Texas Sales Tax Calendar - Texas imposes a 6.25 percent state sales and use tax on all retail sales, leases and rentals of most goods, as well as taxable services. Web 2024 reporting due dates for taxes, fees and reports. The sales tax exemption applies only to qualifying items you buy during the. Due dates on this chart are adjusted for saturdays, sundays and 2024 federal legal holidays. Your business's sales tax return must be filed by the 20th of the month following reporting period. Web if you overpaid your taxes, see sales tax refunds. Web texas sales tax returns are due on the 20th of the month following your reporting period or the next business day if the 20th falls on a weekend or a holiday. Saturday, april 27, through monday, april 29, 2024. Web texas sales tax holiday calendar. The texas sales taxes have remained the.

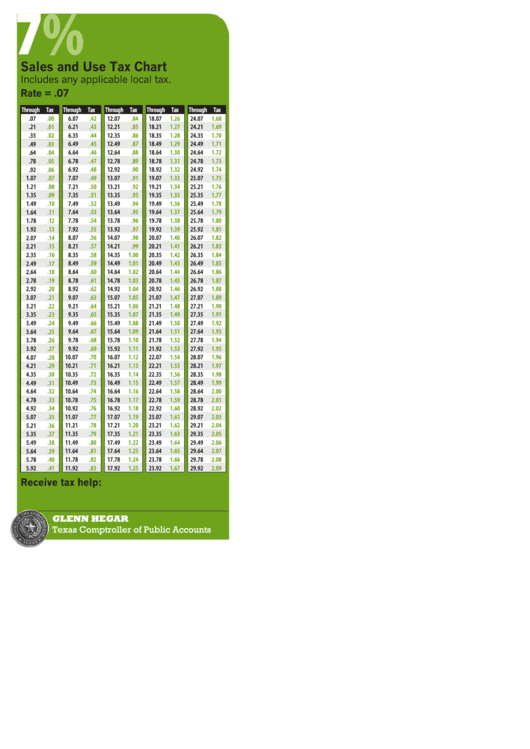

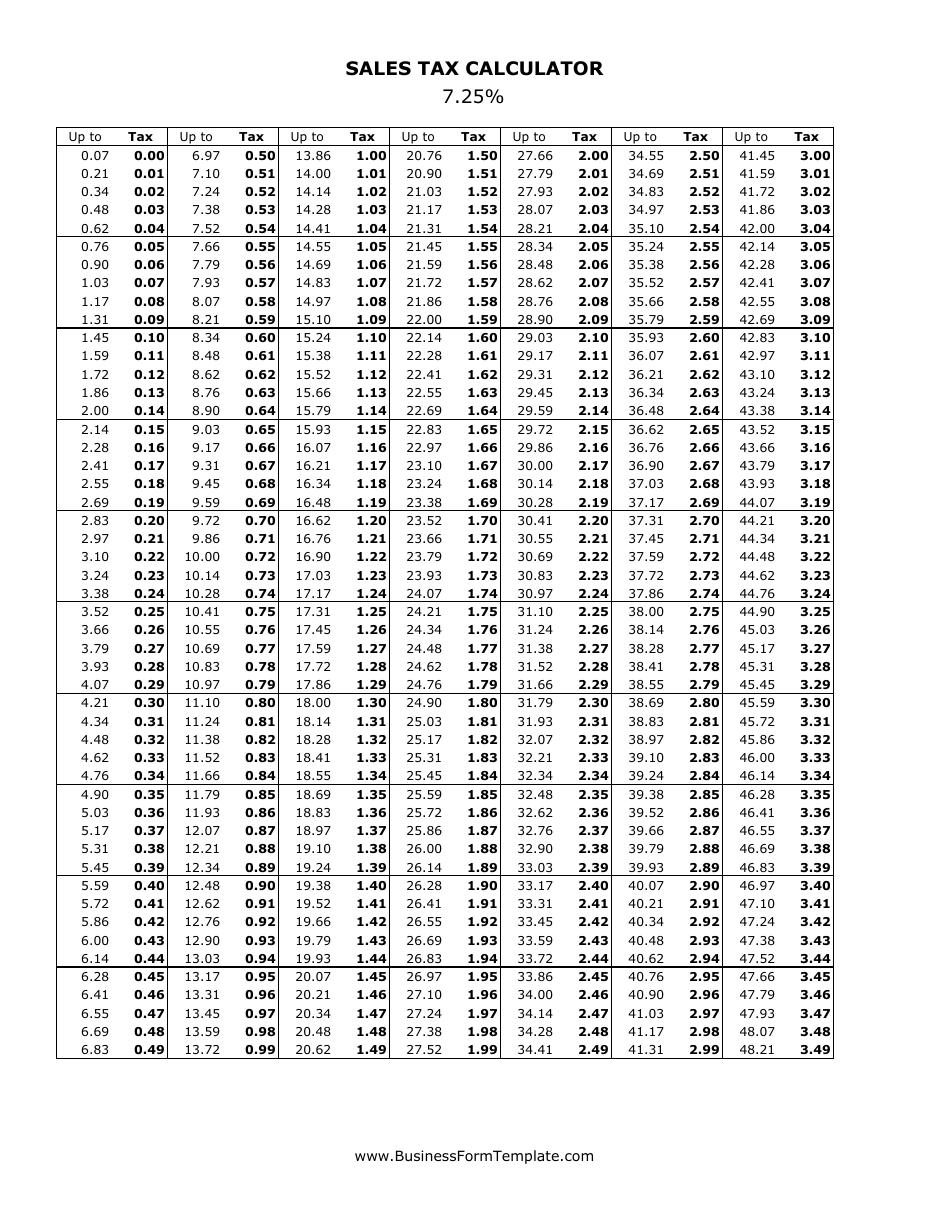

Texas Sales Tax Rate Tax Sales Tax Sales Chart And if you’re

Web your texas sales tax filing frequency & due dates. Web this year’s sales tax holiday begins friday, aug. Texas sales tax range for 2024..

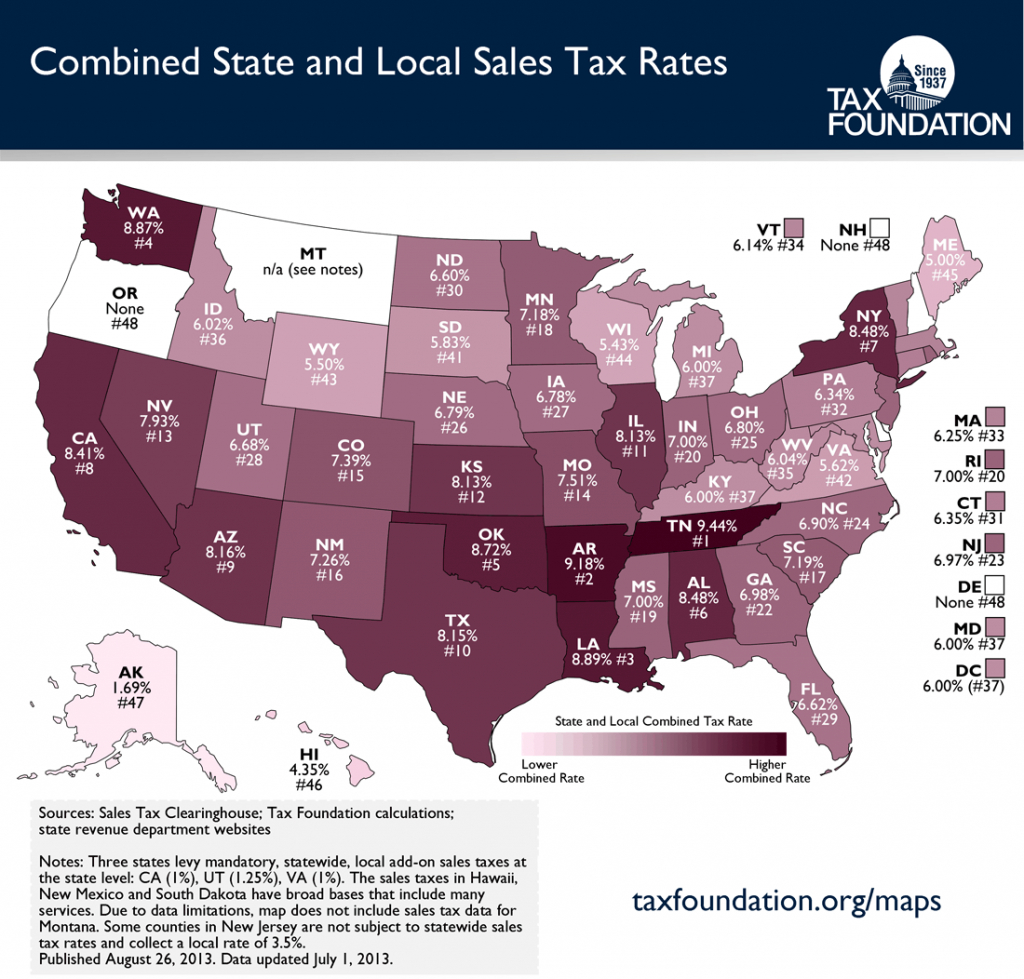

Texas Sales Tax rates, thresholds, and registration guide

Web this year’s sales tax holiday begins friday, aug. Web this is the distribution schedule for sales tax allocation payment distributions to cities, counties, special.

Sales Taxstate Are Grocery Items Taxable? Texas Property Tax Map

Due dates on this chart are adjusted for saturdays, sundays and 2024 federal legal holidays. (6.25% + 1.5%) x $100 = $7.75. Web if you.

Texas Sales Tax Map Printable Maps

Web texas sales tax returns are due on the 20th of the month following your reporting period or the next business day if the 20th.

Texas collects record 2.86 billion in sales tax for July Bond Buyer

Web the due date is april 15th of each year. Web sales tax rate locator. For additional information about how to amend your report, see..

Texas Sales Tax Rate 2024 Jeanne Maudie

Once you begin filing returns, your. These files are for use with the comptroller's software for sales and use tax. Web 2024 reporting due dates.

TX Sales Tax Return Monthly Form Denver City & County Fill out Tax

These files are for use with the comptroller's software for sales and use tax. Texas sales tax range for 2024. In the tabs below, discover.

Top 33 Texas Sales Tax Form Templates free to download in PDF format

Web this year’s sales tax holiday begins friday, aug. Web the due date is april 15th of each year. The next upcoming due date for.

Printable Sales Tax Chart Printable World Holiday

Web sales tax rate locator. For a list of this year's. Web a new federal tax credit of $4,000 for used evs priced below $25k..

Sales Tax Rate Files Current And Historical.

Web created by the texas legislature, both holidays take place saturday, may 25, through monday, may 27. Texas imposes a 6.25 percent state sales and use tax on all retail sales, leases and rentals of most goods, as well as taxable services. Web on this page we have compiled a calendar of all sales tax due dates for texas, broken down by filing frequency. Web all tax holidays fall on a weekend.

In The Tabs Below, Discover New Map And Latitude/Longitude Search Options Alongside The Familiar Single.

Web sales tax rate locator. Web taxes file and pay. This report is due by april 30th of each year and is required for businesses that own property in texas. Web if you overpaid your taxes, see sales tax refunds.

The Next Upcoming Due Date For Each Filing Schedule Is Marked.

Your business's sales tax return must be filed by the 20th of the month following reporting period. Texas businesses must collect and pay sales taxes on most items they sell. The texas comptroller's office estimates shoppers will. For a list of this year's.

(6.25% + 1.5%) X $100 = $7.75.

Web this year’s sales tax holiday begins friday, aug. Welcome to the new sales tax rate locator. Web our free online guide for business owners covers texas sales tax registration, collecting, filing, due dates, nexus obligations, and more. Texas sales tax range for 2024.