up with the traditional calendar year. It is common for organizations to use a calendar year, as opposed to a fiscal year, as the tax year calendar for their company. Web fiscal years can differ from a calendar year and are an important concern for accounting purposes because they are involved in federal tax filings, budgeting, and financial reporting.

Difference Between Fiscal Year and Calendar Year Difference Between

A fiscal year is often the period. Web a fiscal year is 12 months chosen by a business or organization for accounting purposes, while a.

Difference Between Fiscal Year and Calendar Year

Web a period that is set from january 1 to december 31 is called a calendar year. Web the fiscal year, a period of 12.

Fiscal Year vs Calendar Year Top Differences You Must Know! YouTube

Web the calendar year, as the name implies, follows the structure of a standard calendar and begins on january 1. It can be any date.

What is the Difference Between Fiscal Year and Calendar Year

The calendar year commonly coincides with the fiscal. The fiscal year and the calendar year are two distinct ways of measuring time, each with its.

What is Calendar Year What is Financial Year What is Accounting

Web updated july 25, 2023. Here is an example of the difference between a calendar year end and a fiscal year end: A fiscal year.

Tax Talk Tuesday What's the Difference Between Calendar Year & Fiscal

It can be any date as long as the fiscal year is 52. Web fiscal years can differ from a calendar year and are an.

Fiscal Year vs Calendar Year What's The Difference?

31 for those using the gregorian calendar). Web definition of fiscal year vs. Learn when you should use each. A fiscal year is often the.

What is the difference between Calendar and Fiscal Year? YouTube

This is because certain entities can choose when their fiscal year starts. Governments and organizations can choose fiscal years to align with their budgeting and.

What is the Difference Between Fiscal Year and Calendar Year

You have no financial books or records; Web updated july 25, 2023. There is no defined annual accounting period. A year is a year, right?.

Web A Period That Is Set From January 1 To December 31 Is Called A Calendar Year.

A tax year is a calendar year, but a calendar year isn’t necessarily a fiscal year. 31 as a calendar year does, but not all fiscal years do. You have no financial books or records; Web the fiscal year, a period of 12 months ending on the last day of the month, does not line up with the traditional calendar year.

The Critical Difference Between A Fiscal Year And A Calendar Year Is That The Former Can Start On Any Day And End Precisely On The 365Th Day.

Web a fiscal year is 12 months chosen by a business or organization for accounting purposes, while a calendar year refers to the standard january 1 to december 31 period. Web a fiscal year be any chosen start and end date within the calendar year as long as it is no longer than 53 weeks or 371 days. The fiscal year (fy) is a financial accounting period used by businesses, governments, and organizations to track their financial activities. They start on jan 1 and the calendar year end is dec 31.

Learn When You Should Use Each.

A fiscal year can start on any day and end precisely 365 days later. Using a calendar year as a company’s tax year is often the simplest approach. The current tax year doesn’t qualify as a fiscal year. The fiscal year starts on any date.

For Example, A Fiscal Year Can Run From Jan.

Web the calendar year starts on new year’s day. But for businesses whose primary operating season doesn’t fall neatly within a single calendar year, choosing a fiscal year end can make more sense. For example, a business that incorporates on july 1, 2018 could choose a year end of any date within the following 53 weeks. Web definition of fiscal year vs.