Substantial Presence Test For The Calendar Year - “there’s only one way to keep donald trump out of. Web the person must be physically present in the united states on at least: Web you are a 'resident for tax purposes' if you were a legal permanent resident of the united states any time during the past calendar year. New york state businesses have a substantial presence in state contracts and strongly contribute to the economies. All of the days the person was present in the current calendar year, as well as. To determine if you meet the substantial presence test for 2023, count the full 120 days of presence in 2023, 40 days in 2022 (1/3 of 120), and 20 days in 2021 (1/6 of 120). Web the individual must be present in the u.s. 120 days (current year) + 20 days (1/3 of 60 days in 2023) + 5 days (1/6 of 30 days in 2022) = 145 days. For at least 31 days during the current calendar year. Web if you meet the substantial presence test for a calendar year, your residency starting date is generally the first day you are present in the united states during that calendar year.

Substantial Presence Test How to Calculate YouTube

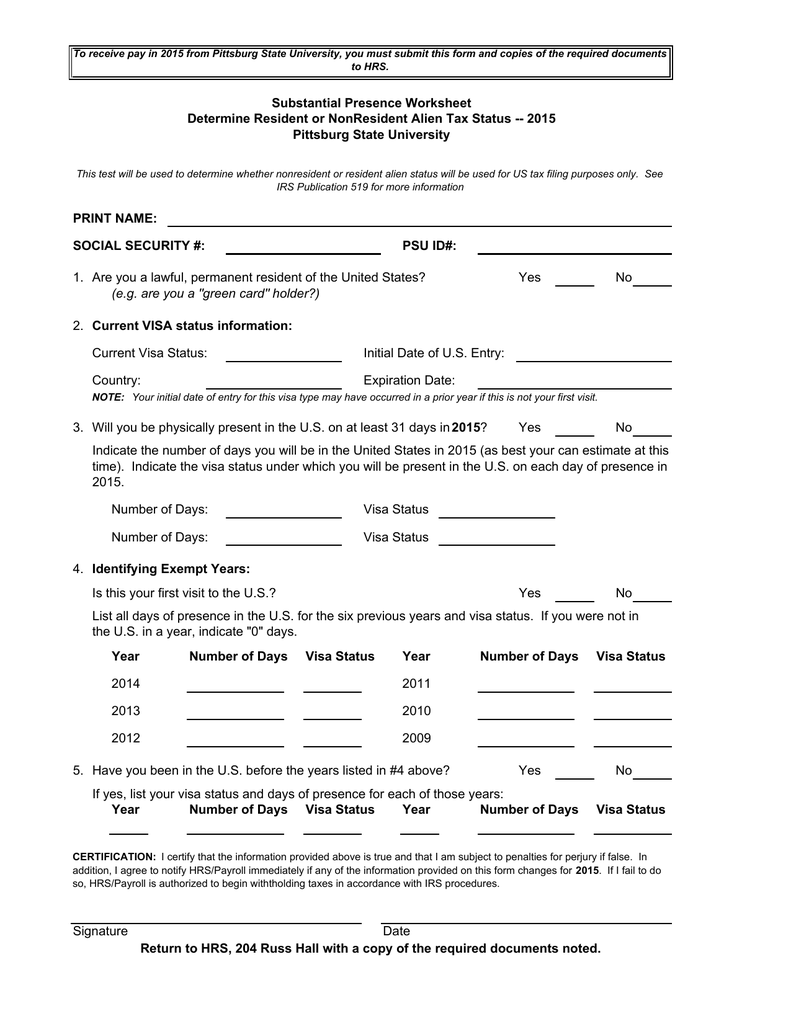

Applicability to whole tax year. For at least 31 days during the current calendar year. For example, a 1.1% aea annual dropout rate conversion calculation.

Substantial Presence Test Calculator Wise

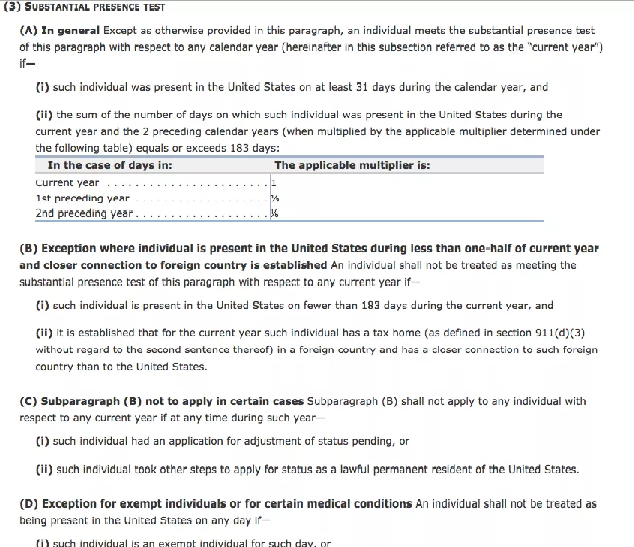

(top) summary of the test. All of the days physically present in the u.s. Number of nonexempt days in united states during 2023: Web if.

The Substantial Presence Test

Web generally, the substantial presence test counts any day that you are physically present in the united states during the calendar year, no matter the.

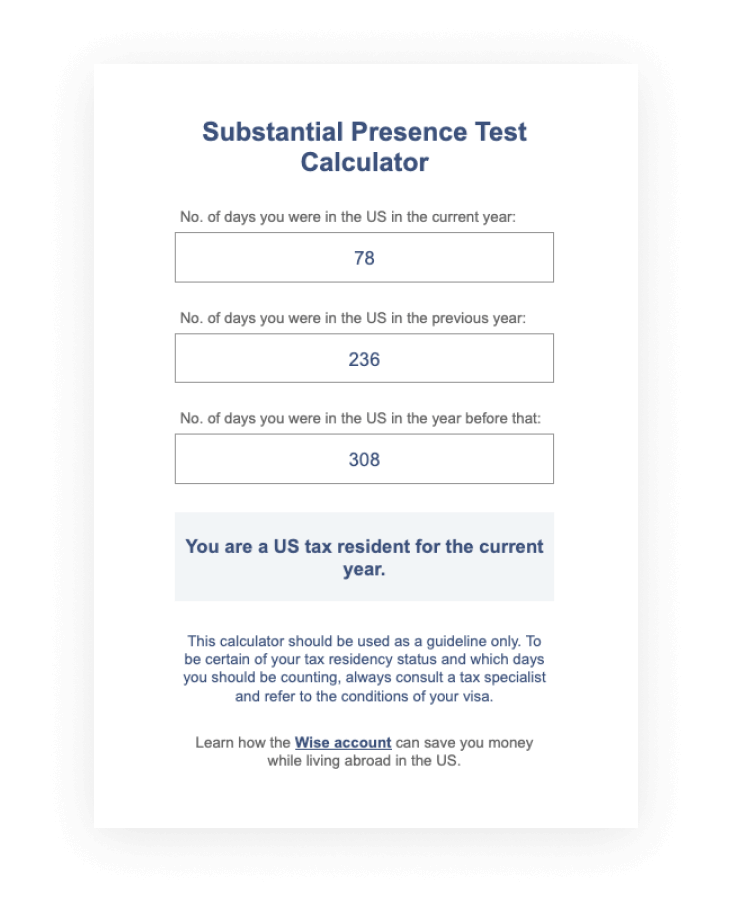

Easy Substantial presence test calculator

However, there are some exceptions to this rule and certain days are not counted under the test. Web by using the multiplier of 5, an.

Why the S. 877A(g)(1)(B) “dual citizen exemption” encourages dual

For at least 31 days during the current calendar year. Definition of united states for physical presence. Citizens and assesses whether they have spent a.

Substantial Presence Test Finance and Treasury

New york state businesses have a substantial presence in state contracts and strongly contribute to the economies. Using the substantial presence test, we calculate her.

Substantial Presence Test for U.S. Tax Purposes What Are the Basics

120 days (current year) + 20 days (1/3 of 60 days in 2023) + 5 days (1/6 of 30 days in 2022) = 145 days..

Substantial Presence Test Calculator Wise

Definition of united states for physical presence. 31 days during 2022, and. You were physically present in the u.s. Web the person must be physically.

Substantial Presence Test Finance and Treasury

31 days during 2022, and. The individual must use the following calculation to satisfy the substantial presence test: (top) summary of the test. Citizens and.

31 Days During 2022, And.

All of the days the person was present in the current calendar year, as well as. New york state businesses have a substantial presence in state contracts and strongly contribute to the economies. Web if you meet the green card test at any time during the calendar year, but do not meet the substantial presence test for that year, your residency starting date is the first day on which you are present in the united states as a lawful permanent resident. Web the substantial presence test for the calendar year 2022 means it shall be determined whether you were physically present in the usa on at least.

To Determine If You Meet The Substantial Presence Test For 2023, Count The Full 120 Days Of Presence In 2023, 40 Days In 2022 (1/3 Of 120), And 20 Days In 2021 (1/6 Of 120).

“there’s only one way to keep donald trump out of. The individual must be present in the united states for at. Web by using the multiplier of 5, an aea campus accumulates points towards the student achievement domain score if its annual dropout rate is less than 20 percent. All the days you were present in 2022, and.

Web Generally, The Substantial Presence Test Counts Any Day That You Are Physically Present In The United States During The Calendar Year, No Matter The Time Of Day.

Applicability to whole tax year. For at least 31 days during the current calendar year. You will be considered a 'resident for tax purposes' if you meet the substantial presence test for the previous calendar year. Web you are a 'resident for tax purposes' if you were a legal permanent resident of the united states any time during the past calendar year.

Web Year Period “Establishes A Rebuttable Presumption The Alien That Lacked Good Moral Character During That Time” And, “[A]Bsent Substantial Relevant And Credible Evidence,” Contrary The Alien Is Statutorily Ineligible For Cancellation Relief.

The individual must use the following calculation to satisfy the substantial presence test: Web if you meet the substantial presence test for a calendar year, your residency starting date is generally the first day you are present in the united states during that calendar year. Relation between residency for tax purposes and citizenship and immigration. Web nys its prefers that the contractor provides a test environment whereby nys ssp staff can conduct test.