Short Put Calendar Spread - Web a calendar spread is an options or futures strategy where an investor simultaneously enters long and short positions on the same underlying asset but with. Buying one put option and selling a second put option with a more distant expiration is an example of a short put calendar. Web any value of the spread outside this range gives us an opportunity to set up a calendar spread. Entering into a calendar spread simply involves buying a call or put option for an expiration month that's further out while simultaneously. Short puts are profitable if the underlying asset's price is above. Web a short calendar spread with calls realizes its maximum profit if the stock price is either far above or far below the strike price on the expiration date of the long call. Web © 2024 google llc. Web a short calendar put spread is an options trading strategy that involves buying and selling two sets of puts with different expiry dates to create a net credit for the trader. The strategy most commonly involves. In this video i have explained about short put calendar spread option strategy this is the complete guide i have covered below topics when to use.

How to Create a Credit Spread with the Short Calendar Put Spread YouTube

Buying one put option and selling a second put option with a more distant expiration is an example of a short put calendar. Web any.

Calendar Put Spread Options Edge

Buying one put option and selling a second put option with a more distant expiration is an example of a short put calendar. Buying one.

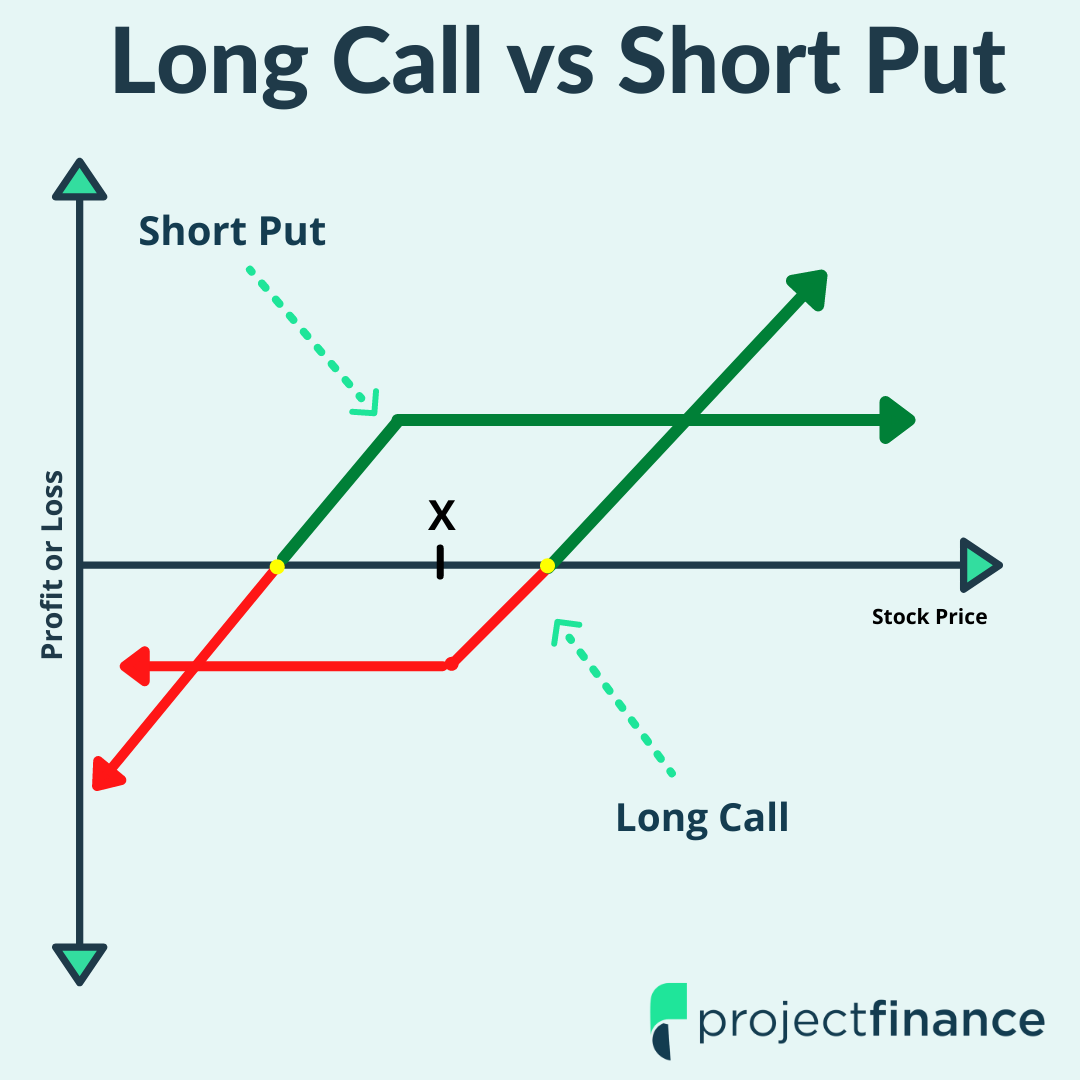

Long Call vs Short Put Comparing Strategies W/ Visuals projectfinance

This strategy profits from an increase in price movement. Most calendar spreads are set. If the spread has increased beyond the upper range of 1.7205,.

Options Trading Made Easy Ratio Put Calendar Spread

The ideal forecast, therefore, is for a “big stock price change when the direction of the change could be. In this video i have explained.

The Dual Calendar Spread (A Strategy for a Trading Range Market) (1106

Web a short calendar spread with puts realizes its maximum profit if the stock price is either far above or far below the strike price.

Trading Guide on Calendar Call Spread AALAP

The strategy most commonly involves. Web © 2024 google llc. The ideal forecast, therefore, is for a “big stock price change when the direction of.

Short Calendar Spread Printable Word Searches

This strategy profits from an increase in price movement. Web a calendar spread is an options or futures strategy where an investor simultaneously enters long.

Short Put Calendar Spread Options Strategy

This strategy profits from an increase in price movement. In this video i have explained about short put calendar spread option strategy this is the.

Put Calendar Spread Guide [Setup, Entry, Adjustments, Exit]

In this video i have explained about short put calendar spread option strategy this is the complete guide i have covered below topics when to.

Short Puts Are Profitable If The Underlying Asset's Price Is Above.

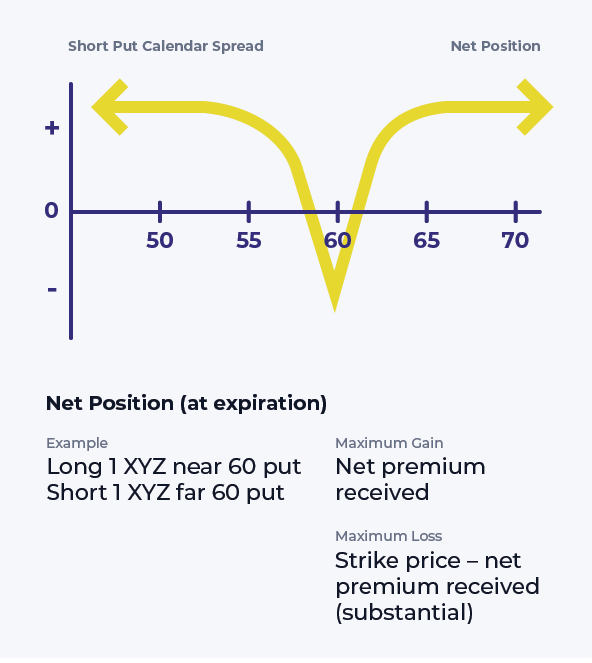

The short calendar put spread is used to try and profit when you are expecting a security to move significantly in price, but it isn't clear on which. Web short calendar put spread. Web a short calendar put spread is an options trading strategy that involves buying and selling two sets of puts with different expiry dates to create a net credit for the trader. Web a calendar spread is an options or futures strategy where an investor simultaneously enters long and short positions on the same underlying asset but with.

Web A Long Calendar Spread—Often Referred To As A Time Spread—Is The Buying And Selling Of A Call Option Or The Buying And Selling Of A Put Option With The Same Strike.

Buying one put option and selling a second put option with a more distant expiration is an example of a short put calendar. Web any value of the spread outside this range gives us an opportunity to set up a calendar spread. In this video i have explained about short put calendar spread option strategy this is the complete guide i have covered below topics when to use. Buying one put option and selling a second put option with a more distant expiration is an example of a short put calendar spread.

Selling A Call Calendar Spread Consists Of Buying One Call Option And Selling A Second Call Option With A More Distant Expiration.

Web a short put spread, sometimes called a bull put spread or short put vertical spread, is an options trading strategy that investors may use when they expect a slight. Web a short calendar spread with calls realizes its maximum profit if the stock price is either far above or far below the strike price on the expiration date of the long call. This strategy profits from an increase in price movement. Web © 2024 google llc.

Web The Calendar Spread.

Web the short calendar call spread is an options trading strategy for a volatile market that is designed to be used when you are expecting a security to move dramatically in price, but. Web a short calendar spread with puts realizes its maximum profit if the stock price is either far above or far below the strike price on the expiration date of the long put. The ideal forecast, therefore, is for a “big stock price change when the direction of the change could be. If the spread has increased beyond the upper range of 1.7205, it.

![Put Calendar Spread Guide [Setup, Entry, Adjustments, Exit]](https://assets-global.website-files.com/5fba23eb8789c3c7fcfb5f31/6019b83133ac2d32ef084fa5_TsbQgZxQ0e-zKJ9h6Fa7azNlnvn0zH-UBlX3l7hriHll2es1fvyFY5N-nOyM1153MJ4wXLNIhH4zanFkJQB0mpqs81lwEBIvqa7IZQRPWXZY1i3J7vV3BpTIL3v5nCyqn-CEbq2U.png)