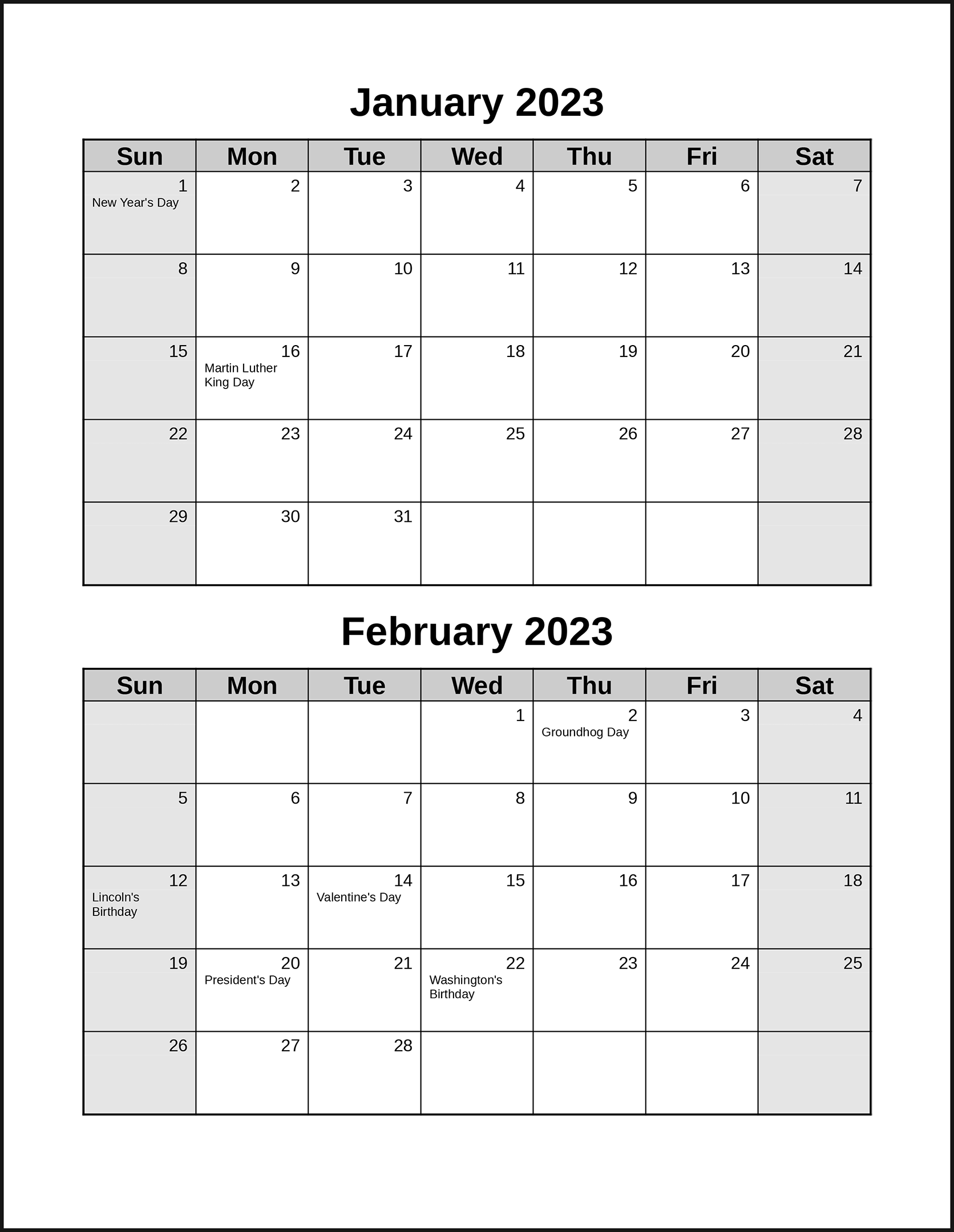

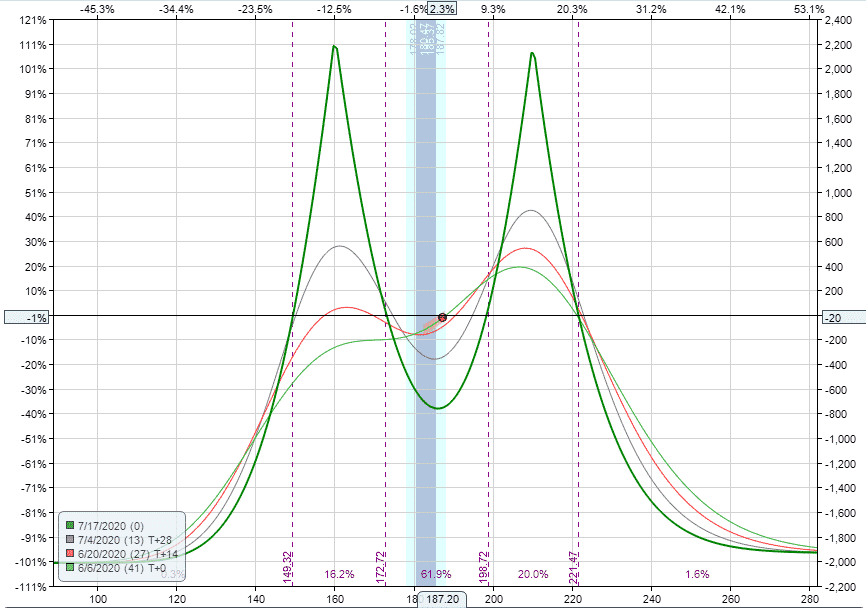

Double Calendar - Click the gear button (top right), then settings and view options. Here’s what you need to know about double calendar spreads and how they are used in options. Radosław wojtaszek and alina kashlinskaya are the new polish champions. Determine the expected move by looking at the straddle pricing. In this video, we go over an example of a double calendar option spread strategy. Alina claimed her maiden gold in this prestigious event. Sell 1 january 110 call @1.00. Buy 1 february 110 call @2.00. I like my short options to have about eight days to expiration and my long options to have about 22 days to expiration. We'll show you how to set up this strategy with four different.

Double Month

Calendars are long vega trades and theoretically make money if iv increases. It is sometimes referred to as a horiztonal spread, whereas a bull put.

Double Calendar Spreads Ultimate Guide With Examples

Web frequently asked questions. Sell 1 january 90 put @1.00. Everything you need to know about calendar spreads. Web inflation has cooled dramatically from its.

What are Calendar Spread and Double Calendar Spread Strategies

Eight days later xyz is trading at. Radosław won his sixth title and is now just one victory short of wlodzimierz schmidt's record (7 titles)..

Twin Tops How and When to Set Up a Double Calendar Ticker Tape

Buy ten february 3 mcd $255 put @ $4.65. Alina claimed her maiden gold in this prestigious event. Web double month contains two months on.

Double Page Calendar Template Example Calendar Printable

Web the double calendar spread is essentially two calendar spreads. If the stock is trading at 50.00 and the 50 call and 50 put are.

Free Printable Two Page Monthly Calendar Calendar Template Printable

A trimester is a study period that occurs three times during the year. How to build a double calendar spread. Radosław wojtaszek and alina kashlinskaya.

Double Calendar Spreads Ultimate Guide With Examples

Web inflation has cooled dramatically from its highs several years ago, thanks to the fed's tightening of monetary policy. Alina claimed her maiden gold in.

Double Calendars Order a Unique Double Calendar Online

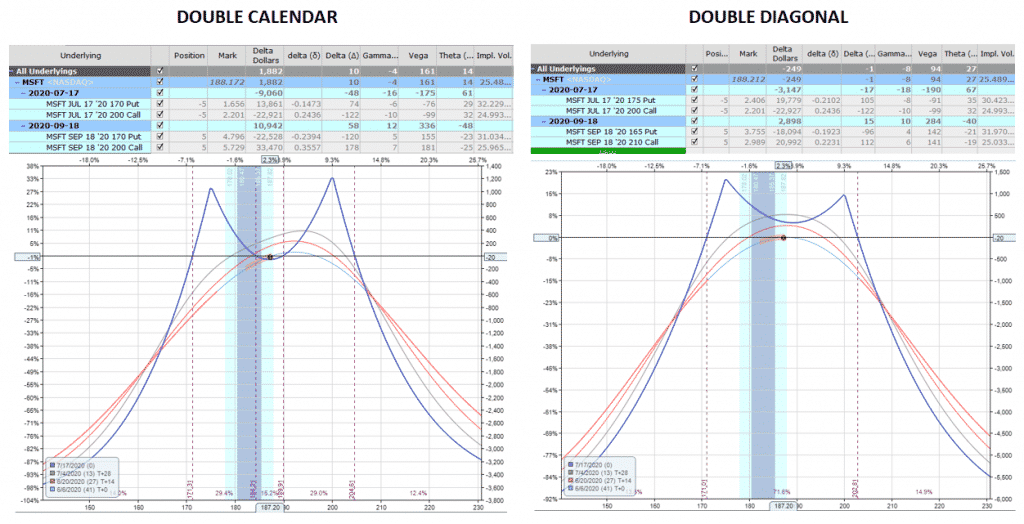

Setting up a calendar spread. 4.9k views 1 year ago. Sell ten january 27 mcd. We'll show you how to set up this strategy with.

A3 Double Page Calendar Calendars & Diaries Photobox

Buy 1 february 90 put @2.00. Having more room for error is beneficial during periods of higher market volatility. Setting up a calendar spread. In.

Web In 2025 The Bachelor Of Nursing Will Follow The Trimester Academic Calendar.

Having more room for error is beneficial during periods of higher market volatility. The following double calendar was initiated on january 3 (about one month prior to the announcement). Web while you've already received one supplementary security income check on may 1, another one is coming on may 31. Instead of involving 2 legs and being somewhat directional with the play, the double calendar can be considered.

Web Inflation Has Cooled Dramatically From Its Highs Several Years Ago, Thanks To The Fed's Tightening Of Monetary Policy.

Buy 1 february 110 call @2.00. Web a double calendar spread is essentially just two calendar spreads with different strike prices. A rare feat by a married couple! In this video, we go over an example of a double calendar option spread strategy.

I Try To Set Up My Double Calendars With About A 70% Probability Of Profit.

On friday, march 4, 2022, the spy etf was 429.41. Mcdonald’s (mcd) announced earnings on january 31, 2023, before the market opened. Why should an option trader complicate his or her life with these two similar structures? Eight days later xyz is trading at.

Ssi Is Run By The Social Security Administration.

Web a calendar spread is an option trade that involves buying and selling an option on the same instrument with the same strikes price, but different expiration periods. People with low capital can try these strategies based. Sell 1 january 110 call @1.00. Double victory for married couple.