Futures Calendar Spread - Web what are futures calendar spreads? Is it different from using a spread with a stock as the underlying asset? Web futures calendar spreads present an intriguing alternative to equity pairs because futures contracts for the same underlying are closely related to each other and thus seem. Web what is a future spread? The most common type of spread utilized for futures is a calendar strategy. Web learn how to options on futures calendar spreads to design a position that minimizes loss potential while offering possibility of tremendous profit. Web calendar spreads—also called intramarket spreads—are types of trades in which a trader simultaneously buys and sells the same futures contract in different expiration months. Web a calendar spread involves purchasing and selling derivatives contracts with the same underlying asset at the same time and price, but different expirations. Web within the context of futures markets, spreads generally refer to the calendar spread between two futures contracts, in other words, showing how two futures contracts with. It is deployed by taking a long position in one futures contract and.

NIFTY FUTURES CALENDAR SPREAD STRATEGY (CSS) for NSENIFTY by

It is deployed by taking a long position in one futures contract and. Web this article provides a comprehensive understanding of calendar spreads, including their.

Calendar Spread Option Strategy 2024 Easy to Use Calendar App 2024

Web this article provides a comprehensive understanding of calendar spreads, including their purpose, execution, potential profits, and key considerations. Is it different from using a.

Futures Trading the definitive guide to trading calendar spreads on

Web calendar spreads—also called intramarket spreads—are types of trades in which a trader simultaneously buys and sells the same futures contract in different expiration months..

Futures Calendar Spread

Web in a calendar spread, both the futures contracts have the same underlying, however their expiries are different. Web within the context of futures markets,.

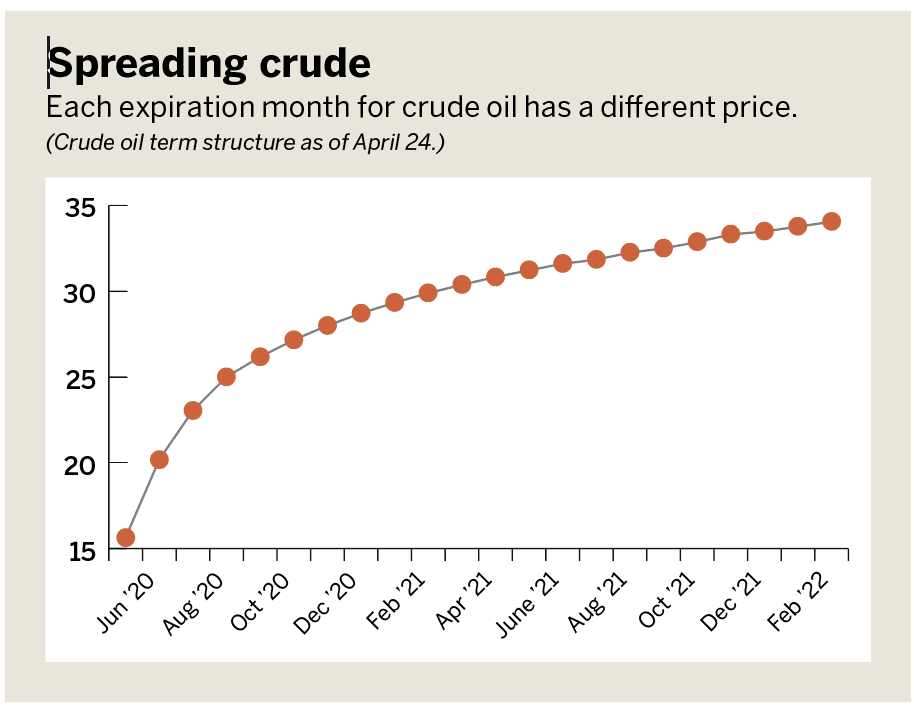

Futures Curve by Accutic Treasury Futures Calendar Spreads

Web learn about spreading futures contracts, including types of spreads like calendar spreads and commodity product spreads, and more. The strategy consists of writing a.

Futures Spread Trading TradeSafe, LLC

Web calendar spreads—also called intramarket spreads—are types of trades in which a trader simultaneously buys and sells the same futures contract in different expiration months..

What Exactly Are Futures Spreads StoneX Financial Inc, Daniels

Web what are futures calendar spreads? Web in finance, a calendar spread (also called a time spread or horizontal spread) is a spread trade involving.

Leg Up on Futures Calendar Spreading luckbox magazine

The strategy consists of writing a shorter term call option and taking a longer term call option with the same strike price. Web a calendar.

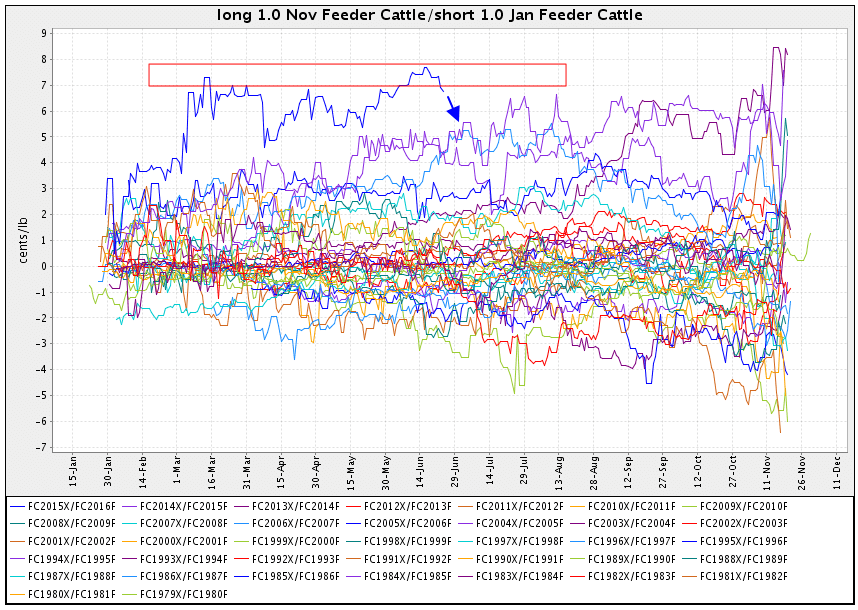

Seasonal Futures Spreads Calendar Spread with Feeder Cattle futures

Traditionally calendar spreads are dealt with a price based approach. Web within the context of futures markets, spreads generally refer to the calendar spread between.

Web In A Calendar Spread, Both The Futures Contracts Have The Same Underlying, However Their Expiries Are Different.

Web calendar spreads—also called intramarket spreads—are types of trades in which a trader simultaneously buys and sells the same futures contract in different expiration months. Web what is a future spread? Web in finance, a calendar spread (also called a time spread or horizontal spread) is a spread trade involving the simultaneous purchase of futures or options expiring on a particular. Web what are futures calendar spreads?

The Most Common Type Of Spread Utilized For Futures Is A Calendar Strategy.

The strategy consists of writing a shorter term call option and taking a longer term call option with the same strike price. Index futures are currently pointing to a modestly higher open on friday, with stocks likely to regain ground after moving. Web this article provides a comprehensive understanding of calendar spreads, including their purpose, execution, potential profits, and key considerations. Web within the context of futures markets, spreads generally refer to the calendar spread between two futures contracts, in other words, showing how two futures contracts with.

Is It Different From Using A Spread With A Stock As The Underlying Asset?

Web learn how to options on futures calendar spreads to design a position that minimizes loss potential while offering possibility of tremendous profit. Web futures calendar spread trading is a popular strategy used by traders to profit from the price difference between two futures contracts with different expiration dates. Web for any given futures product, a standard calendar spread is a transaction that combines the purchase of a futures contract for one delivery month and the sale of a futures. Web a calendar spread is a trading technique that involves the buying of a derivative of an asset in one month and selling a derivative of the same asset in another month.

It Is Deployed By Taking A Long Position In One Futures Contract And.

Web a calendar spread involves purchasing and selling derivatives contracts with the same underlying asset at the same time and price, but different expirations. Learn how to optimize this. Web a calendar spread is an options or futures strategy where an investor simultaneously enters long and short positions on the same underlying asset but with different delivery. Web a futures calendar spread is constructed by simultaneously buying and selling two futures contracts with a common underlying instrument but different expiration dates—for.