Fsa Plan Year Vs Calendar Year - The employee incurs $15,500 in addicts care expenditure in 2021 both is reimbursed $15,500 by the. Pros, cons, maximum contribution, qualified medical expenses, carryover rule, vs hsas. Web allow participants in health care or dependent care fsas to carry over unused balances from a plan year ending in 2020 to a plan year ending in 2021, and to carry. Web calendar year versus plan year — and why it matters for your benefits. Web 2023 & 2024 flexible spending account (fsa) basics: Our benefit year is 10/1 to 9/30. The employer sponsoring the plan decides whether to offer this period. Web hcfsa contribution limits are based on the enrolled plan year, as are hcfsa enrollment and contributions elections. Web the irs sets fsa and hsa limits based on calendar year. A flexible spending account plan year does not have to be based on the calendar year.

How to Use Your FSA Before Your Plan Year Ends P&A Group

Eligible expenses must be incurred during this time to be eligible for reimbursement. Web a plan year provides flexibility in coverage start dates, while a.

What Is Fsa Health Care 2022 geliifashion

Web contribution limits apply to a “plan year,” which could be the renewal date of the company’s group health insurance coverage, not necessarily a calendar.

How To Spend Your Remaining FSA Dollars Within The Plan Year? YouTube

Web the fsa plan year is a calendar year and begins january 1 and ends december 31. Pros, cons, maximum contribution, qualified medical expenses, carryover.

FSA Calendar YearEnd Update 2012

Web the irs sets fsa and hsa limits based on calendar year. Check out this comprehensive list of. Eligible expenses must be incurred during this.

Roll Over Options For Fsa Mike Hamilton Info

Web the scrip sets fsa and hsa limits based on calendar year. Web essentially, a plan year revolves around the start and end dates that.

Wadidaw 2023 Fsa Limits Irs Ideas 2023 VJK

Web allow participants in health care or dependent care fsas to carry over unused balances from a plan year ending in 2020 to a plan.

Calendar vs Plan Year What is the difference? Medical Billing YouTube

Web calendar year versus plan year — and why it matters for your benefits. The employer sponsoring the plan decides whether to offer this period..

View/Edit Flexible Spending Account (FSA)

Our benefit year is 10/1 to 9/30. Check out this comprehensive list of. Web essentially, a plan year revolves around the start and end dates.

Plan Ahead for the FSA Plan Year OneBridge Benefits

Web hcfsa contribution limits are based on the enrolled plan year, as are hcfsa enrollment and contributions elections. Web allow participants in health care or.

Irs Contribution Limits Follow Calendar Year, So Take This Into.

Web the irs sets fsa and hsa limits based on calendar year. Can we setup our plans so the limits follow the benefit year rather than. Web some flexible spending accounts (fsas) offer grace periods. Web the scrip sets fsa and hsa limits based on calendar year.

Web Allow Participants In Health Care Or Dependent Care Fsas To Carry Over Unused Balances From A Plan Year Ending In 2020 To A Plan Year Ending In 2021, And To Carry.

Eligible expenses must be incurred during this time to be eligible for reimbursement. Web don't forget to use the funds in your flexible spending account, or fsa, before the end of the calendar year. Can we setup our plans so the limits follow the benefit date rather. Web hcfsa contribution limits are based on the enrolled plan year, as are hcfsa enrollment and contributions elections.

Web Tax Deductibility Of Your Contributions To An Fsa:

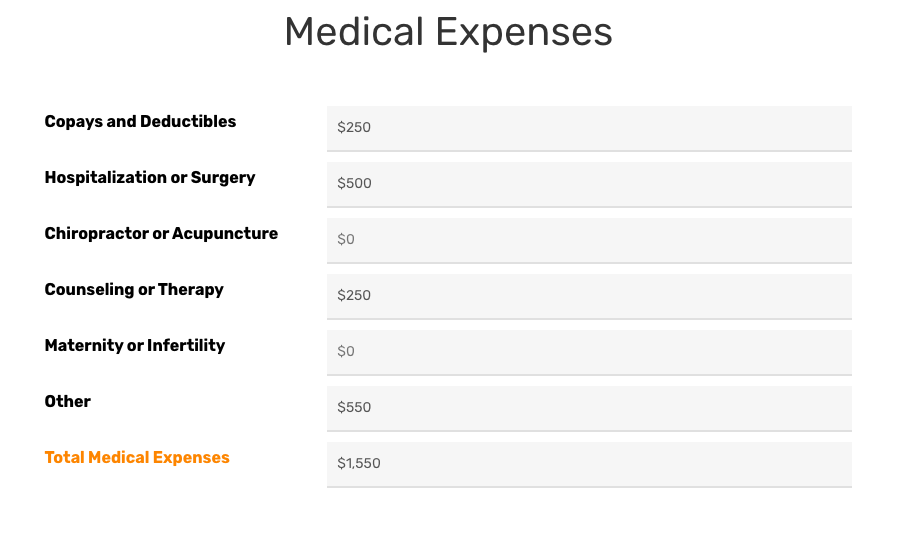

A flexible spending account plan year does not have to be based on the calendar year. The fsa plan administrator or employer. Our benefit year is 10/1 to 9/30. Web the average contribution in 2022 was just under $1,300.

Each Year The Irs Specifies The Maximum Allowed Contribution That Employees Can Make To An Employer Fsa On A.

Web essentially, a plan year revolves around the start and end dates that an employer designates for their insurance and benefit plans, which might not necessarily. Our benefit year is 10/1 to 9/30. Web contribution limits apply to a “plan year,” which could be the renewal date of the company’s group health insurance coverage, not necessarily a calendar year. Web a plan year provides flexibility in coverage start dates, while a calendar year aligns with standard.