Tax Return Status Calendar - (1) return received, (2) refund approved and (3) refund sent. Web washington (ap) — the irs said thursday it will make permanent the free electronic tax return filing system that it experimented with this year and is asking all 50 states and the district of columbia to help taxpayers file their returns through the program in 2025. Has a tracker that displays progress through 3 stages: Web most refunds will be issued in less than 21 days. Refund information is updated on the irs website once a day, overnight. “there’s only one way to keep donald trump out of. If you filed your tax return weeks ago and still haven't received your refund money, it could be for a number of reasons. Find out why your refund may be delayed or may not be the amount you expected. The irs started accepting and processing income tax returns on january 29, 2024. Web 5 min read.

irs tax refund turnaround chart Mighty Taxes

Web you can use the tool to check the status of your return: You can get your refund information for the current year and past.

Where is My Amended Tax Return and When Will I get My Refund? 2023

Has a tracker that displays progress through 3 stages: Web most refunds will be issued in less than 21 days. The irs tried the direct.

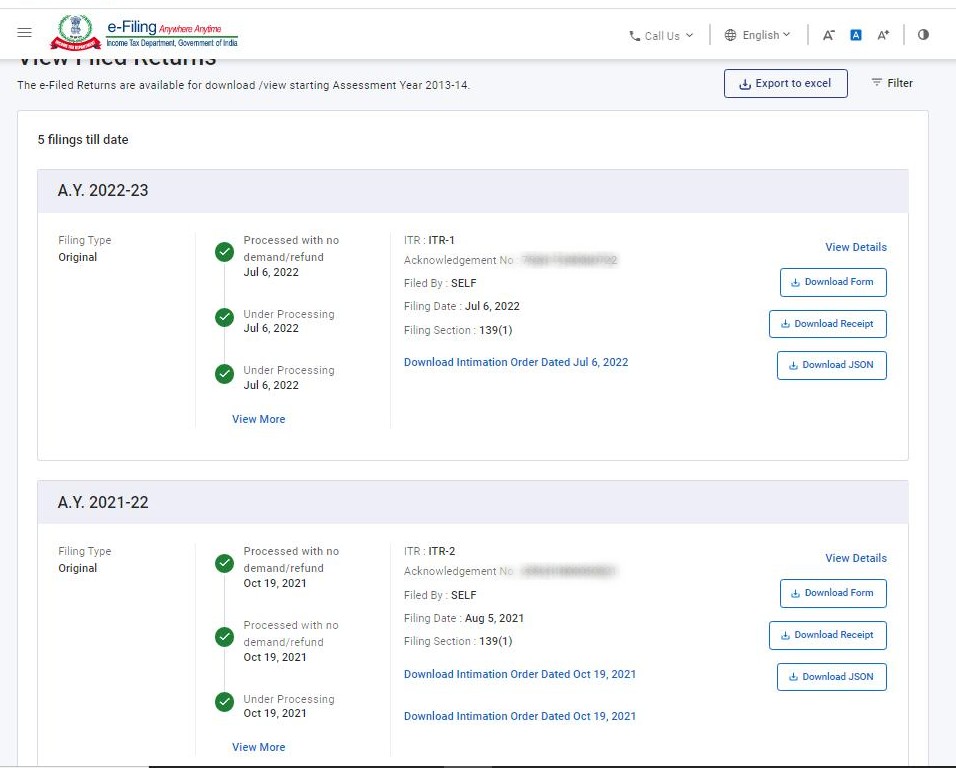

Easy Guide to Check Tax Return (ITR) Status Online

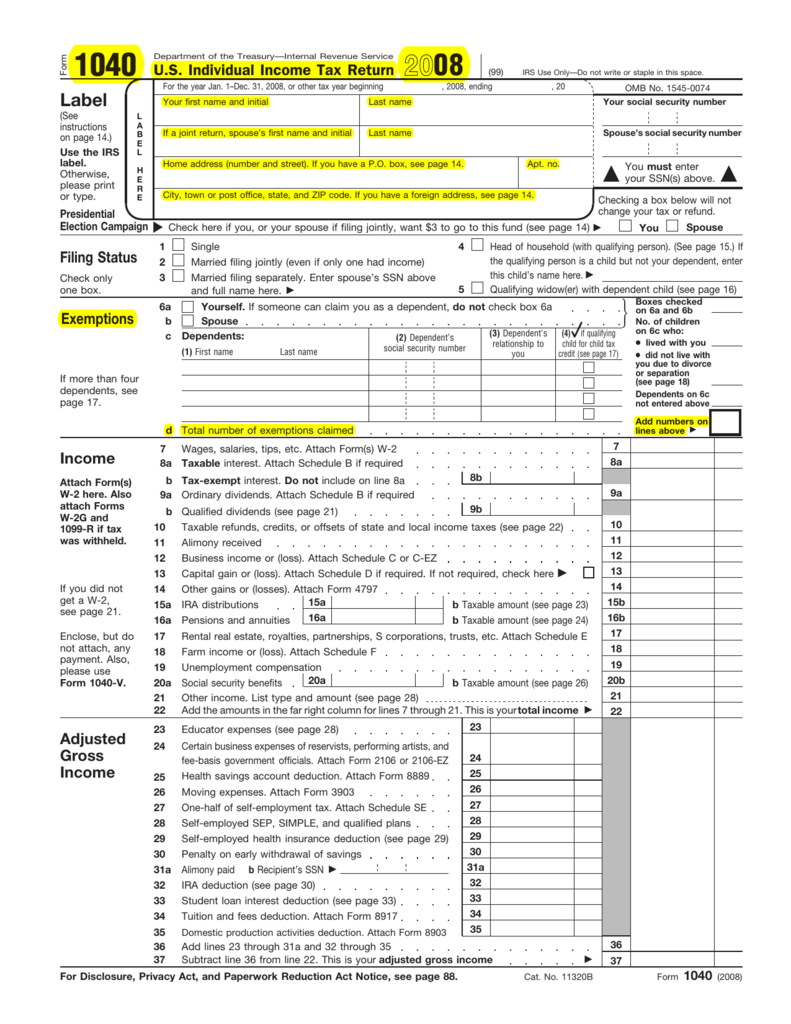

Subject to other requirements like lower annual income (see below) revised credit applies to battery electric vehicles with an. Enter the ssn or itin shown.

ITR filing How to track your tax return status BusinessToday

All fields marked with an asterisk (*) are required. Web shortly after trump’s guilty verdict was read aloud in court, president biden posted a fundraising.

When To Expect Your Tax Refund In 2023 YouTube

Check how to register for self assessment. Check your refund on an amended return. Please enter your social security number, tax year, your filing status,.

IRS Tax Return Calendar 2023, Chart, Status, Schedule, Calendar

Web the irs has announced it will start accepting tax returns on january 23, 2023 (as we predicted as far back as october 2022). Has.

2024 Tax Season Calendar For 2023 Filings and IRS Refund Schedule

The irs tried the direct file project for the 2024 tax season on a. Web the calculation will start on the latest of the following.

Irs Form Release Date 2023 Printable Forms Free Online

Check if you need to send a self assessment tax return. Web a new federal tax credit of $4,000 for used evs priced below $25k..

2024 Tax Refund Calendar 2024 Calendar Printable

Contact your state’s taxation department to learn about tracking your state tax refund status. So, early tax filers who are a due a refund can.

(1) Return Received, (2) Refund Approved And (3) Refund Sent.

Check the status of your refund. Be sure you have a copy of your return on hand to verify information. Web once the irs acknowledges receipt of a return, refund status information is typically available within: Check if you need to send a self assessment tax return.

Amended Returns Take Up To 3 Weeks To Show Up In Our System And Up To 16 Weeks To Process.

Refund information is updated on the irs website once a day, overnight. So, early tax filers who are a due a refund can often see the refund. The 30th day after you file your return. The deadline to file returns in 2024 is april 15 (this sometimes varies.

Web A New Federal Tax Credit Of $4,000 For Used Evs Priced Below $25K.

However, if you mailed your return and expect a refund, it could take four weeks or more to process your return. “there’s only one way to keep donald trump out of. Subject to other requirements like lower annual income (see below) revised credit applies to battery electric vehicles with an. Check your state tax refund status.

Web The Irs Generally Issues Refunds Within 21 Days Of When You Electronically Filed Your Tax Return, And Longer For Paper Returns.

Find out why your refund may be delayed or may not be the amount you expected. Please enter your social security number, tax year, your filing status, and the refund amount as shown on your tax return. The day you overpaid your taxes. Web better yet, if the irs owes you money for an overpayment on your part in 2023, and your refund is delayed, the interest rate the agency will be subject to is 8% through september of this year.