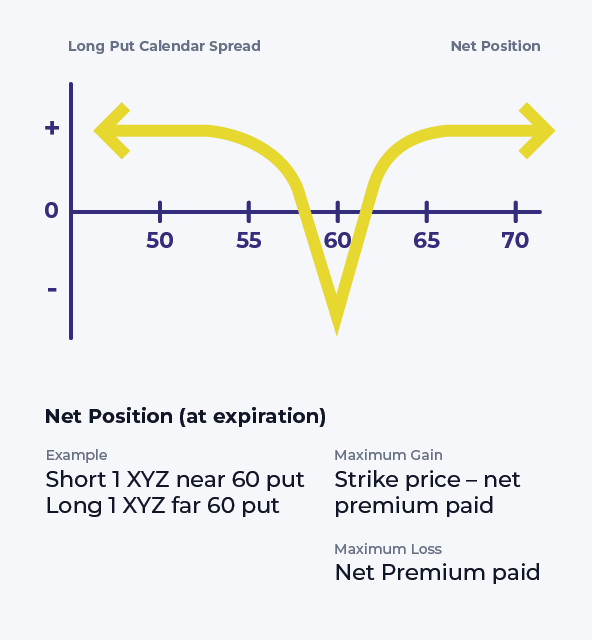

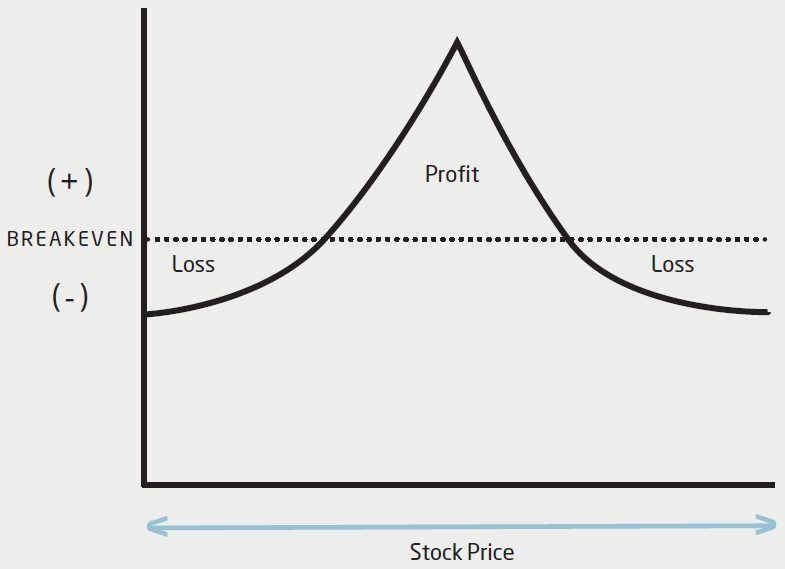

Long Put Calendar Spread - Web a long calendar spread is a neutral options strategy that capitalizes on time decay and volatility, rather than focusing on the movement of the underlying stock. Includes box scores, video highlights, play breakdowns and updated odds. Web a calendar spread is a strategy used in options and futures trading: It involves buying and selling contracts at the. A calendar spread is an options strategy that involves multiple legs. Web a long calendar spread consists of two options of the same type and strike price, but with different expirations. What is a calendar spread? Web the complex options trading strategy, known as the put calendar spread, is a type of calendar spread that seizes opportunities from time decay and volatility disparities. Long calendar spreads are great strategies for. To profit from neutral stock price action near the strike price of the calendar.

How Long Calendar Spreads Work (w/ Examples) Options Trading

Web updated october 31, 2021. Web long put calendar spread: This strategy anticipates a moderate drop in. Web a long calendar spread consists of two.

500 WEEKLY WITH THE LONG PUT CALENDAR SPREAD ON ROBINHOOD! YouTube

Web updated october 31, 2021. This strategy anticipates a moderate drop in. A calendar spread is an options strategy that involves multiple legs. A put.

Long Put Calendar Spread (Put Horizontal) Options Strategy

Web a long calendar spread—often referred to as a time spread—is the buying and selling of a call option or the buying and selling of.

Long put Calendar Long Put calendar Spread Calendar Spread YouTube

Employing two different put options spread across two calendar. Web a calendar spread is a strategy used in options and futures trading: It involves buying.

The Long Calendar Spread Explained 1 Options Trading Software

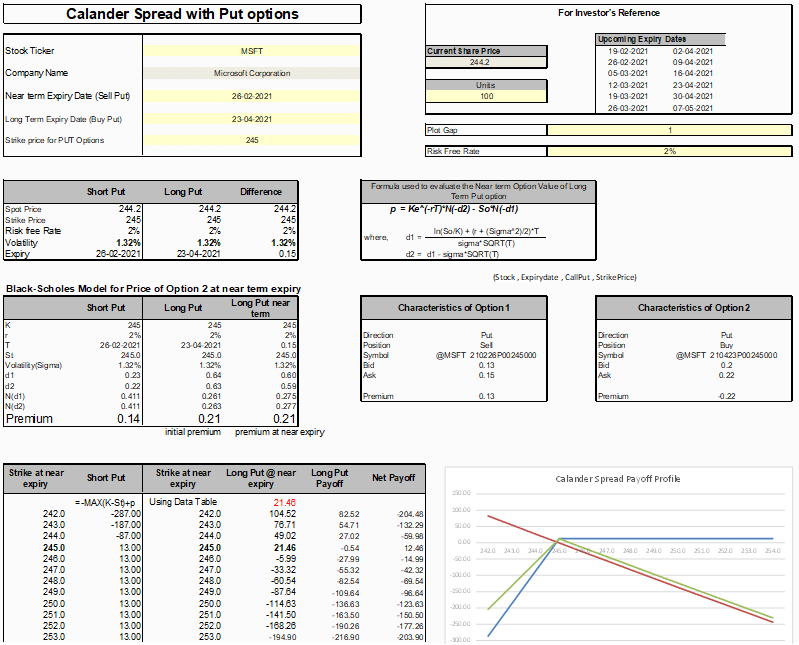

When running a calendar spread with puts, you’re selling and buying a put with the same strike price, but the put you buy will have.

Long Calendar Spread with Puts Strategy With Example

Web live scores for every 2024 ncaaf season game on espn. Web a long calendar spread consists of two options of the same type and.

Put Calendar Spread Guide [Setup, Entry, Adjustments, Exit]

The options institute at cboe ®. When running a calendar spread with puts, you’re selling and buying a put with the same strike price, but.

Calendar Put Spread Options Edge

Web a long calendar spread is a neutral options strategy that capitalizes on time decay and volatility, rather than focusing on the movement of the.

Long Calendar Spread Using Puts Option Strategy MarketXLS

Web a calendar spread is a strategy used in options and futures trading: When running a calendar spread with puts, you’re selling and buying a.

What Is A Calendar Spread?

Web a long put calendar spread involves buying and selling put options for the same underlying security at the same strike price, but at different expiration dates. Web live scores for every 2024 ncaaf season game on espn. Web a calendar spread is a neutral strategy that profits from time decay and an increase in implied volatility. Web a calendar spread is a strategy used in options and futures trading:

When Running A Calendar Spread With Puts, You’re Selling And Buying A Put With The Same Strike Price, But The Put You Buy Will Have A Later Expiration Date Than The.

Includes box scores, video highlights, play breakdowns and updated odds. Option trading strategies offer traders and investors the opportunity to profit in ways not. A calendar spread is an options strategy that involves multiple legs. Web long put calendar spread:

Web A Long Calendar Spread Is A Neutral Options Strategy That Capitalizes On Time Decay And Volatility, Rather Than Focusing On The Movement Of The Underlying Stock.

A put calendar is best used when the short. Web a long calendar spread—often referred to as a time spread—is the buying and selling of a call option or the buying and selling of a put option with the same strike. It involves buying and selling contracts at the. A calendar spread can be constructed with either calls or puts by.

Web The Complex Options Trading Strategy, Known As The Put Calendar Spread, Is A Type Of Calendar Spread That Seizes Opportunities From Time Decay And Volatility Disparities.

Web a calendar spread is a strategy used in options and futures trading: Employing two different put options spread across two calendar. When the market is in backwardation can be a good. To profit from neutral stock price action near the strike price of the calendar.

![Put Calendar Spread Guide [Setup, Entry, Adjustments, Exit]](https://assets-global.website-files.com/5fba23eb8789c3c7fcfb5f31/6019b83133ac2d32ef084fa5_TsbQgZxQ0e-zKJ9h6Fa7azNlnvn0zH-UBlX3l7hriHll2es1fvyFY5N-nOyM1153MJ4wXLNIhH4zanFkJQB0mpqs81lwEBIvqa7IZQRPWXZY1i3J7vV3BpTIL3v5nCyqn-CEbq2U.png)

:max_bytes(150000):strip_icc()/dotdash_Final_Using_Calendar_Trading_and_Spread_Option_Strategies_Nov_2020-01-b1d47a55f4684e1b9d37580d219dc778.jpg)