Short Calendar Spread - Web a long calendar spread—often referred to as a time spread—is the buying and selling of a call option or the buying and selling of a put option with the same strike. A calendar spread typically involves buying and selling the same type of option (calls or puts) for the same underlying security at the same strike. If the spread has increased beyond the upper range of 1.7205, it. This strategy can profit from a stock move or a volatility change,. This strategy involves buying and. This is a similar p/l to the short iron butterfly. The ideal forecast, therefore, is for a “big stock price change when the direction of the change could be. Web learn how to use a short calendar call spread to profit from a volatile market when you are unsure of the direction of price movement. Web what is a calendar spread? The calendar spread, which uses two put options or two call options, enables a trader to express a view on volatility in the short.

Calendar Spread Option Strategy 2024 Easy to Use Calendar App 2024

Web what is a calendar spread? Web updated october 31, 2021. Traders can use a short calendar spread with either calls or puts. A calendar.

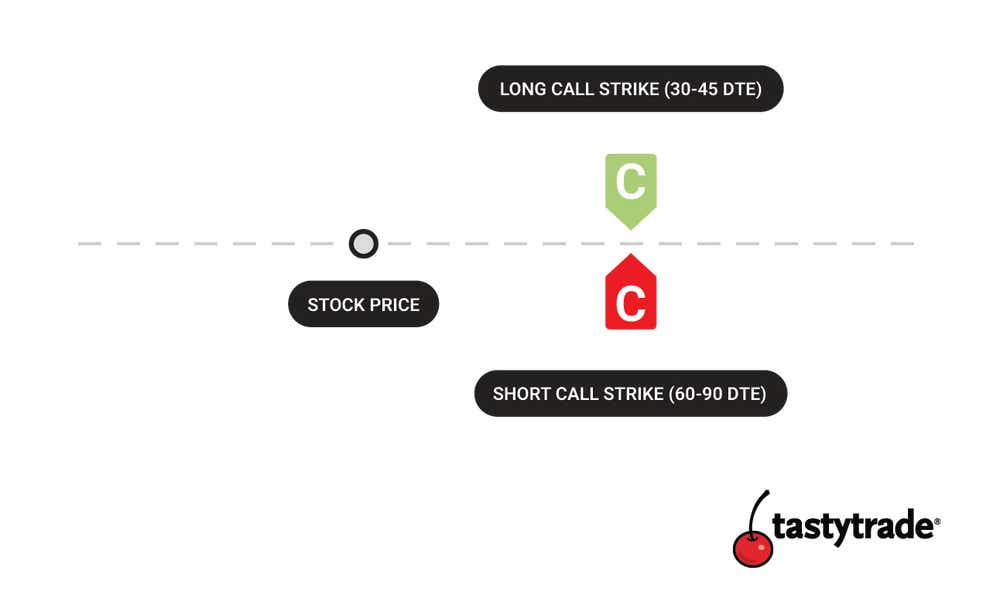

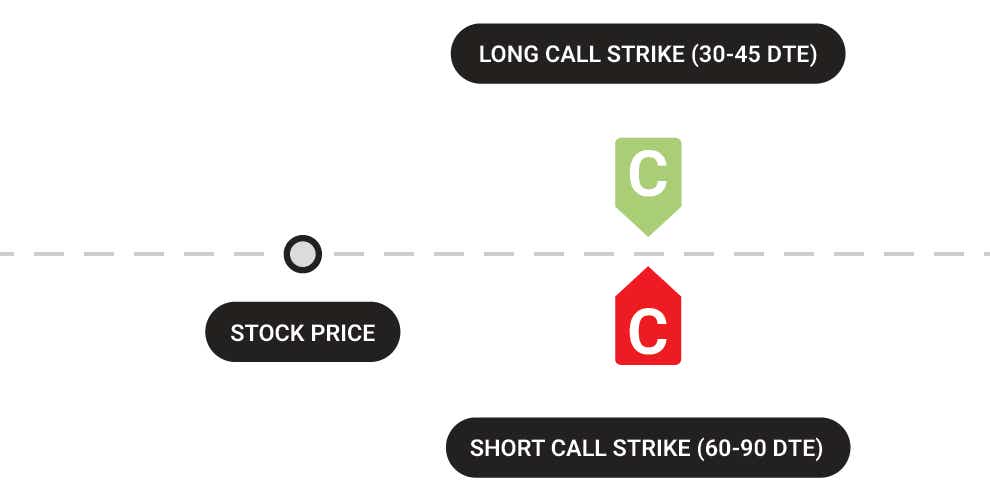

Calendar Spread What is a Calendar Spread Option? tastytrade

Web what is a calendar spread? Web any value of the spread outside this range gives us an opportunity to set up a calendar spread..

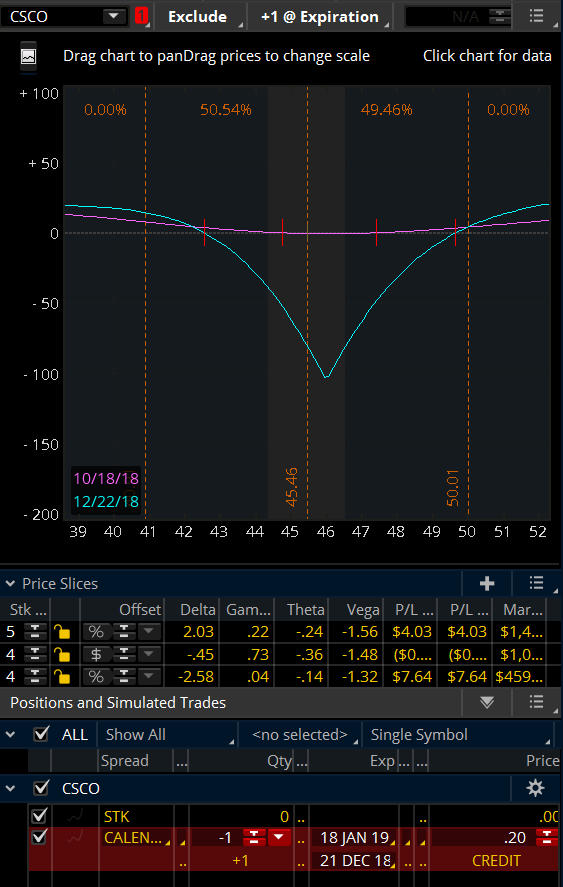

Trading Guide on Calendar Call Spread AALAP

Traders can use a short calendar spread with either calls or puts. Web a calendar spread is a strategy used in options and futures trading:.

What are Calendar Spread and Double Calendar Spread Strategies

Web short calendar spread. The calendar spread, which uses two put options or two call options, enables a trader to express a view on volatility.

What is a Calendar Spread? Aeromir

Web what are short call calendar spreads. This strategy can profit from a stock move or a volatility change,. Web learn how to use a.

Short Calendar Spread

Web a long calendar spread—often referred to as a time spread—is the buying and selling of a call option or the buying and selling of.

Calendar Spread What is a Calendar Spread Option? tastylive

Web what are short call calendar spreads. The ideal forecast, therefore, is for a “big stock price change when the direction of the change could.

How to Create a Credit Spread with the Short Calendar Put Spread YouTube

Web updated october 31, 2021. Web a calendar spread is a strategy used in options and futures trading: This is a similar p/l to the.

Calendar Spread, stratégie d'options sur deux échéances différentes.

The ideal forecast, therefore, is for a “big stock price change when the direction of the change could be. Web a calendar spread is a.

Web What Is A Calendar Spread?

It is considered a “short” calendar spread options strategy because. A calendar spread typically involves buying and selling the same type of option (calls or puts) for the same underlying security at the same strike. Option trading strategies offer traders and investors the opportunity to profit in ways not. Web updated october 31, 2021.

Web A Long Calendar Spread—Often Referred To As A Time Spread—Is The Buying And Selling Of A Call Option Or The Buying And Selling Of A Put Option With The Same Strike.

The goal is to benefit from an increase in the options’ implied. This strategy involves buying and. However many traders (including market. If the spread has increased beyond the upper range of 1.7205, it.

Web A Calendar Spread Is A Strategy Used In Options And Futures Trading:

The calendar spread, which uses two put options or two call options, enables a trader to express a view on volatility in the short. Traders can use a short calendar spread with either calls or puts. Web short calendar spread. The ideal forecast, therefore, is for a “big stock price change when the direction of the change could be.

Web Learn How To Use A Short Calendar Call Spread To Profit From A Volatile Market When You Are Unsure Of The Direction Of Price Movement.

Web a short calendar spread with calls realizes its maximum profit if the stock price is either far above or far below the strike price on the expiration date of the long call. Web what are short call calendar spreads. This is a similar p/l to the short iron butterfly. This strategy can profit from a stock move or a volatility change,.