What Is The Difference Between Fiscal And Calendar Year - A tax year is a calendar year, but a calendar year isn’t necessarily a fiscal year. The calendar year, as the name implies, follows the structure of a standard calendar and begins on january 1. For example, a business that incorporates on july 1, 2018 could choose a year end of any date within the following 53 weeks. Differences between fiscal year and calendar year. What is a calendar year? A calendar year always begins on new year’s day and ends on the last day of the month (jan. Web a fiscal year be any chosen start and end date within the calendar year as long as it is no longer than 53 weeks or 371 days. A company that starts its fiscal year on january 1 and ends it on. Web while a fiscal year lasts one year, it doesn't always align with the calendar year. This is because certain entities can choose when their fiscal year starts and ends based on their accounting and auditing needs or practices.

What is the Difference Between Fiscal Year and Calendar Year

Web a fiscal year is a concept that you will frequently encounter in finance. Organizations use fiscal year for financial reporting and budgeting. Fiscal years.

Fiscal Year What It Is and Advantages Over Calendar Year

Web a fiscal year is a concept that you will frequently encounter in finance. Web the fiscal year, a period of 12 months ending on.

Fiscal Year vs Calendar Year What's The Difference?

This is because certain entities can choose when their fiscal year starts and ends based on their accounting and auditing needs or practices. Well, it.

What Is a Fiscal Year?

The calendar year, as the name implies, follows the structure of a standard calendar and begins on january 1. It's used differently by the government.

What is a Fiscal Year? Your GoTo Guide

Web although following a calendar year is often simpler and more common among businesses, a fiscal year can show a more accurate picture of how.

Difference Between Fiscal Year and Calendar Year

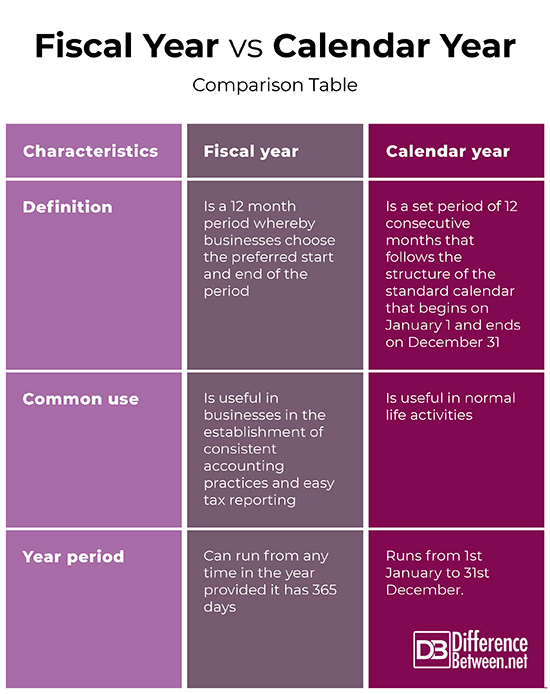

Web the business uses the fiscal year to prepare its accounting, financial reporting, and easy tax reporting, whereas the calendar year is useful in normal.

Fiscal Year vs Calendar Year Top Differences You Must Know! YouTube

31 as a calendar year does, but not all fiscal years do. Web the business uses the fiscal year to prepare its accounting, financial reporting,.

Difference Between Fiscal Year and Calendar Year Difference Between

The university of miami’s fiscal year begins on: Organizations use fiscal year for financial reporting and budgeting. While the fiscal year is a 12 month.

What is the Difference Between Fiscal Year and Calendar Year

June 1 and ends on may 31. Web the business uses the fiscal year to prepare its accounting, financial reporting, and easy tax reporting, whereas.

Well, It Can Get More Complicated Than That When You’re Talking About Money And Taxes.

Fiscal years tend to be more common for seasonal businesses. Web while a fiscal year lasts one year, it doesn't always align with the calendar year. The fiscal year (fy) is a financial accounting period used by businesses, governments, and organizations to track their financial activities. A company that starts its fiscal year on january 1 and ends it on.

Governments And Organizations Can Choose Fiscal Years To Align With Their Budgeting And Tax Requirements.

Organizations use fiscal year for financial reporting and budgeting. 31 as a calendar year does, but not all fiscal years do. Web the calendar year begins on the first of january and ends on 31st december every year, while the fiscal year can begin on any day of the year but will end on exactly the 365th day of that year. Web a fiscal year be any chosen start and end date within the calendar year as long as it is no longer than 53 weeks or 371 days.

Web Although Following A Calendar Year Is Often Simpler And More Common Among Businesses, A Fiscal Year Can Show A More Accurate Picture Of How A Company Is Performing.

Both these years have a total period of twelve consecutive months. A fiscal year lasts for the same. Web a fiscal year is 12 months chosen by a business or organization for accounting purposes, while a calendar year refers to the standard january 1 to december 31 period. Differences between fiscal year and calendar year.

While The Fiscal Year Is A 12 Month Period Whereby Businesses Choose The Preferred Start And End Of The Period, The Calendar Year Is A Set Period Of 12 Consecutive Months That Follow The Structure Of The Standard Calendar That Begins On January 1 And Ends On December 31.

June 1 and ends on may 31. There are two types of fiscal years. It's used differently by the government and businesses, and does need to correspond to a calendar year. Web a fiscal year, by contrast, can start and end at any point during the year, as long as it comprises a full 12 months.

:max_bytes(150000):strip_icc()/FY-887c7c1cad1c47f38bd91db6e080b68e.jpg)

:max_bytes(150000):strip_icc()/fiscal-year-definition-federal-budget-examples-3305794_final-c54e01b8314f424a8aefacb8c126d192.png)