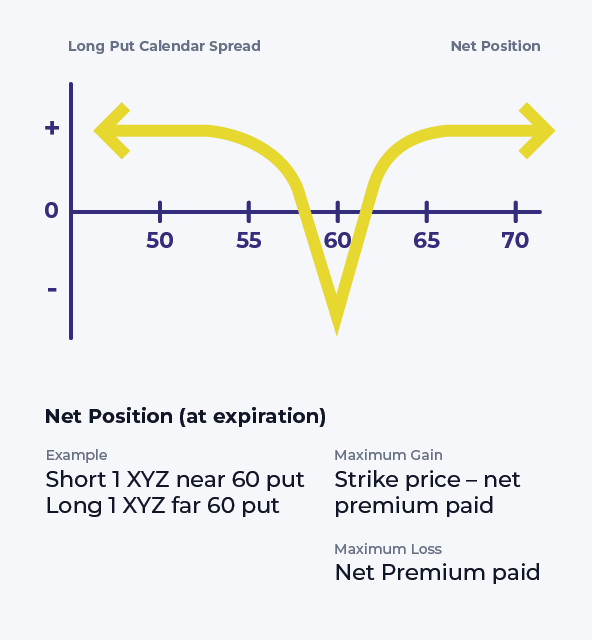

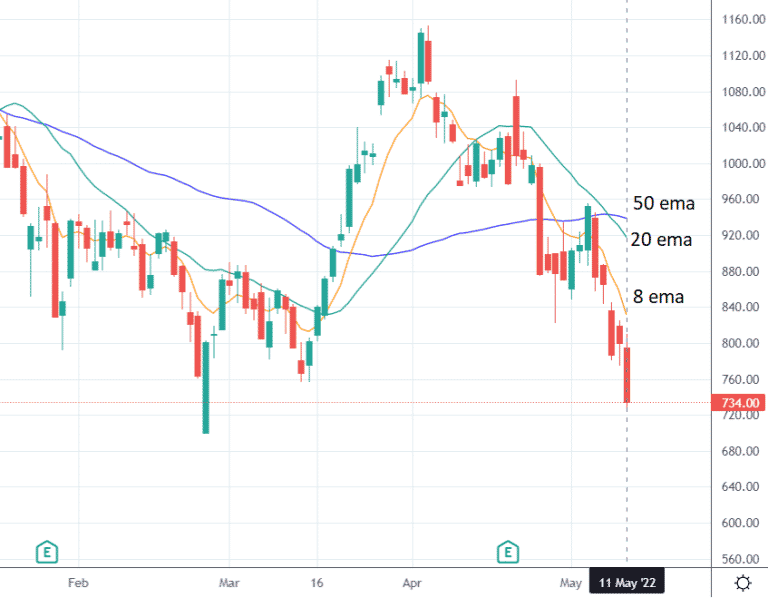

Put Calendar Spread - A calendar spread typically involves buying and selling the same type of option (calls or puts) for the same underlying security at the same strike price, but at different (albeit small differences in) expiration dates. The strategy is successful if the underlying stock price stays at or above the strike price of the short put. In both cases, the maximum potential loss is limited to the premium spent as this is a net debit transaction. The only difference is the expiration dates. A neutral to mildly bearish/bullish strategy using two puts of the same strike, but different expiration dates. Web a calendar spread is a strategy involving buying longer term options and selling equal number of shorter term options of the same underlying stock or index with the same strike price. The forecast, therefore, can either be “neutral,” “modestly bullish,” or “modestly bearish,” depending on the relationship of the stock price to the strike price when the position is. Web what is a calendar spread? For example, you may create one option that expires in a month, then set the second one to expire in two months. This uses calls only, with different strike prices.

Long Put Calendar Spread (Put Horizontal) Options Strategy

The only difference is the expiration dates. It is sometimes referred to as a horiztonal spread, whereas a bull put spread or bear call spread.

Long put Calendar Long Put calendar Spread Calendar Spread YouTube

Web a calendar spread is an option trade that involves buying and selling an option on the same instrument with the same strikes price, but.

Bearish Put Calendar Spread Option Strategy Guide

When running a calendar spread with puts, you’re selling and buying a put with the same strike price, but the put you buy will have.

Bearish Put Calendar Spread Option Strategy Guide

Web what is a calendar put spread? For example, you may create one option that expires in a month, then set the second one to.

Options Trading PCS (Put Calendar Spread) YouTube

Web a long calendar spread with puts realizes its maximum profit if the stock price equals the strike price on the expiration date of the.

Calendar Put Spread Options Edge

You may trade two calls or two puts, but each is the same type. Web a long calendar spread with puts realizes its maximum profit.

Put Calendar Spread Guide [Setup, Entry, Adjustments, Exit]

This uses puts only, with different strike prices. In both cases, the maximum potential loss is limited to the premium spent as this is a.

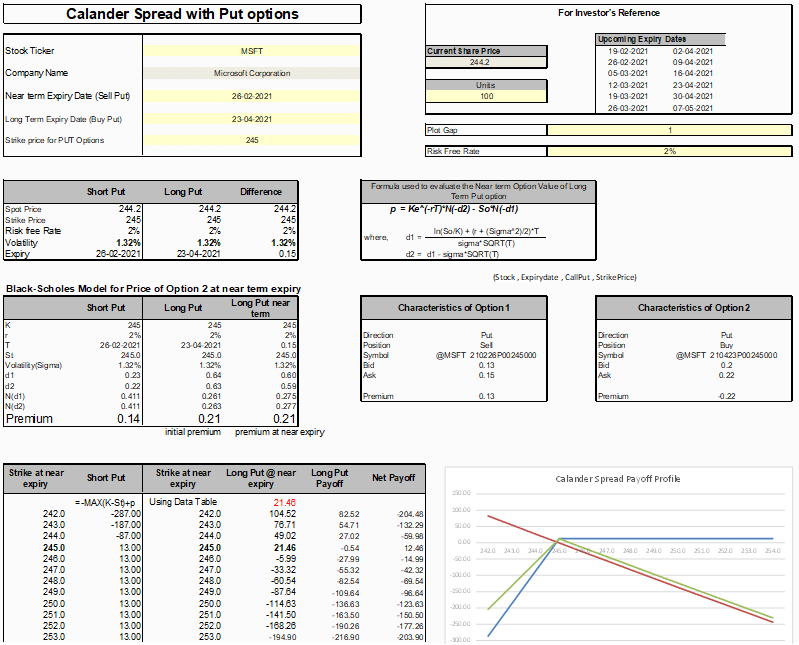

Long Calendar Spread Using Puts Option Strategy MarketXLS

The options are both calls or puts, have the same strike price and the same contract. Web to utilize a calendar spread strategy, you buy.

Long Calendar Spread with Puts Strategy With Example

This type of strategy is also known as a time or horizontal spread due to the differing maturity dates. Calculate the fair value of current.

Web A Long Calendar Spread With Puts Realizes Its Maximum Profit If The Stock Price Equals The Strike Price On The Expiration Date Of The Short Put.

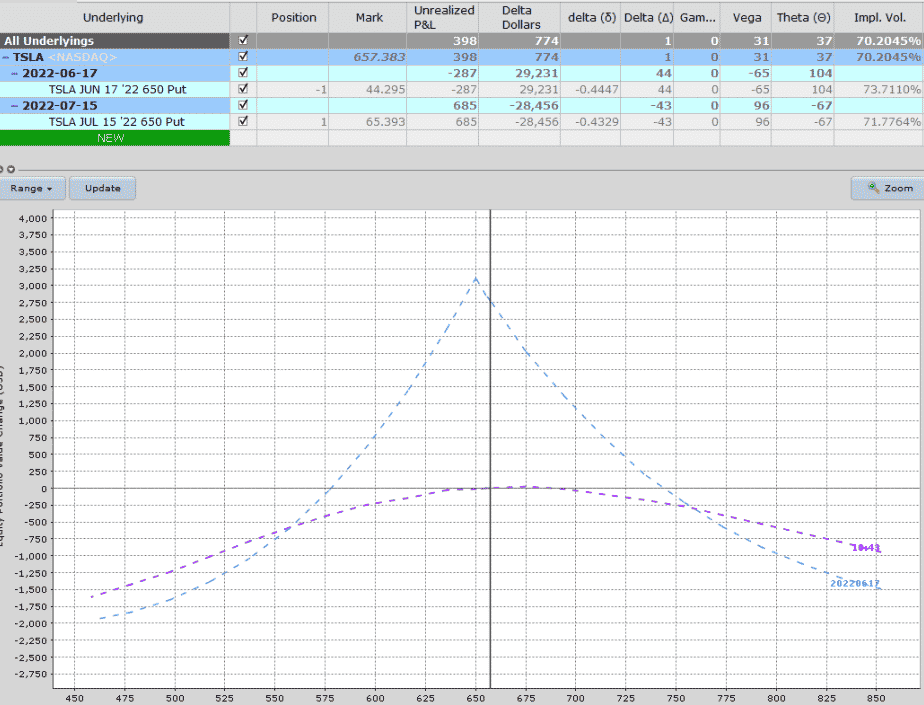

When running a calendar spread with puts, you’re selling and buying a put with the same strike price, but the put you buy will have a later expiration date than the put you sell. Traditionally calendar spreads are dealt with a price based approach. Web what is a calendar spread? The forecast, therefore, can either be “neutral,” “modestly bullish,” or “modestly bearish,” depending on the relationship of the stock price to the strike price when the position is.

Two Put Positions (Short And Long), With The Same Strike Price And Different Expiration Dates, Are Required To Form A Put Calendar Spread.

Neutral limited profit limited loss. If the stock is near strike a when the earlier call expires, you will be able to close it for a profit. Web a long calendar spread—often referred to as a time spread—is the buying and selling of a call option or the buying and selling of a put option with the same strike price but having different. This uses calls only, with different strike prices.

The Strategy Is Successful If The Underlying Stock Price Stays At Or Above The Strike Price Of The Short Put.

Web what is a calendar put spread? Web a calendar spread is a strategy involving buying longer term options and selling equal number of shorter term options of the same underlying stock or index with the same strike price. For example, you may create one option that expires in a month, then set the second one to expire in two months. Web demystifying the put calendar spread:

This Uses Puts Only, With Different Strike Prices.

You may trade two calls or two puts, but each is the same type. Web to utilize a calendar spread strategy, you buy and sell two options. Calculate the fair value of current month contract. A diagonal spread allows option traders to collect premium and time decay similar to the calendar spread, except these trades take a directional bias.

![Put Calendar Spread Guide [Setup, Entry, Adjustments, Exit]](https://assets-global.website-files.com/5fba23eb8789c3c7fcfb5f31/6019b83133ac2d32ef084fa5_TsbQgZxQ0e-zKJ9h6Fa7azNlnvn0zH-UBlX3l7hriHll2es1fvyFY5N-nOyM1153MJ4wXLNIhH4zanFkJQB0mpqs81lwEBIvqa7IZQRPWXZY1i3J7vV3BpTIL3v5nCyqn-CEbq2U.png)