Tax Rebate Calendar - Web singapore’s corporate income tax rate is 17%. 1st to 15th day of each month: These incentive payment amounts will be paid on january 15, april 15, july 15, and october 15th in 2024. Web quarterly climate action incentive payment amounts. Declaration and payment of commodity tax. Companies may enjoy tax rebates and tax exemption schemes e.g. Web the deadlines to file a return and claim the 2020 and 2021 credits are may 17, 2024, and april 15, 2025, respectively. (1) return received, (2) refund approved and (3) refund sent. Resident individuals are also eligible for a rebate of up to 100% of income tax subject to a maximum limit depending on tax regimes as under: The recovery rebate credit is a refundable credit for those who missed out on one or more economic impact payments.

Tax Rebate u/s 87A Calculate and Claim Tax Rebate FY 2021

They also remind filers that many tax software programs allow you to submit your taxes before the start of tax season. Web filing and paying.

Managing Your Tax Rebate Luxe Calendar

Web if you file your taxes electronically by march 15, 2024, you should receive your next canada carbon rebate (ccr) payment (formerly known as the.

Tax rates for the 2024 year of assessment Just One Lap

1st to 15th day of each month: For residents of newfoundland and labrador, nova scotia, and prince edward island, payments. Economic impact payments, also referred.

What To Expect With your Tax Rebate Mass.gov

Web if you file your taxes electronically by march 15, 2024, you should receive your next canada carbon rebate (ccr) payment (formerly known as the.

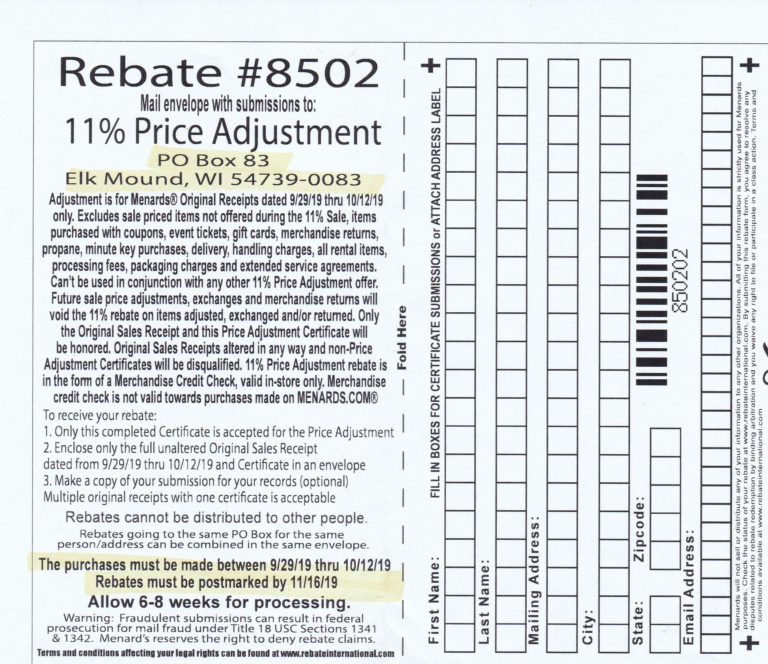

Menards Printable Rebate Forms

You will get personalized refund information based on the processing of your tax return. The irs will accept and process returns through april 15, 2024..

Menards Rebate Printable Form

Has a tracker that displays progress through 3 stages: Declaration and payment of tobacco and alcohol tax. Resident individuals are also eligible for a rebate.

Grow Your Business During 2023 Tax Refund Season Higher Images Inc

Economic impact payments, also referred to as stimulus payments, were issued in 2020 and 2021. Web the program provides eligible homeowners with a rebate of.

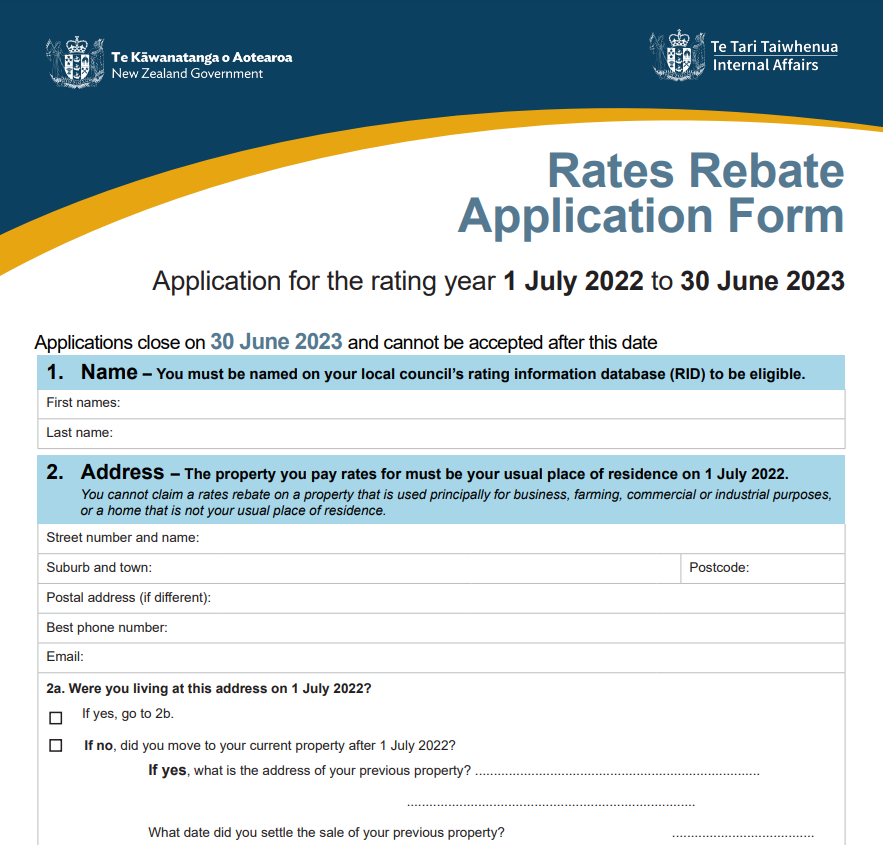

Rates Rebate Form For Pensioners Durban 2022 Calendar Printable

Web if you file your taxes electronically by march 15, 2024, you should receive your next canada carbon rebate (ccr) payment (formerly known as the.

2022 Child Tax Rebate ends July 31 Access Community Action Agency

The irs will accept and process returns through april 15, 2024. Web the deadlines to file a return and claim the 2020 and 2021 credits.

If You File Your Taxes Electronically By.

Web use this tool to find out what you need to do to get a tax refund (rebate) if you’ve paid too much income tax. Web quarterly climate action incentive payment amounts. (1) return received, (2) refund approved and (3) refund sent. 4 weeks or more after mailing a return.

The Irs Does Not Release A Calendar, But Continues To Issue Guidance That Most Filers Should Receive Their Refund Within 21 Days.

Web when to expect your payments. Federal tax refund delivery time. 1st to 15th day of each month: Declaration and payment of commodity tax.

Web Tnn / Mar 15, 2024, 04:27 Ist.

For residents of newfoundland and labrador, nova scotia, and prince edward island, payments. Web singapore’s corporate income tax rate is 17%. Web as a result of all of this, the deadline for filing federal income tax returns (generally form 1040), will be tuesday, april 18, 2023, and most states usually follow the same calendar for state. Companies may enjoy tax rebates and tax exemption schemes e.g.

These Incentive Payment Amounts Will Be Paid On January 15, April 15, July 15, And October 15Th In 2024.

1st to 15th day of each month: Web a new federal tax credit of $4,000 for used evs priced below $25k. All of the amounts listed on your tax bill are eligible to be included in the rebate calculation, except amounts for: Resident individuals are also eligible for a rebate of up to 100% of income tax subject to a maximum limit depending on tax regimes as under: