Future Calendar Spread - Web a futures calendar spread trading strategy involves simultaneously buying and selling futures contracts of the same underlying asset but with different expiration dates. Web settlement prices on instruments without open interest or volume are provided for web users only and are not published on market data platform (mdp). There is currently no calendar data for this product. It is sometimes referred to as a horiztonal spread, whereas a bull put spread or bear call spread would be referred to as a vertical spread. There are always exceptions to this. It basically refers to taking a long position in one futures contract and a short position in another. Web calendar spreads—also called intramarket spreads—are types of trades in which a trader simultaneously buys and sells the same futures contract in different expiration months. This strategy aims to profit from the price difference between the two contracts. Nicholas burns, us ambassador to china, said in a may. Web winning calendar spread in meta.

Futures Calendar Spread

Web calendar spreads—also called intramarket spreads—are types of trades in which a trader simultaneously buys and sells the same futures contract in different expiration months..

NIFTY FUTURES CALENDAR SPREAD STRATEGY (CSS) for NSENIFTY by

Nicholas burns, us ambassador to china, said in a may. Web calendar spreads—also called intramarket spreads—are types of trades in which a trader simultaneously buys.

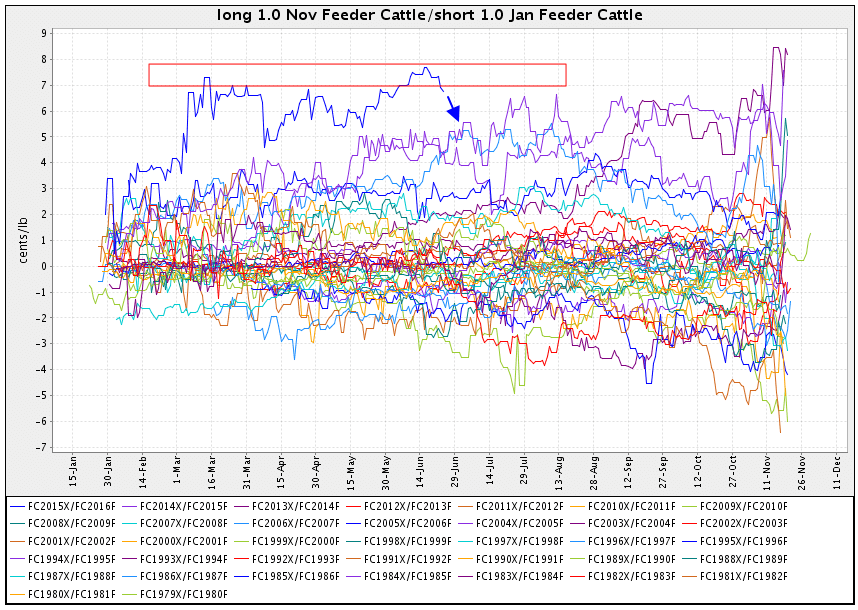

Seasonal Futures Spreads Calendar Spread with Feeder Cattle futures

Open interest increased by 98.9k contracts two weeks ago, which was its second fastest increase on record, prompting me to suggest a cycle low for.

Futures Spread Trading TradeSafe, LLC

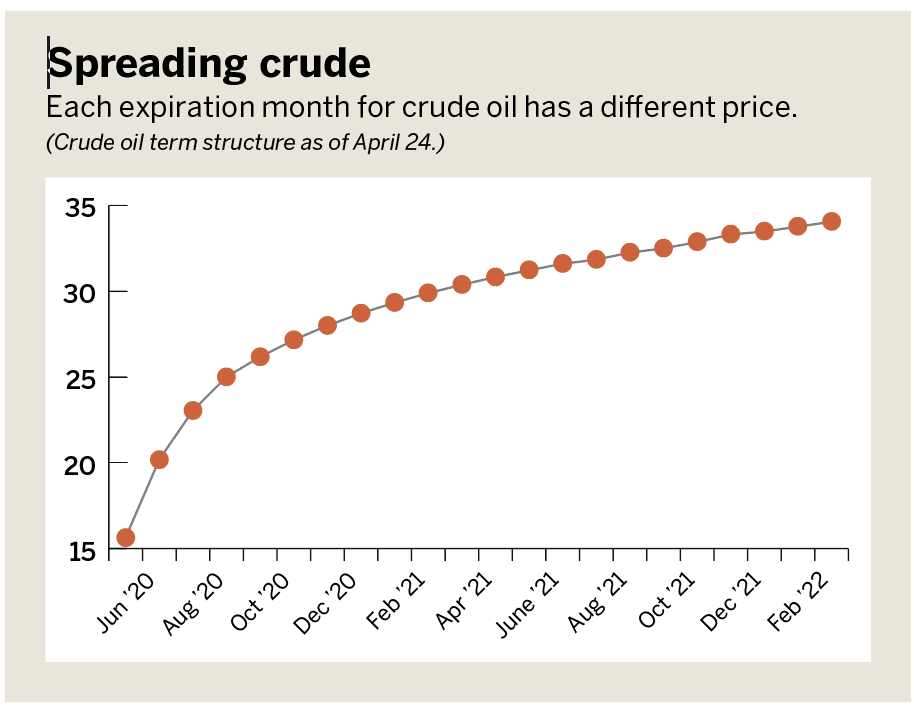

While low interest rates, excess liquidity, and weak economic growth have. Web entering into a calendar spread simply involves buying a call or put option.

What Exactly Are Futures Spreads StoneX Financial Inc, Daniels

Web calendar spreads—also called intramarket spreads—are types of trades in which a trader simultaneously buys and sells the same futures contract in different expiration months..

Futures Curve by Accutic Treasury Futures Calendar Spreads

Web what are calendar spreads? Open interest increased by 98.9k contracts two weeks ago, which was its second fastest increase on record, prompting me to.

Calendar Spread Option Strategy 2024 Easy to Use Calendar App 2024

It's earnings, not the economy. Gdp data and earnings in focus. Web in finance, a calendar spread (also called a time spread or horizontal spread).

Futures Trading the definitive guide to trading calendar spreads on

Web settlement prices on instruments without open interest or volume are provided for web users only and are not published on market data platform (mdp)..

Leg Up on Futures Calendar Spreading luckbox magazine

A futures spread is a combination of two opposite transactions. Web calendar spreads—also called intramarket spreads—are types of trades in which a trader simultaneously buys.

Web This Article Provides A Comprehensive Understanding Of Calendar Spreads, Including Their Purpose, Execution, Potential Profits, And Key Considerations.

Let's understand the types of spreads in the market: Web a calendar spread is a strategy used in options and futures trading: Web the state department, which issued 105,000 chinese student and scholar visas in the fiscal year that ended in september, declined to comment. Web a calendar spread is an option trade that involves buying and selling an option on the same instrument with the same strikes price, but different expiration periods.

Web Winning Calendar Spread In Meta.

Open interest increased by 98.9k contracts two weeks ago, which was its second fastest increase on record, prompting me to suggest a cycle low for volatility. 3 'wide moat' tech stocks to buy and hold. The options are both calls or puts, have the same strike price and the same contract. Heating oil is hovering above the lows from late last year.

A Futures Spread Is A Combination Of Two Opposite Transactions.

Web a long calendar spread—often referred to as a time spread—is the buying and selling of a call option or the buying and selling of a put option with the same strike price but having different. There is currently no calendar data for this product. Calendar spreads are also known as ‘time spreads’, ‘counter spreads’ and ‘horizontal spreads’. Web a futures calendar spread trading strategy involves simultaneously buying and selling futures contracts of the same underlying asset but with different expiration dates.

Web A Calendar Spread Is A Trading Technique That Involves The Buying Of A Derivative Of An Asset In One Month And Selling A Derivative Of The Same Asset In Another Month.

Web the weekly cot report revealed another wild volume swing on the vix futures contract, only this time to the downside. Web what are futures calendar spreads? Is there any leg or legging risk? Finance enthusiast jim schultz hosts his final discussion on gamestop (gme) before shifting focus to overall market commentary and portfolio adjustments.