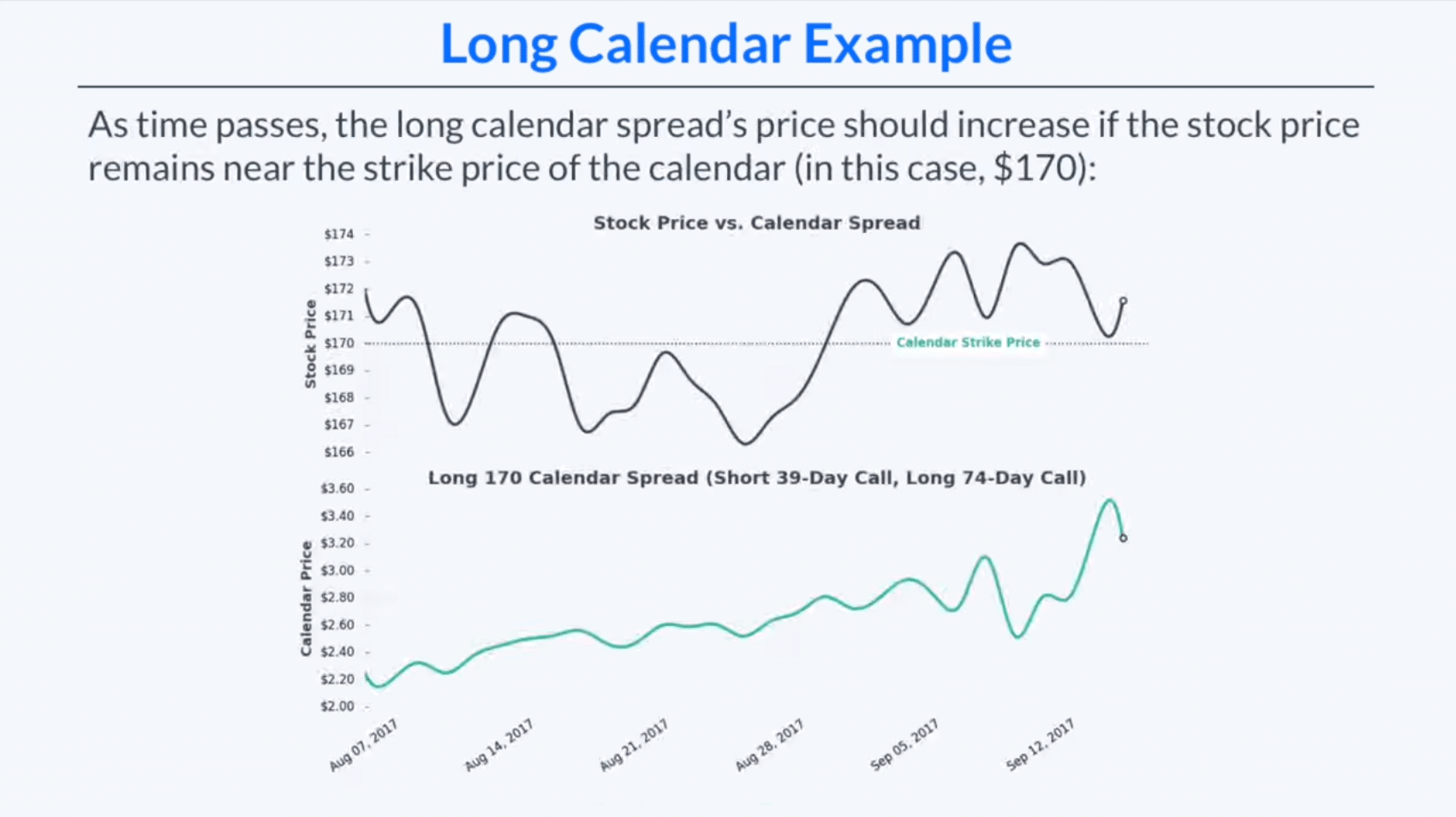

Long Calendar Spread - Long call calendar spreads will require paying a debit at entry. Find out how implied volatility affects the risk and reward of this trade and how to enter it at the right time. Original study notes from options industry council (oic) education. Web a calendar spread allows option traders to take advantage of elevated premium in near term options with a neutral market bias. Both call options will have the same strike price. The options institute at cboe ®. A diagonal spread allows option traders to collect premium and time decay similar to the calendar spread, except these trades take a directional bias. Web a calendar spread is an options or futures strategy where an investor simultaneously enters long and short positions on the same underlying asset but with different delivery dates. Web what is a long calendar spread? A calendar is a time spread because it benefits from the passing of time.

Long Calendar Spreads for Beginner Options Traders projectfinance

Web a calendar spread is an options or futures strategy where an investor simultaneously enters long and short positions on the same underlying asset but.

The Long Calendar Spread Explained 1 Options Trading Software

Web a calendar spread is an options or futures strategy where an investor simultaneously enters long and short positions on the same underlying asset but.

Long Calendar Spreads for Beginner Options Traders projectfinance

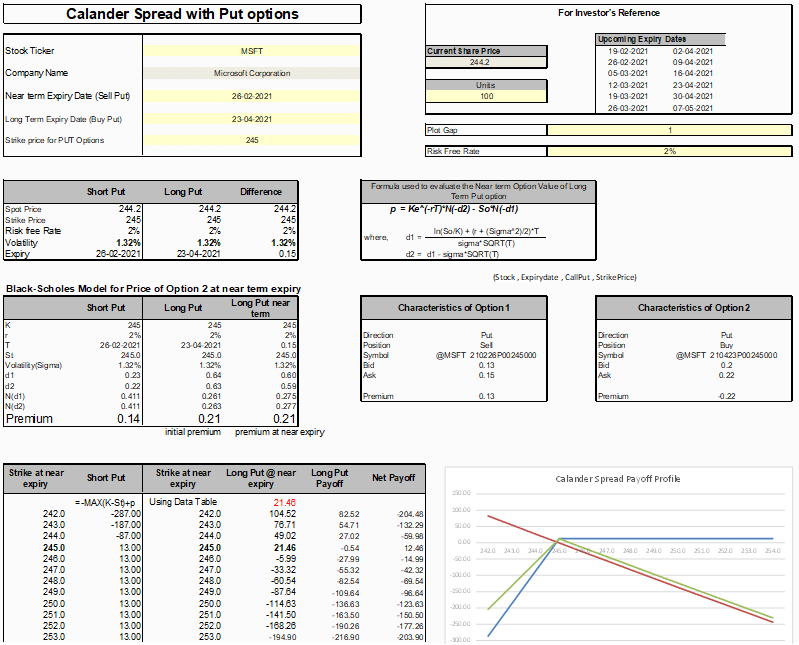

Traditionally calendar spreads are dealt with a price based approach. Web a long calendar spread—often referred to as a time spread—is the buying and selling.

Long Call Calendar Long call calendar Spread Calendar Spread YouTube

A calendar spread is an option trade that involves buying and selling an option on the same instrument with the. Original study notes from options.

Long Calendar Spread with Puts Strategy With Example

Web what is a long calendar spread? I had briefly introduced the concept of calendar spreads in chapter 10 of the futures trading module. Calendar.

Printable Calendar Spreads on Behance

Calculate the fair value of current month contract. Web a long calendar call spread is seasoned option strategy where you sell and buy same strike.

Long Calendar Spread with Puts

Web what's a calendar spread? The strategy consists of writing a shorter term call option and taking a longer term call option with the same.

Using Calendar Trading and Spread Option Strategies

Web the objective for a long call calendar spread is for the underlying stock to be at or near, nearest strike price at expiration and.

Long Calendar Spread Using Puts Option Strategy MarketXLS

Original study notes from options industry council (oic) education. Web learn how a calendar spread is an option trading strategy that profits from time decay.

Web What Is A Long Calendar Spread?

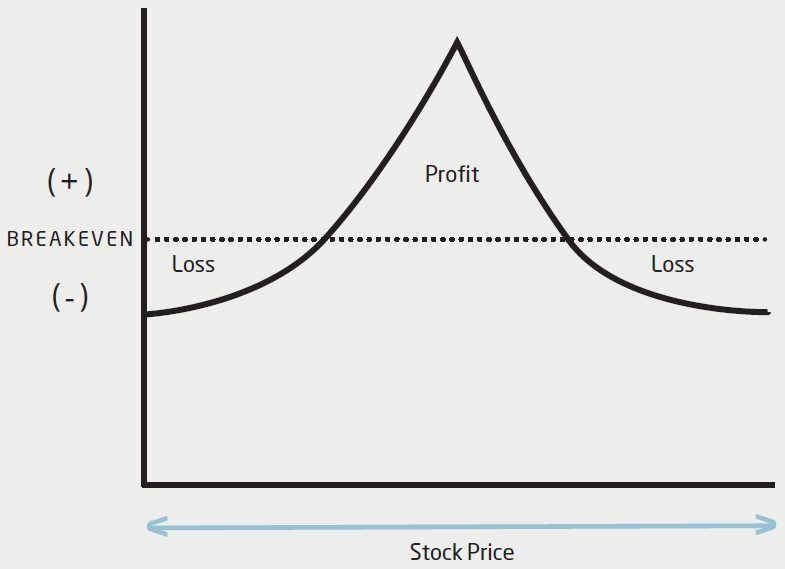

Long call calendar spreads will require paying a debit at entry. Traditionally calendar spreads are dealt with a price based approach. Web to initiate a long calendar spread, you sell the option with the earlier expiration date and buy the option with the later expiration date. Web the objective for a long call calendar spread is for the underlying stock to be at or near, nearest strike price at expiration and take advantage of near term time decay.

I Had Briefly Introduced The Concept Of Calendar Spreads In Chapter 10 Of The Futures Trading Module.

Web a calendar spread is an options or futures strategy where an investor simultaneously enters long and short positions on the same underlying asset but with different delivery dates. To profit from neutral stock price action near the strike price of the calendar spread with limited risk in either direction. See examples, profit and loss diagrams, and how to profit from time decay and stock price movements. Web a calendar spread allows option traders to take advantage of elevated premium in near term options with a neutral market bias.

Web What's A Calendar Spread?

A calendar spread is an option trade that involves buying and selling an option on the same instrument with the. Calendar spreads are also known as ‘time spreads’, ‘counter spreads’ and. What you need to know. For a short calendar spread, you do the opposite.

Web Learn How To Use Long Calendar Spreads, A Strategy That Involves Buying And Selling Options Of The Same Type And Strike Price, But Different Expiration Dates.

Web a long calendar spread—often referred to as a time spread—is the buying and selling of a call option or the buying and selling of a put option with the same. Web a calendar spread is a strategy used in options and futures trading: Web a calendar spread is an options strategy that is constructed by simultaneously buying and selling an option of the same type ( calls or puts) and strike price, but different expirations. A long calendar spread, sometimes called a “horizontal spread,” involves buying and selling two options of the same type (either calls or puts) with the same strike price but different expiration dates.

:max_bytes(150000):strip_icc()/dotdash_Final_Using_Calendar_Trading_and_Spread_Option_Strategies_Nov_2020-01-b1d47a55f4684e1b9d37580d219dc778.jpg)