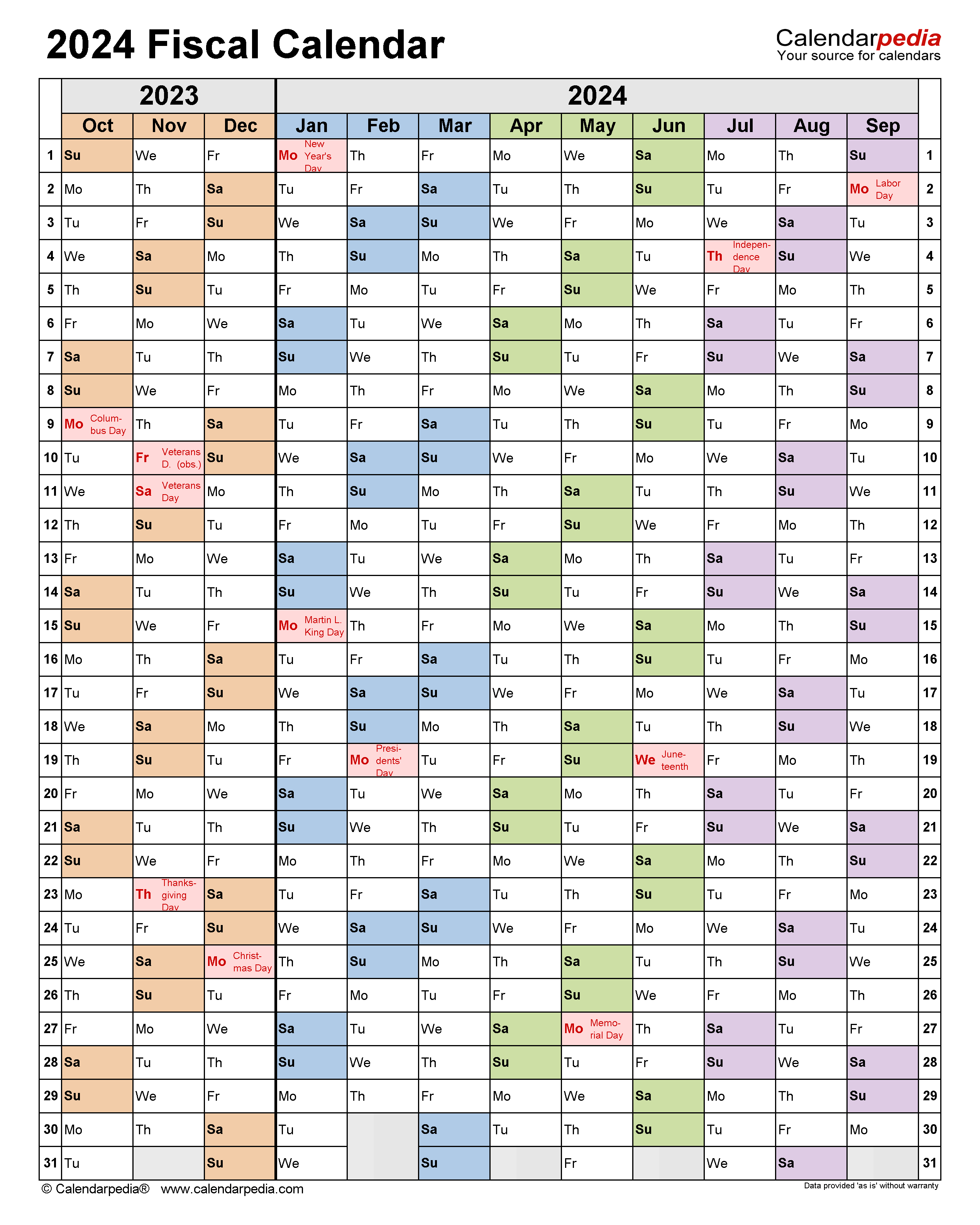

Tax Calendar For Individuals - Reporting march tip income of $20 or more to employers (form 4070). Page last reviewed or updated: Web this basic tax calendar has been developed to provide a guide to taxpayers about the key deadlines for the main segments of taxpayers. Web head of household. This tax calendar has the due dates for 2024 that most taxpayers will need. Web the 2024 federal income tax filing deadline for individuals is april 15, 2024. Web the due date for filing your tax return is typically april 15 if you’re a calendar year filer. Filing a 2022 income tax return (form 1040 or form 1040. Submission of the deemed dividend. Enter values as estimated for the year ending.

2021 tax calendar Cleveland CPA Accounting Firm Barnes Wendling CPAs

Web use the irs tax calendar to view filing deadlines and actions each month. Simplify your tax compliance with cloudcfo. Review the calendar and contact.

Tax Calendar for S.A. Businesses and Individuals Lamna

Review the calendar and contact us with questions or. Simplify your tax compliance with cloudcfo. Web the 2023 publication 509, tax calendars, contains a general.

Calendar For Taxes 2024 Adel Loella

Employers and persons who pay excise taxes should also use the employer's. Web primarily, employers need to use this publication. Web the following tax rates.

Tax Due Dates (Filing Deadlines) & IRS Tax Calendar pdfFiller

Payment of paye deducted from employees’ emoluments. Web primarily, employers need to use this publication. Review the calendar and contact us with questions or. Web.

2021 Tax Calendar for Individuals and Businesses SVA CPA

Generally, most individuals are calendar year filers. This tax calendar has the due dates for 2024 that most taxpayers will need. Web january 2024 to.

Federal Tax Calendar Template Word

Filing a 2022 income tax return (form 1040 or form 1040. Access the calendar online from your mobile device or desktop. Web january 2024 to.

2017 Tax Calendar for Individuals Expert Fiscaliste

Web head of household. Generally, most individuals are calendar year filers. For individuals, the last day to file. Web january 2024 to june 2024. Page.

Tax Planning for Individuals 2018 Insights Fleming

Review the calendar and contact us with questions or. Reporting march tip income of $20 or more to employers (form 4070). Employers and persons who.

Stay organized with your 2018 tax calendar

Simplify your tax compliance with cloudcfo. Tax due dates by month. Payment of paye deducted from employees’ emoluments. Web the following tax rates are effective.

See Current Federal Tax Brackets And Rates Based On Your Income And Filing.

Generally, most individuals are calendar year filers. Payment of paye deducted from employees’ emoluments. Web the following tax rates are effective for resident individuals for calendar year 2024: This tax calendar has the due dates for 2024 that most taxpayers will need.

Web Primarily, Employers Need To Use This Publication.

Filing a 2022 income tax return (form 1040 or form 1040. Submission of the deemed dividend. Reporting march tip income of $20 or more to employers (form 4070). Web the 2024 federal income tax filing deadline for individuals is april 15, 2024.

Employers And Persons Who Pay Excise Taxes Should Also Use The Employer's.

Web this basic tax calendar has been developed to provide a guide to taxpayers about the key deadlines for the main segments of taxpayers. For individuals, the last day to file. Review the calendar and contact us with questions or. By the end of next month.

Enter Values As Estimated For The Year Ending.

Page last reviewed or updated: Web the 2023 publication 509, tax calendars, contains a general calendar for individuals and businesses, a calendar for employers, and a calendar for excise. Tax due dates by month. Web january 2024 to june 2024.