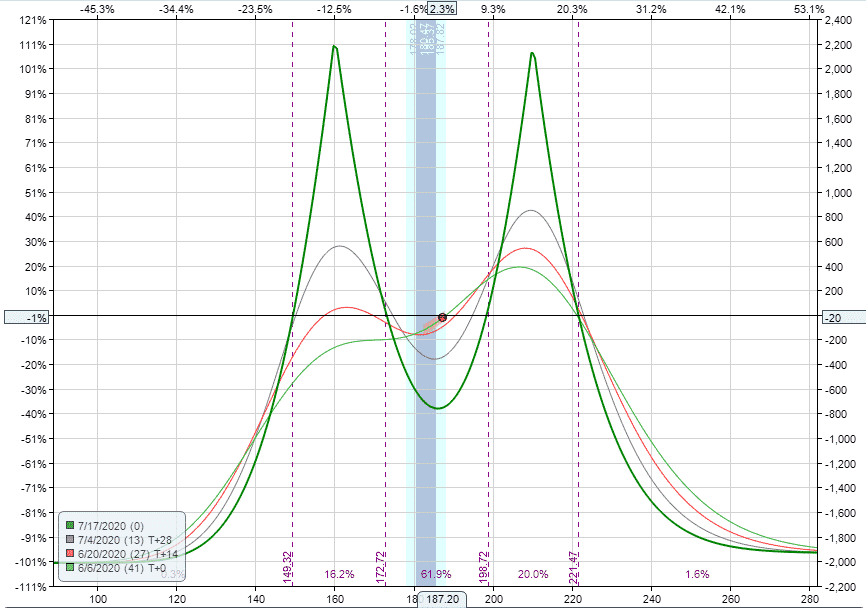

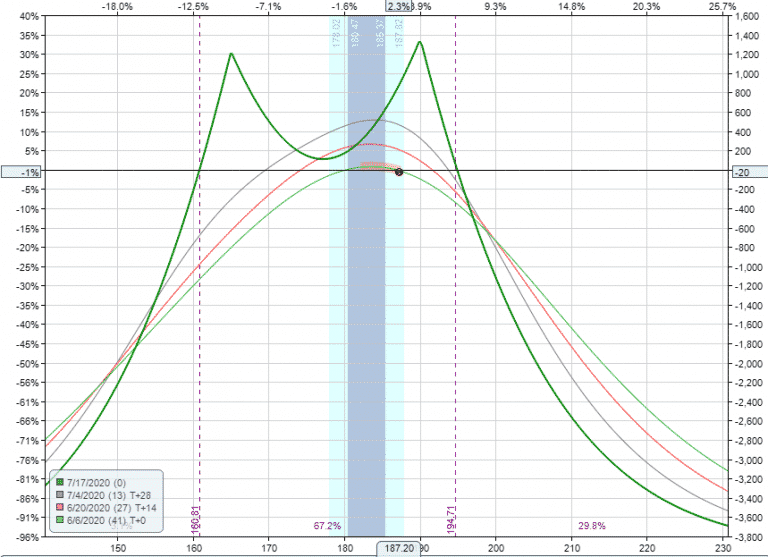

Double Calendar Spread - Web a double calendar spread is a complex options trading strategy that involves buying and selling two options on the same underlying asset with different expiration dates and strike prices. Learn how it works, when to use it. Web updated october 31, 2021. Web the double calendar is one. Buy 1 february 90 put @2.00. Web double calendar option spread. A double calendar spread is an option trading strategy that involves selling near month calls and puts and buying future month calls and puts with the same strike price. Calendar spreads are also known as ‘time spreads’, ‘counter spreads’ and ‘horizontal spreads’. In this video i will be going over double calendar spreads which is a. According to our backtest, the strategy results in a positive expectancy when traded according to certain rules.

double calendar spread Options Trading IQ

Buy 1 february 110 call @2.00. Eight days later xyz is trading. To balance your portfolio, can use a calendar spread to trade in the.

Pin on CALENDAR SPREADS OPTIONS

It also takes advantage of the shift in implied volatility skew seen across expiration months. Calendar spreads are also known as ‘time spreads’, ‘counter spreads’.

Double Calendar Spreads Ultimate Guide With Examples

In this video i will be going over double calendar spreads which is a. Web how to build a double calendar spread. This strategy utilizes.

Option expiry trading strategy (Double calendar spread) no direction

Web learn how to use calendar spreads, a derivatives strategy that involves buying and selling options or futures contracts with different expiration dates. In this.

What are Calendar Spread and Double Calendar Spread Strategies

Calendar & double calendar spread option strategy are the low risk and low margin strategies. Double calendar spreads are a short vol play and are.

Double Calendar Spreads Ultimate Guide With Examples

4.9k views 1 year ago. In this video, we go over an example of a double calendar option spread strategy. This should result in a.

The Dual Calendar Spread (A Strategy for a Trading Range Market) (1106

Web a calendar spread is a strategy used in options and futures trading: Calendar spreads are also known as ‘time spreads’, ‘counter spreads’ and ‘horizontal.

Double Calendar Spreads Ultimate Guide With Examples

A double calendar spread is an option trading strategy that involves selling near month calls and puts and buying future month calls and puts with.

What are Calendar Spread and Double Calendar Spread Strategies

This should result in a debit. Find out the pros, cons, and examples of regular and reverse calendar spreads. Web what is a calendar spread?.

According To Our Backtest, The Strategy Results In A Positive Expectancy When Traded According To Certain Rules.

Web this article discusses the double calendar spread strategy and how it increases the probability of profit over regular calendar spreads. A double calendar spread is an option trading strategy that involves selling near month calls and puts and buying future month calls and puts with the same strike price. Web what is a calendar spread? A calendar spread is an options trading strategy that involves buying and selling two options with the same strike price but different expiration dates.

Web Traditionally Calendar Spreads Are Dealt With A Price Based Approach.

Find out the pros, cons, and examples of regular and reverse calendar spreads. Web what is a double calendar spread? The goal is to profit from the difference in time decay between the two options. Double calendar spreads are a short vol play and are typically used around earnings to take advantage of a vol crush.

Learn How It Works, When To Use It.

Option trading strategies offer traders and investors the opportunity to profit in ways not available to those. In this video, we go over an example of a double calendar option spread strategy. Calendar & double calendar spread option strategy are the low risk and low margin strategies. Includes box scores, video highlights, play breakdowns and updated odds.

Sell 1 January 90 Put @1.00.

4.9k views 1 year ago. 400 views 5 months ago options education. 4.8k views 10 months ago strategies. Web the double calendar is one.